This is the sixth and last in a series of articles about option payoff diagrams. The previous articles were part 1, part 2, part 3, part 4 and part 5.

In last week’s installment, we looked at an example of a Vertical Call Spread on Apple stock. Here is the price chart as it appeared then:

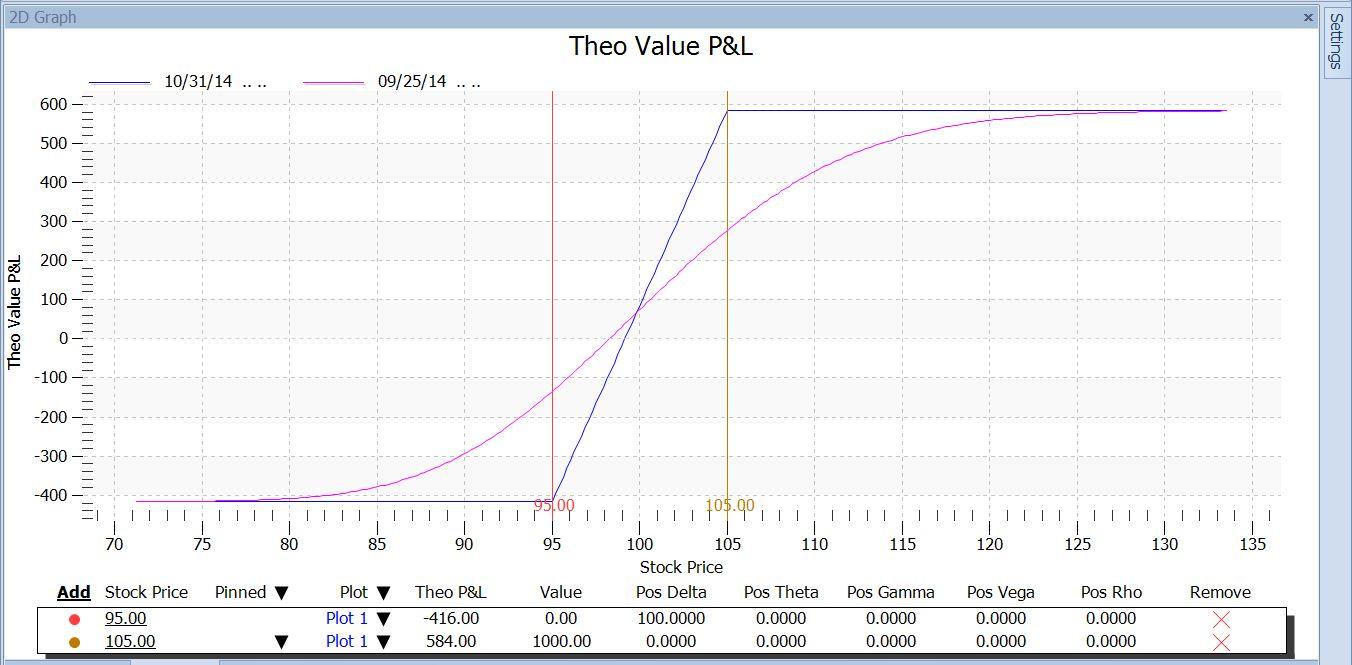

Assuming a bullish outlook, we could at that time have put on a Bull Call Spread, which is one of the variations of the vertical spread. At that time the October 95/105 call spread could be done as follows: Long 1 October 95 calls at $7.20 and short one October 105 calls at $1.25. The net debit was $595 per contract. Here is the diagram as it looked then:

A week later, Apple had dropped a bit, from $101.61 to $97.87 by the close. In after-hours trading it had recovered a bit, to $98.27.

The price chart now looked like so:

The stock had dropped, and was not too far from a previous low at $96.23. Assuming that we were still bullish (which is getting to be a harder assumption to make), we would want to place a stop around that $96.20 level.

A diagram of the 95/105 bull call spread now appeared like this:

Using the payoff diagram, we can answer some what-if questions, like these:

- If Apple drops to my stop level at $96.20 – How much would I lose if it happened today? What if it didn’t happen until expiration?

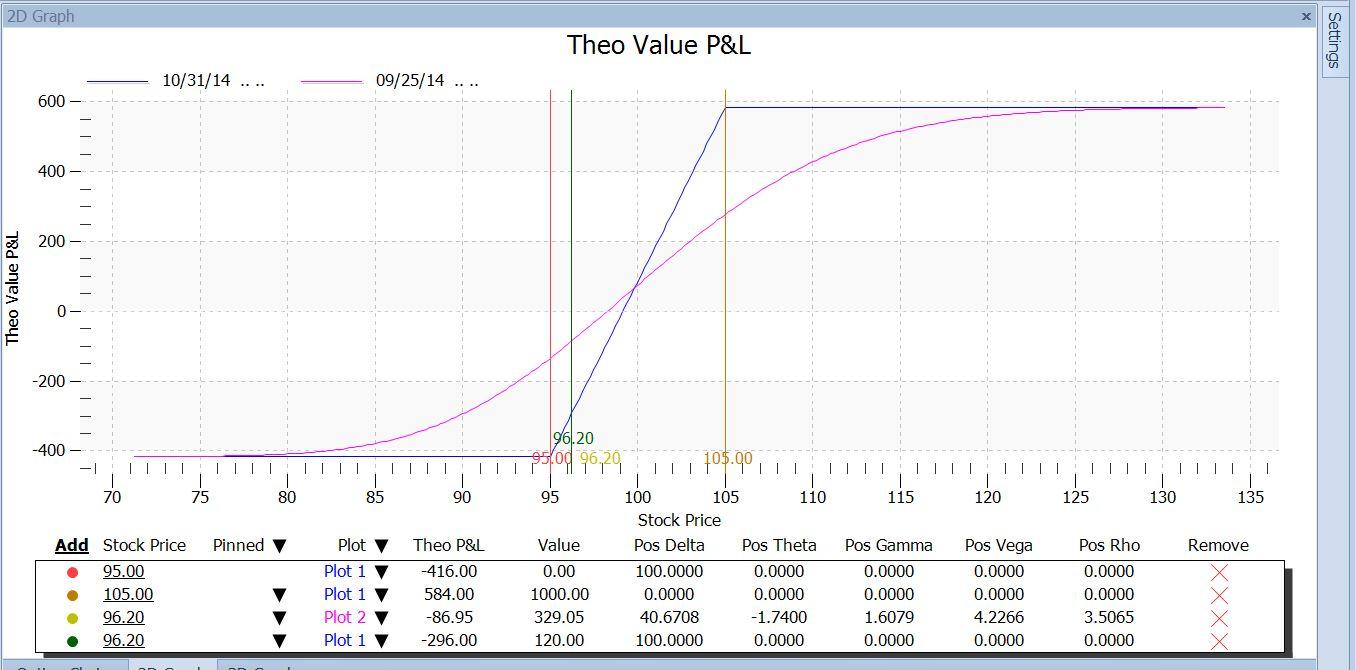

This is easy to answer by placing a marker at that $96.20 price, as in this version:

From the table under the chart, we can see that if that happened today, we would have a loss of $86.95 (next to last row, Theo P&L column). If the trade tortured us by waiting until the last minute to hit that stop, our loss would be $296.00 (last row). The difference is the net time value that we own today.

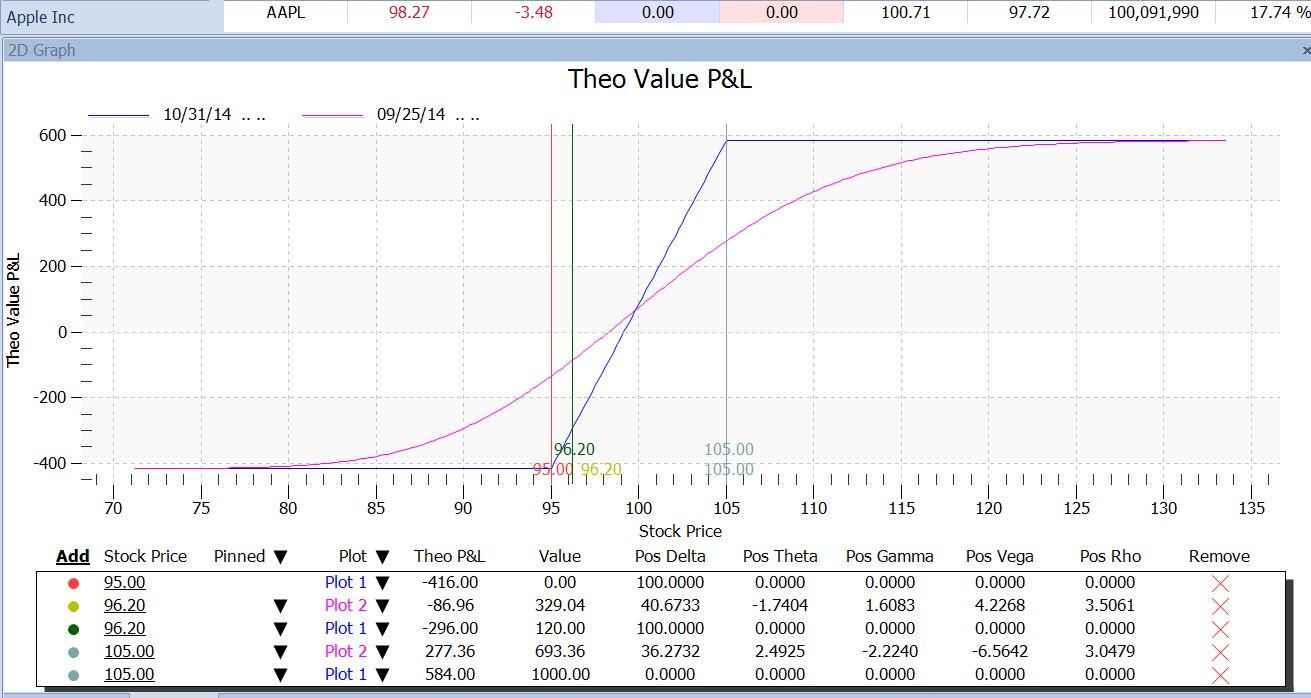

In the same way we can see what the effect would be of Apple reaching the $105 target, by placing a marker there:

Now we can see that at the $105.00 target, this trade would make $277.36 if it happened today; and if it took until expiration, it would make $584.00, which is twice as much. Also, following that magenta line upward, we can see that it doesn’t hit the maximum P/L mark today unless Apple goes to $125.

This might be kind of curious until we think about it. Why is it a good thing that the trade ends soon if it goes against us, but better if it takes longer if it goes our way?

The answer here can be seen from the fact that the current P/L line (magenta) is above the expiration P/L line (blue) at stock prices below $100. In that range, the $95 long call has more time value than the $105 short call, so we are net long time value. But at stock prices higher than $100, the opposite is true. When the stock price leaves the $95 strike behind and rises toward the $105 strike, the $95 call goes further and further into the money. It gains intrinsic value, but actually loses time value. Meanwhile, the $105 call transitions from being very far out of the money to being close to the money. So it gains time value. At some point the $105 short call has more time value than the $95 long call. At that point, we become net short time value. From that price upwards, the passage of time no longer hurts us, and instead it helps us.

Furthermore, at prices that are high enough ($125), the blue and magenta lines merge. That tells us that if that price were reached today, the $105 call itself would be so far in the money that it would no longer have any time value either. At that point, there would be no time value in either option, and each would be worth just its intrinsic value. The intrinsic value of our long $95 call would be stock price – strike price = $125 – $95 = $30. That of the short $105 call would be would be $125 – 105 = $20. So the net value would be $30 – $20, or $10 per share.

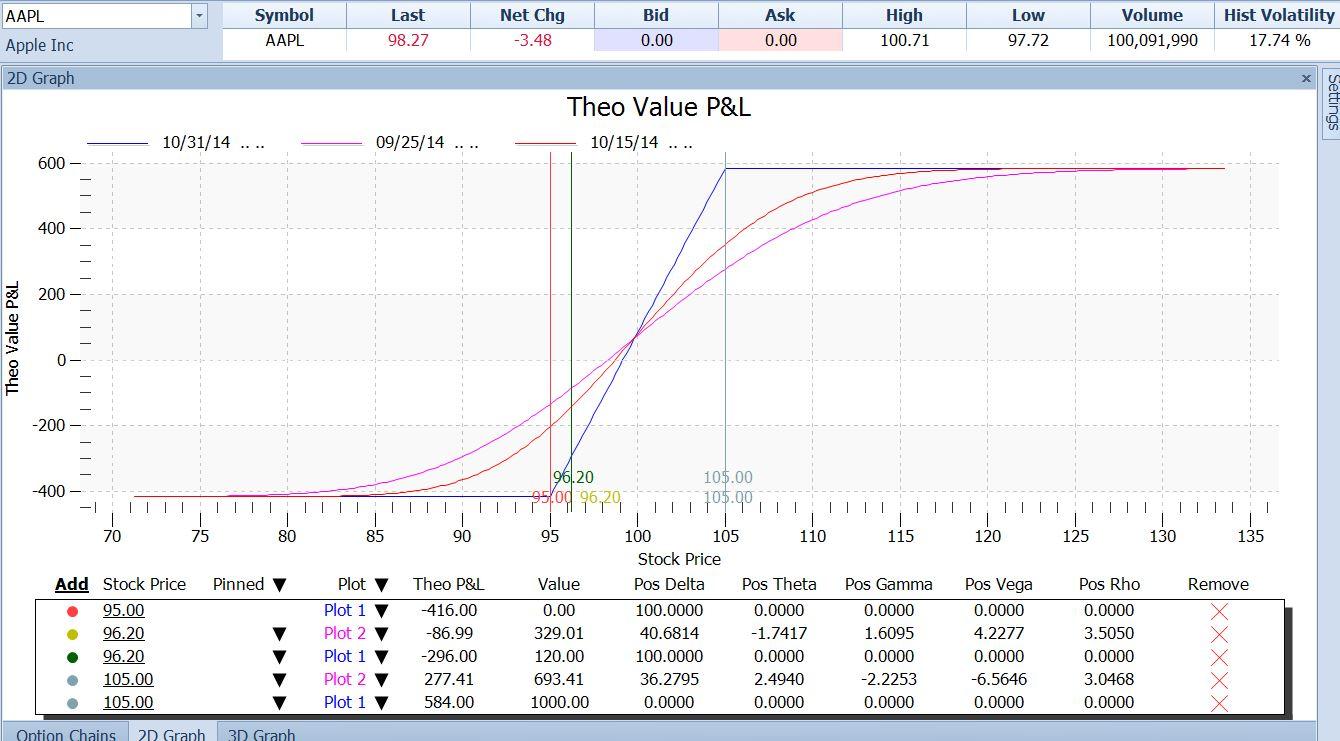

As each day goes by, the magenta “current P/L” line moves toward the blue “expiration P/L” line. If we want to see the effect of that at some intermediate time, we can add another plot, which is as of a different time – say 2 weeks away. Here is what that looks like:

The red line now shows that the farther out in time we are, the nearer the price at which we make our maximum profit.

I hope this series has stimulated you to look into the uses of the option payoff diagrams for your option trading. The more you use them, the more invaluable you will find them.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.