As we start 2016, I thought it might be good to look back on some of the trends from 2015. Looking back can give us a glimpse of the future.

Foreign buyers: The news media says things like, “Foreigners are buying up the U.S.!!!” Well, there is no doubt that there is a great deal of money coming in from many places around the world buying U.S. properties. Most of the foreign investing in the U.S. is concentrated on commercial and luxury markets. In my opinion, this is a positive thing for the real estate market at this time and it’s not affecting the middle class home buyer. I saw this happen in the 80’s when the Japanese where purchasing up all kinds of real estate.

Cash was still being used a great deal in 2015. In California it was reported that 23 percent of buyers paid all-cash. That fact is a strong indicator that the cash buyer market is still going strong.

Credit is easing up but not back to the early 2000 “standards”. According to Laurie Goodman Ph.D., Director of Housing policy at the Urban Institute, “Credit is expanding very, very slightly from absurdly tight levels. Lenders needed clarity before they were going to be willing to underwrite more risky loans, and they have not had that clarity. The good news is that everyone is aware they need it and it is beginning to happen very slowly.” There is evidence that the default rate is half of what it was in the years heading up to the mortgage crisis. This is evidence, Goodman maintains, that lenders have less to fear by taking on more risk.

Rents hit all-time highs with no stop in sight. USC Professor Raphael Bostic states that, “Our forecast continues to report that we will see rents increase pretty aggressively and I don’t see any signs that it is going to slow.” There are two main reasons: 1) many renters can’t get loans and 2) more individuals that are of age and means to buy are choosing to rent.

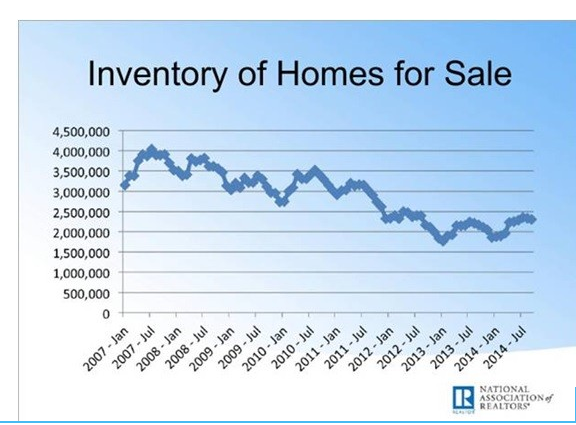

Lack of Supply/Inventory: We know that six to seven months of inventory is considered “the norm”. In 2015 we saw typically only three months’ worth of inventory. We know that with limited supply, prices increase.

There are a number of things that are leading to the historically low inventory numbers. These are just a few:

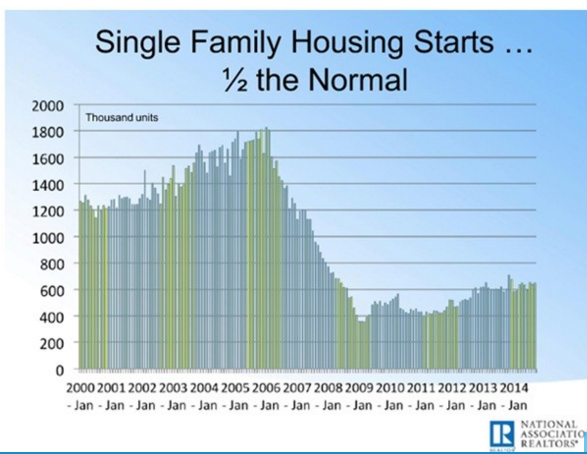

- Lack of new building: Since 2008 there have been unparalleled low levels of new housing starts. Builders are building but it’s more commercial product such as apartments, not SFR’s.

- Values are not back to 2007 levels. In many parts of the country values are back to 2007 levels but there are many more that haven’t reached those levels yet. Often sellers in these areas are waiting to sell until the prices come back to the 2007 levels.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD loses traction after earlier rebound, tests 1.1600

EUR/USD fails to preserve its recovery momentum after rising toward 1.1650 earlier in the day and tests 1.1600. The risk-averse market atmosphere amid the widening conflict in the Middle East and the broad-based US Dollar strength make it difficult for the pair to hold its ground.

GBP/USD stays weak near 1.3350 amid UK stagflation risks

GBP/USD stays in negative territory near 1.3350 in the second half of the day Thursday. The Pound Sterling loses ground amid fears that the United Kingdom economy could face stagflation risks due to higher energy prices, while the US Dollar attracts fresh safe-haven demand, weighing on the pair.

Gold struggles to benefit from risj-aversion, drops toward $5,100

Gold turns south in the American session on Thursday and declines toward $5,100. The persistent US Dollar (USD) strength doesn't allow XAU/USD to gather recovery momentum despite markets remain risks-averse due to the deepening conflict in the Middle East.

Crypto Today: Bitcoin, Ethereum, XRP hold weekly gains despite US-Iran war

The cryptocurrency market is gaining strength on Thursday, building on Wednesday's upswing, which saw Bitcoin reach a weekly high above $74,000. Ethereum and Ripple are moderating their recent gains amid uncertainty stemming from the escalating war in the Middle East.

Markets attempt to rally on positive news from Iran

There’s been an abrupt change in sentiment this morning, European stock markets are higher and oil and gas prices are moderating, after comments from Iran’s deputy minister about pre-conflict talks between Iran and the US.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.