With the Sensex breaking 20000 and the Nifty making significant highs, many investors are wondering if the markets will be able to take out the previous highs. Investors are eagerly awaiting the budget to see if the markets will indeed continue their bullish run after the recent basing.

The best thing we can do as traders is to look to the charts for the actual clues to the market direction. Looking first to the Nifty, we can see that price has been trading right into a supply zone. With the slow entry into that zone, you would expect that if we do drop from the zone, it would only be a correction and not a trend reversal. A healthy correction to the 5650 demand is likely and also confirmed by negative divergence on the RSI. As long as we do not have the RSI drop below 40 when we correct, we should see new highs afterward. This was confirmation of bullish trend continuing as the corrections indicated in June, July, Sept, and Nov. 2012.

The Sensex is also into supply with a slow approach. I would have expected a sharp declining only if we approached the supply quickly. As of now, I am only seeing a pullback likely to the 18500 levels.

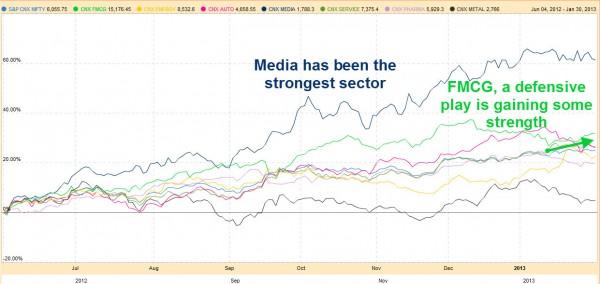

Those of you who have been in my Professional Trader class or in the Extended Learning Track course know that I like to look at the sectors that are fueling the markets in order to determine whether the markets are likely to continue their trends. I looked back on the equity index charts to see where the current bullish move began. I started my study from the June 4th 2012 lows. When I compare the sectors from the start of the bullish run, I see that the move was one that was participated in by all of the sectors and was healthy. The strongest sector was the media.

As the equity markets were nearing the recent supply levels, all of the sectors were moving lower except for FMCG. This shows nervousness in investor sentiment as they shift funds into safer sectors. If we do not see a large drop in cyclical stock investments (autos, IT, durables etc) then we should only see a pullback in the indexes.

Intraday traders should look at profiting from the short side of the market as the daily charts will be leaning toward short-term downtrends. But once those demand zones are reached, look for the long opportunities to test the prior highs.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

AUD/USD bounces back toward 0.7050 amid renewed USD weakness

AUD/USD stages a comeback toward 0.7050 in Friday's Asian trading, after falling about 1% on Thursday. The pair draws support from a fresh selling wave seen around the US Dollar even as risk sentiment remains weak. Surging oil prices due to the Middle East war dent risk appetite.

USD/JPY struggles near 157.50, eyes turn to US NFP

USD/JPY edges lower to near 157.50 in the Asian session on Friday after posting modest gains in the previous session. Broad US Dollar weakness, Japanese FX intervention risks and a risk-off market mood undermine the major, despite uncertainty over the BoJ interest rate hikes. All eyes now remain on the US Nonfarm Payrolls data.

Gold awaits US Nonfarm Payrolls for a clear directional impetus

Gold rebounds above $5,100 early Friday after testing the $5,050 level amid global sell-off. The US Dollar pulls back as profit-taking creeps in ahead of US labor data. For February. 21-day SMA holds amid bullish RSI; a daily closing above 61.8% Fibo is critical for Gold buyers.

Ethereum pull in $169M as validators pile in to stake ETH

US spot Ethereum exchange-traded funds recorded $169 million in net inflows on Wednesday, marking the largest daily intake in two months, according to SoSoValue data. The rise in inflows signals renewed institutional interest in Ethereum amid broader market volatility.

The market compass is pointing at a barrel of Oil

The Asian open is arriving with equities leaning the wrong way, and the reason is not complicated. The market’s compass needle has snapped firmly toward crude. In this tape, oil is not just another input price; it is the gravitational center around which every asset class is orbiting.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.