As prices in the Indian equity markets approach the previous highs set in 2010, there are a lot of stocks that are making 52-week or even all-time highs. As traders, we know that we should participate in the dominant trend but base our exits on supply and demand zones. But where are we supposed to exit when we do not have a zone as a signal?

Fortunately, there are several techniques that we can use to identify probable exit point to protect our profits. Remember, none of these are as strong as actual supply zones but they do seem to offer higher probability targets when we are breaking out into unknown territory.

The first method is one of the easiest. Before prices break to new highs, it often pulls back to gain momentum. If you measure the depth of the pullback and then project that same length at the breakout, it will often mark the area of the first correction after the breakout.

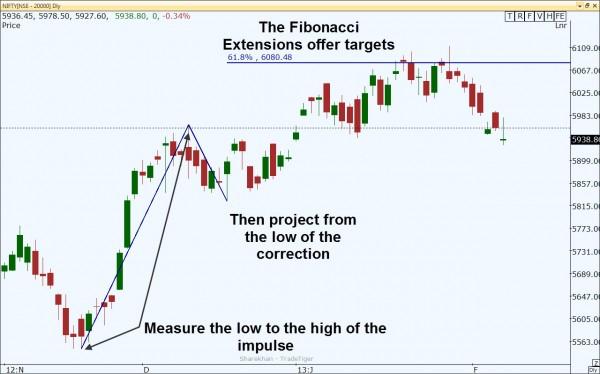

The next method offers multiple targets and uses a tool that is available on most software platforms. The Fibonacci extension tool measures the impulse prior to the breakout and then projects certain measurements of that impulse from the recent lows. By doing this, you can often identify the area where the breakout impulse will stall.

The last method is to simply wait for a signal that the trend has been broken. Moving averages offer a summary of the current trend and the mean price. In a bullish trend, prices should move away from an average and then snap back to it but not close below the moving average. This is called reversion to the mean. If price breaks the moving average by closing below it, then the trend has likely ended.

There are two problems with this technique. First, you will never exit at the top of the move since we wait for a pullback to trigger the exit. That is fine though as we can still participate and profit from the majority of the move.

Secondly, is the choice of the moving average period. We need to select a period or length of the moving average that price will respect for the trend. Stocks and timeframes differ and one moving average may not work for all securities. There are some advanced techniques for finding the best length but I will save that for discussion in our courses.

So if the price of your security breaks to new highs, you might now be better prepared to take your profits at the right time rather than trying to guess. To learn more, contact your local Online Trading Academy center and enroll in the Professional Trader course today.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

AUD/USD: The hunt for 0.7000 kicks in

AUD/USD finally cleared the key 0.6800 barrier, up for the fourth session in a row on the back of the persistent downward momentum in the Greenback in the wake of the Fed’s rate cut.

EUR/USD maintains its constructive tone and targets 1.1200

EUR/USD managed to add to Wednesday’s gains and climbed to the area of weekly tops around 1.1180 following further weakness in the US Dollar as investors continued to factor in the likelihood of extra rate cuts in the next few months.

Gold maintains the upward pressure near $2,600

Following a pullback in the early American session, Gold regains its traction and trades decisively higher on the day at around $2,580. The 10-year US Treasury bond yield retreats toward 3.7%, supporting XAU/USD in the Fed aftermath.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

BoE expected to keep interest rate unchanged at 5% as price pressures persist

After a close call in August, the Bank of England’s September interest rate decision is keenly awaited for fresh cues on the bank’s future policy action and the pace of its bond sales.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

Discover how to make money in forex is easy if you know how the bankers trade!

5 Forex News Events You Need To Know

In the fast moving world of currency markets, it is extremely important for new traders to know the list of important forex news...

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and...

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.