Over the last fifteens year or so, the financial product known as the Exchange Traded Fund has grown immensely in popularity, and for good reason. ETF’s, as they are commonly referred to on Wall Street are closed end funds, meaning that they are pools of money that are put together with a specific mandate. In the example of the SPY, the most popular and liquid ETF, the objective of the fund is to match the returns of the cash S&P 500 by continuously managing a portfolio to match the index. These funds are closed ended because after the initial investors pooled their money, these funds no longer accept new money. This allows them to trade exactly like a stock, with the major difference being that an ETF is designed to track a broad based equity index or commodity. Although there are literally thousands of ETF’s to choose from, the two most popular ETF’s (and thus most liquid) of the index funds are the SPY, which track the S&P 500, and the QQQ whose mandate is to mimic the Nasdaq 100, an index comprised of the biggest stocks in the Nasdaq.

ETF’s are a great alternative to stocks in accounts where Futures contracts are not permitted to be traded, or where leverage is not appropriate. Because ETF’s track a broad index, they tend to mitigate the gap risk associated with stocks. Even when this may be the case, the futures markets are a very good odds enhancer in trading the ETF’s because the futures often tend to lead, and they trade continuously throughout the night.

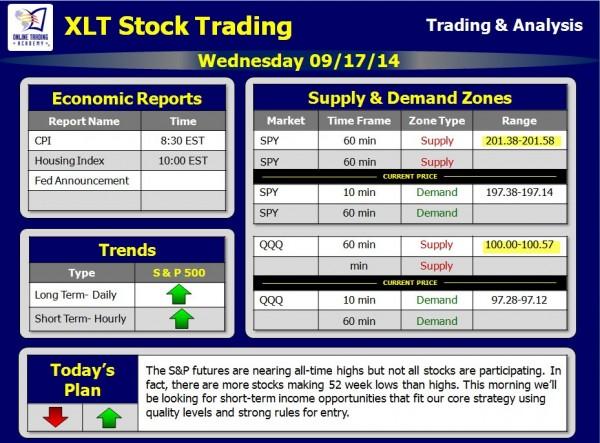

On Wednesday of last week, I was conducting a stock XLT in which we not only find stocks to trade intraday, but we also track, and trade the SPY and QQQ. We start the session with what we call the prep screen in which we detail the supply and demand levels for the aforementioned ETF’s in order to track these indexes. It’s important to watch these indexes when trading stocks as they exert the biggest influence on their price. Below is the screen capture of that day’s Prep screen. Notice I’ve highlighted the supply levels of both the SPY and QQQ because they came into play later that day as the Federal Reserve announced that they were going to end the quantitative easing program in October.

As we can see in the charts, in both examples, the QQQ hit the level of 100.00 spot on, before turning down intraday, and the SPY actually pierced the higher line of supply. Why did that happen?

If we look at the corresponding Futures contracts we can see that the NQ ( Emini Nasdaq) hit its supply level at the same time the QQQ was filling its gap. This made for a high probability trade in both instruments.

The ES ( Emini S&P 500) on the other hand did not have a quality supply level as it made an nominal all-time high. This produced a higher high on the SPY which made that level invalid.

So as we can see, using the futures markets to time our entries in ETF’s can be very useful. And since there are EFT’s for pretty much every commodities market, futures, if used in conjunction with supply and demand can produce high quality entry points.

You can find out more about the stock futures market, and how to trade, starting with a free Power Trading Workshop at Online Trading Academy. Classes are held on a regular basis at our local financial education centers and online.

This content is intended to provide educational information only. This information should not be construed as individual or customized legal, tax, financial or investment services. As each individual's situation is unique, a qualified professional should be consulted before making legal, tax, financial and investment decisions. The educational information provided in this article does not comprise any course or a part of any course that may be used as an educational credit for any certification purpose and will not prepare any User to be accredited for any licenses in any industry and will not prepare any User to get a job. Reproduced by permission from OTAcademy.com click here for Terms of Use: https://www.otacademy.com/about/terms

Editors’ Picks

EUR/USD loses traction after earlier rebound, tests 1.1600

EUR/USD fails to preserve its recovery momentum after rising toward 1.1650 earlier in the day and tests 1.1600. The risk-averse market atmosphere amid the widening conflict in the Middle East and the broad-based US Dollar strength make it difficult for the pair to hold its ground.

GBP/USD stays weak near 1.3350 amid UK stagflation risks

GBP/USD stays in negative territory near 1.3350 in the second half of the day Thursday. The Pound Sterling loses ground amid fears that the United Kingdom economy could face stagflation risks due to higher energy prices, while the US Dollar attracts fresh safe-haven demand, weighing on the pair.

Gold struggles to benefit from risj-aversion, drops toward $5,100

Gold turns south in the American session on Thursday and declines toward $5,100. The persistent US Dollar (USD) strength doesn't allow XAU/USD to gather recovery momentum despite markets remain risks-averse due to the deepening conflict in the Middle East.

Crypto Today: Bitcoin, Ethereum, XRP hold weekly gains despite US-Iran war

The cryptocurrency market is gaining strength on Thursday, building on Wednesday's upswing, which saw Bitcoin reach a weekly high above $74,000. Ethereum and Ripple are moderating their recent gains amid uncertainty stemming from the escalating war in the Middle East.

Markets attempt to rally on positive news from Iran

There’s been an abrupt change in sentiment this morning, European stock markets are higher and oil and gas prices are moderating, after comments from Iran’s deputy minister about pre-conflict talks between Iran and the US.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.