In the last couple of articles (Part 1 and Part 2), I’ve discussed two of the five greeks. The greeks are variables that measure the amount of option price change that is expected to result from changes in the forces that define option values. As a quick review, here are the five greeks:

Greek Name Measures option price change resulting from:

Delta Changes in the current price of the underlying asset

Vega Changes in expectations for future price change in the underlying asset

Theta Drop in option price due to the passage of time

Rho Changes in the risk-free interest rate

Gamma Change in Delta due to changes in the current price of the underlying asset

Last week we finished up Delta and started on Vega. Today we’ll continue with that.

As discussed before, each of the forces measured by the greeks acts separately on every option. So if a Call option has a Delta of .50, an increase of one dollar in the stock’s price will cause an upward push of fifty cents on the option price.

But that doesn’t mean that a one dollar increase guarantees that the option’s price will actually go up by fifty cents. The underlying price effect, measured by Delta, is not working in isolation. Delta’s plus-fifty-cent effect will have to be added to the sum of the effects measured by the other Greeks.

Let’s say that our option with a Delta of .50 has a Vega value of .15. As we discussed last week, that means that a one-percentage-point change in the option market’s expectation for future annualized stock volatility will change the option’s price by fifteen cents. For example, let’s say that yesterday the reading for implied volatility on this option was 30%. This means that the option-buying public, by being willing to pay the price at which this option was trading, were indicating that they expected this stock to move within a 30% annual range. If today they decide that they only expect further movement within a 28% range, then implied volatility has gone down by two percentage points, from 30 to 28. Multiplying that 2-point change by the Vega value of .15, the effect on the option’s price would be a decrease of thirty cents. So the net change would be plus fifty cents (from the Delta effect) minus thirty cents (from the Vega effect), for a running total of plus twenty cents.

Notice that above I said running total, not net change. That is because we’re not done yet.

Between yesterday and today, while the underlying stock was rising by a dollar and implied volatility was falling, another event occurred – the passage of one day’s time. Every option that contains any time value loses some of that time value every day.

Notice the qualification above - every option that contains any time value. This qualification is needed because not every option does. Those that are very deeply in the money and have a Delta of 1.0, have no time value, only a very large amount of intrinsic value. They are effected by underlying price movement only, and by nothing else. On the other hand, options that are very far out of the money, such that they have no value at all, clearly have no time value either. With no time value to lose, they too are unaffected by the passage of time.

But for those options that do have time value, that time value is a wasting asset. Every day that passes means less time for the stock to move into (or further into) the money. So all such options lose some time value every day (including weekends and holidays). We call this loss of value time decay.

The amount of time decay an option will incur for the next one-day passage of time is measured by the greek called Theta. It gives the amount of option price decrease, in dollars per share, for the next day. Notice I did not say per day. The amount of time value lost per day changes as time passes. So if an option’s Theta value is .02 today, it could be .03 tomorrow, and more the day after that, and so on until expiration.

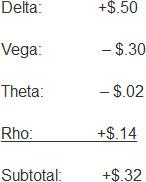

Let’s say for our example, that the option we’re looking at had a Theta value of .02 yesterday. Then we’d expect the value lost due to time decay from yesterday to today to be two cents. Netting this with the fifty-cent increase measured by Delta and the thirty-cent decrease measured by Vega, we now have a running total of +$.50 -$.30 -.02 = + $.18.

Here’s our summary scorecard for Theta:

Greek name: Theta

Force acting on option price: Passage of time

Unit of measure: Pennies per share of option price change for a one-day time increment (multiply by 100 to get the amount of price change per option contract)

Sign: Negative for both puts and calls

Notes: Options with more time value have higher Theta values. For a given expiration date, at-the-money (ATM) options have the highest Theta values. For a given strike price, options with a nearer expiration date have higher Theta values. Theta generally increases each day, unless an option is far in or out of the money.

The next effect we have to consider is from a change in interest rates. This change is measured by the greek called Rho. In brief, higher interest rates make call options more valuable, and put options cheaper. This is because a call option is an alternative to buying stock, while a put option is an alternative to selling stock. If we bought stock, it’s assumed that we would borrow the money to do it. The amount of interest we would pay to borrow the money for the stock purchase is built into the call’s price. The higher the interest cost we’re avoiding by buying calls instead of stock, the more valuable the calls are.

For puts the shoe is on the other foot. If we sold stock, we would have the cash proceeds and could be earning interest on that amount. So the value of the interest income foregone by owning the put instead of selling the stock, is in effect subtracted from the value of the put.

The bottom line is that higher interest rates make calls more expensive while they make puts cheaper. And if the interest rate changes in the course of an option’s life, its price will change too. For an increase in interest rates, call prices go up while put prices go down. For an interest rate decrease, the effects will be reversed.

The interest rate used for these calculations is the risk-free rate, or the rate we could earn on money without taking any risk. In the U.S., the rate used is usually the rate on U.S. Treasury securities that mature at the same time as the option expires. Three-month T-bills for a 3-month option, etc.

The greek called Rho gives the option price change, in dollars per share, for a one percentage point increase in the relevant interest rate. Calls have positive Rho values, while puts have negative Rho values.

The risk-free interest rate does not change very often. But for our example, let’s say that today happened to be the day, and the risk free rate increased by one percent. This would be a huge change, by the way – these rates usually change in much smaller increments.

If our example option had a Rho value of .14, then a one percent change in the rate would have a 14-cent positive effect on our call options.

Taken together, the effects of the changes we have so far are:

As we can now see, the one-dollar change in the underlying stock price does not completely explain the total price change of an option. Understanding this will help us to create option positions that will either take advantage of, or at least not be hurt by, each of the Greeks.

We are not quite finished with the Greeks, but we’re getting there. Next week we’ll include the effects of dividends, talk about gamma, the last of the greeks, and wrap it up.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

AUD/USD remains confined in a range below 0.7100 after RBA minutes

AUD/USD extends the sideways consolidative price move and reacts little to the RBA February minutes, which reinforced a tightening bias. The hawkish outlook, however, fails to provide any impetus to the Australian Dollar as the risk of another rate hike is already priced in. In contrast, bets for more rate cuts by the Fed keep the US Dollar bulls on the defensive and act as a tailwind for the Aussie amid the underlying bullish sentiment.

USD/JPY struggles to capitalize on strength beyond 153.75 hurdle

The USD/JPY faces resistance near the 153.75 zone during the Asian session on Tuesday, stalling the previous day's positive move as divergent BoJ-Fed policy expectations offer some support to the Japanese Yen. That said, Japan's weak Q4 GDP print, released on Monday, tempered bets for an immediate BoJ rate hike. This, along with the underlying bullish sentiment, warrants caution for the JPY bulls and could act as a tailwind for the currency pair.

Gold sticks to a negative bias below $5,000; lacks bearish conviction

Gold remains depressed for the second consecutive day and trades below the $5,000 psychological mark during the Asian session on Tuesday, as a positive risk tone is seen undermining safe-haven assets. Meanwhile, bets for more interest rate cuts by the Fed keep a lid on the recent US Dollar bounce and act as a tailwind for the non-yielding bullion, warranting caution for bearish traders ahead of FOMC minutes on Wednesday.

AI Crypto Update: Bittensor eyes breakout as AI tokens falter

The artificial intelligence (AI) cryptocurrency segment is witnessing heightened volatility, with top tokens such as Near Protocol (NEAR) struggling to gain traction amid the persistent decline in January and February.

US CPI is cooling but what about inflation?

The January CPI data give the impression that the Federal Reserve is finally winning the war against inflation. Not only was the data cooler than expected, but it’s also beginning to edge close to the mystical 2 percent target. CBS News called it “the best inflation news we've had in months.”

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.