There is a popular saying in trading, “Amateurs open the market, but professionals close it.” That saying refers to the massive amounts of orders that brokerages have to fill at the open as a result of amateur traders and investors flooding them with buys and sells from news they heard in the afternoon or evening. Typically the professionals and institutions will wait for the day’s trend to develop before working out their purchase or sales price in the afternoon. However, fueled by fear and/or greed, the novice jumps in as soon as they can when the market opens or even in the pre-open.

When there is an influx of orders, the brokers will want to fill them as soon as they can since they earn their commission from the order flow. But this rush to fill the orders can exhaust the momentum and cause additional swings in the morning. As an example, let’s suppose the market looks bullish. You hear good news about a company and want to buy their stock. You must remember that you are not the only person who has heard this news nor are you the only person submitting a buy order.

In the pre-open, the exchanges look at all of the buy orders and sell orders being received and try to match them at an opening price that would best fill the greatest number of orders for the customers. This is great except, if the majority of buy orders have been satisfied in the pre-open, then how will the price rise when the markets open? Think about it. If everyone who wanted to buy just got into their stock, then there will not be the demand needed to push prices higher at the open.

Often, the large demand for stock will cause the price to gap up on the open into a level where many sellers are waiting. This area is called resistance. It is an area where prices had collapsed in the past due to an imbalance of buyers and sellers. If the demand is exhausted in this area, could the price go anywhere but down? This offers a great opportunity for an intraday trader who can identify the levels properly.

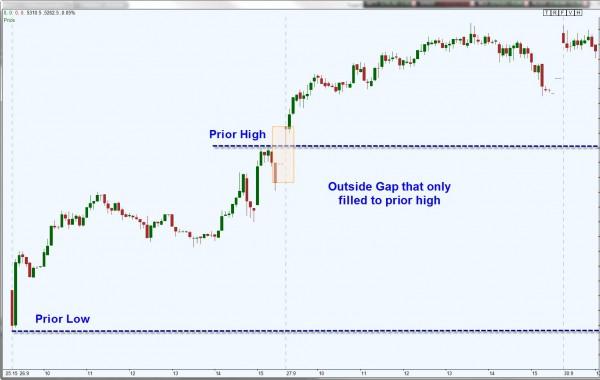

Gaps are a normal part of trading. Traders can view these gaps as a great inconvenience or an excellent opportunity. The key is to see what the price action is telling you after it gaps. An interesting thing to see is whether prices were able to gap beyond the prior day’s price action. When I speak of the prior day’s price action, I am referring to the movement of price between the prior day’s high price and the prior day’s low price. If prices gap but do not open above the prior high or below the prior low, then the gap is called an inside gap and is likely to fill during that day.

As an intraday trader, I can identify stocks that are exhibiting this pattern and plan trades to take advantage of the gap filling as long as the Nifty is also confirming the movement. This could also have huge implications for swing traders as a gap that occurs opposite to their position may be able to be ignored thus preventing panic and an early exit.

Should price gap above the prior high or below the prior low, then the gap is considered to be an outside gap. Outside gaps also offer interesting trading opportunities. They tend not to fill in the day but will change direction at the prior high or prior low. If a stock does gap above the prior day’s high, it is an outside gap and will likely only fill until it reaches the prior high which will act as support. If the markets are bullish, then expect a bounce here for a long.

If the stock gaps down and tries to fill the gap, often the prior low will act as resistance and cause the stock to drop from that point thus identifying a shorting opportunity.

There are always exceptions to these guidelines on gaps and traders should exercise caution and discretion when identifying trading opportunities surrounding gaps. Look at the broad market and also larger trends for guidance and above all, place protective stops to manage your trades. Trade safe and trade well!

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD: US Dollar comeback in the makes? Premium

The US Dollar (USD) stands victorious at the end of another week, with the EUR/USD pair trading near a four-week low of 1.1742, while the USD retains its strength despite some discouraging American data released at the end of the week.

Gold: Escalating geopolitical tensions help limit losses Premium

Gold (XAU/USD) struggled to make a decisive move in either direction this week as it quickly recovered above $5,000 after posting losses on Monday and Tuesday.

GBP/USD: Pound Sterling braces for more pain, as 200-day SMA tested Premium

The Pound Sterling (GBP) crashed to its lowest level in a month against the US Dollar (USD), as critical support levels were breached in a data-packed week.

Bitcoin: No recovery in sight

Bitcoin (BTC) price continues to trade within a range-bound zone, hovering around $67,000 at the time of writing on Friday, and falling slightly so far this week, with no signs of recovery.

US Dollar: Tariffed. Now What? Premium

The US Dollar (USD) reversed its previous week’s decline, managing to stage a meaningful rebound and retesting the area just above the 98.00 barrier when tracked by the US Dollar Index (DXY).

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.