Gaps are a normal part of trading. Traders can view these gaps as a great inconvenience or an excellent opportunity. The key is to see what the price action is telling you after it gaps. Stocks gap due to a massive imbalance between buying and selling pressure. In an effort to balance out these orders, the price will gap to an area where the market’s supply and demand equation is right for filling the orders of the traders and investors. The gap left behind is a vacuum where there is an absence of buyers (a gap down), or an absence of sellers (a gap up).

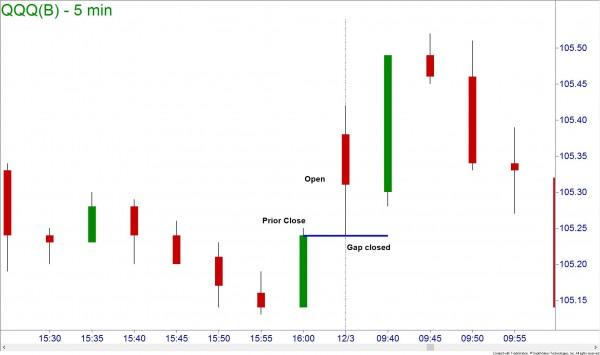

Gaps are a magnet for price. They are usually formed when prices are impulsing in the trend direction. During corrections, price will often try to fill the gap. A gap fill means that prices have returned to the closing price of the candle before the gap itself. Once a gap has been filled, it has no more impact on price.

An interesting thing to see is whether prices were able to gap beyond the prior day’s price action. When I speak of the prior day’s price action, I am referring to the movement of price between the prior day’s high and the prior day’s low. If prices gap, but do not open above the prior high or below the prior low, then the gap is called an inside gap and is likely to fill during that day.

As an intraday trader, I like to identify stocks that are exhibiting this pattern and plan trades to take advantage of the gap filling as long as the broad market is also confirming the movement. The best trading opportunity occurs when prices gap inside of the prior day’s price action but opens into a supply or demand zone.

An inside gap could also have implications for swing traders as a gap that occurs opposite to their position may be able to be ignored, thus preventing panic and an early exit.

Should price gap above the prior day’s high or below the prior day’s low, then the gap is considered to be an outside gap. Outside gaps also offer interesting trading opportunities. They tend not to fill in the day, but instead will change direction at the prior high or prior low. If a stock does gap above the prior day’s high, it is an outside gap and will likely only fill until it reaches the prior high, which will act as support. If the markets are bullish, then expect a bounce here for a long.

If the stock gaps down and tries to fill the gap, often the prior low will act as resistance and cause the stock to drop from that point, thus identifying a shorting opportunity.

There are always exceptions to these guidelines on gaps, and traders should exercise caution and discretion when identifying trading opportunities surrounding gaps. Look at the broad market and also larger trends for guidance and, above all, place protective stops to manage your trades. Trade safe and trade well!

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD seems fragile below 1.1700 as Middle East war boosts energy prices

The EUR/USD pair trades flat at around 1.1680 during the Asian trading session on Tuesday, but broadly seems vulnerable, being close to its five-week low. The major currency pair is under pressure as surging oil prices due to the United States-Israel war with Iran have increased the risks of higher inflation for the Old Continent.

Gold weakens below $5,300 as sustained USD buying counter Middle East tensions

Gold attracts some intraday selling and falls around $100 from the daily top, around the $5,380 area. The US Dollar climbs to a fresh high since January 20 and turns out to be a key factor exerting downward pressure on the commodity. However, concerns about a broader regional conflict in the Middle East continue to weigh on investors' sentiment and underpin demand for the traditional safe-haven bullion.

GBP/USD hovers around 1.3400 with bearish pressure intact

GBP/USD edges higher after three days of losses, trading around 1.3400 during the Asian hours on Tuesday. The technical analysis of the daily chart indicates an ongoing bearish bias, as the pair trades within a descending channel pattern.

Stellar risks deeper losses as derivatives metrics turn negative

Stellar is trading red below $0.16 at the time of writing on Tuesday, after a slight recovery the previous day. Weakening derivatives data caps the recovery, while an unfavorable technical outlook projects a deeper correction for the XLM token in the upcoming days.

The market is not panicking it is repricing the probability distribution of Oil and time

At the end of the day, markets do not trade morality or geopolitics. They trade transmission channels. And the only channel that truly matters in this maelstrom runs through the price of energy and the time value of money.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.