Most people who have heard of put and call options know that they can be used to make money from stock movement. Puts tend to go up when stock prices go down. Calls tend to go up when stock prices go up.

The important phrase in the above sentence is “tend to.” It is not guaranteed that call prices will go up when stock prices do. People who know the rules and the exceptions to this tendency can do very well by trading options. Those who don’t can get some unpleasant surprises.

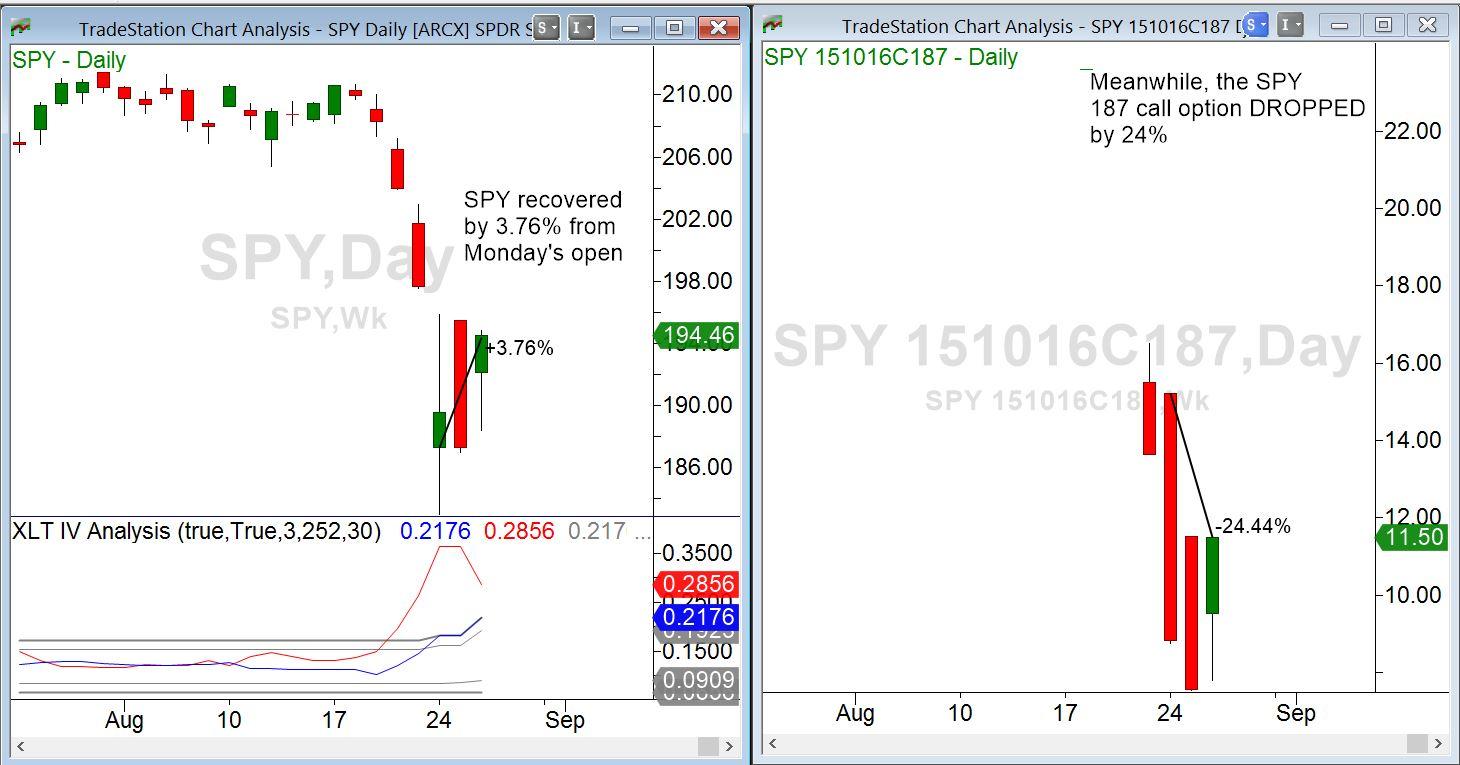

A good example was the slam-bam market over the past week (end of August 2015). Note the charts below:

In the left-hand chart we see a daily plot of the price of SPY, the ETF that tracks the S&P 500 index. SPY made a big drop over the weekend of Friday August 21 to Monday August 24. After closing on Friday around $198, it opened on Monday around $187. From that dismal open it clawed its way partway back over the next three days and closed on Wednesday around $195. This was a recovery of 3.76%. This partial recovery was small comfort for anybody who owned SPY before the drop, but an improvement in any case off the bottom.

Now note the right-hand chart. This is the price of a call option, the right to purchase SPY at $187. This strike price was chosen because $187 was SPY’s opening price on Monday after the weekend crash. Say that a trader somehow had inside information that the bottom of the market was in and bought this call option as the market opened on Monday. “Knowing” that calls go up when stocks go up, the trader figured that this was a low-cost way to trade the bounce. The cost of the call at that time was $15.22 per share.

Imagine the trader’s surprise two days later: He had been exactly right about the market and SPY was up by almost 4%. In “normal” times this should have led to an increase in the value of the calls of several times that 4%. Yet the calls were actually DOWN by 24%. What happened?

The answer is, changing expectations. In the option world we refer to this as “implied volatility.” On Monday morning people who were buying options were paying crazy prices. They were behaving as though the recent rate of change was going to continue. This was a state of high implied volatility.

This is the usual reaction when stock prices drop suddenly. Some people are frantic to buy put options to protect themselves and will pay high prices for that protection. This drives the prices of that stock’s call options up as well. This may seem perverse since call options are a bullish instrument, but it is true. If it were otherwise, and only put options became more valuable when people were nervous, then risk-free profits would be possible. The exact mechanism is beyond the scope of this article; suffice it to say that fear makes both put and call options more expensive.

When the fear dissipates, people return to their senses and are no longer willing to pay such high prices for options. This was the case by Wednesday afternoon. The crisis had passed (at least for the moment). The drop in option prices due to the decline in the fear factor more than overcame the effect of the rise in the stock price.

A properly educated option trader would have known better than to buy call options at a time like this. There are definitely ways to use options profitably in such a situation when you know how. Don’t be an option trader who knows just enough to be dangerous. Our Professional Option Trader course helps you know the right strategy to use at the right time. Find out about it from your local center.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD advances above 1.1800 ahead of German inflation data

EUR/USD stretches higher above 1.1800 in the European session on Friday, helped by sustained US Dollar weakness. Attention now turns toward the release of the preliminary inflation data for February from Germany and its major states during the day.

GBP/USD struggles near 1.3500 amid UK political drama, BoE easing bias

GBP/USD struggles to build on the overnight modest bounce from the weekly low and oscillates in a narrow band near 1.3500 in European trading on Friday. The Gorton and Denton by-election, held on February 26, has become a focal point of political drama in the UK, along with the Bank of England (BoE) easing expectations, acts as a headwind for the British Pound and the GBP/USD pair.

Gold flat lines below $5,200; traders look to US PPI for fresh impetus

Gold struggles to capitalize on its modest gains registered over the past two days and trades below the $5,200 mark through the first half of the European session on Friday. Geopolitical risks remain in play amid a large US naval and air power buildup in the Middle East.

Bitcoin, Ethereum and Ripple consolidate with short-term cautious bullish bias

Bitcoin, Ethereum and Ripple are consolidating near key technical areas on Friday, showing mild signs of stabilization after recent volatility. BTC holds above $67,000 despite mild losses so far this week, while ETH hovers around $2,000 after a rejection near its upper consolidation boundary.

Changing the game: International implications of recent tariff developments

The Supreme Court ruling on International Emergency Economic Powers Act (IEEPA) tariffs provides limited relief for the rest of the world, with weighted average tariff rates modestly lower.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.