I wanted to share a recent email I received:

Hi Brandon,

I am one of your students from Philadelphia. I took your Pro Trader and Futures class about this time last year.

I have been wondering what hammer candles really mean. It occurred to me it might be a good subject for one of the newsletter articles. What is really happening with the buyers and sellers with those candles? I think the long wick means emotion. So when we are coming down a drop with red candles and then we get a green hammer, hammer at the top, what does it really mean? I think there must be some panic in the candles. Are there some things for us to know that would help us read these and what’s coming? Another question is, if we see these as part of an opposing zone as we try to set targets, how should we read them? (E.g. a target for a long and the wick is dangling down from a potential opposing zone.)

I’ve wondered about this for a while and wondered if someone like you might address it in a newsletter.

Beth

People seem to think that because so few people are successful in trading that there must be a complicated process to complete in order to make money. The truth is that the simpler we make trading, the more profitable it seems to be. This week I decided to discuss a simple technique that is often overlooked when traders are reading charts. We are all too quick to look at the squiggly lines we call indicators and oscillators and dismiss the simplest signal available to us, PRICE!

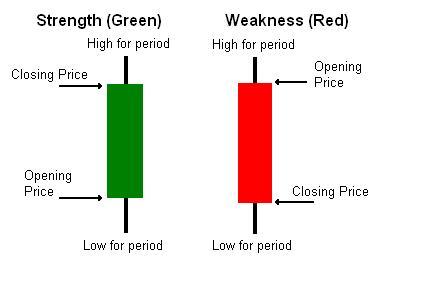

The most common way that price is displayed for most traders is through candle charts. If you are not familiar with the construction of a candlestick, I have included the quick reference below. A green candle usually indicates strength in price and is formed by price closing higher than it opened during that particular period. Conversely, the red candle indicates weakness due to the closing price being lower than the open for that period.

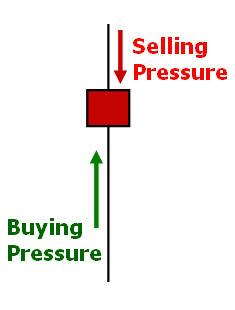

The problem is that many traders end their candle analysis there. You must look to see what the tails (wicks, shadows or whatever else you wish to call them) are telling you. These tails mark the highs and lows of the period. If I asked you what the candle below signifies, you may tell me weakness since it is red.

However with further examination, you will see that there is a long tail to the downside. This means that even though the bears pushed the price lower, there was enough bullish pressure to move price higher before the close of that period. This is actually a bullish candle! Let’s see where it was in the whole trend.

A red candle actually indicated that we were ready to bounce off support with a lot of bullish pressure. You have to listen to the tale the tails are telling you. Any candle tail that is above the real body (colored portion of candle) tells that the bulls were not able to hold price up and the bearish pressure moved prices downward. Any tail below the real body indicates buying pressure.

This becomes especially important when price is nearing a level of supply or demand. By seeing which force is winning (bulls or bears) we can anticipate a bounce or break of that price level and take appropriate action.

Remember that price gives us clues as to the immediate direction it will go. We just have to be open to viewing it and listen to the tale of the tails! You do not need to memorize the “candle patterns” such as a hammer, just learn to read the price action itself and the candles will tell you the tale of price movement.

This is one key factor for my trading success. There are several others that we teach in the Professional Trader course. Be sure to stop by your local Online Trading Academy office to see one of our many superstar traders/instructors for an educational experience you won’t ever forget!

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

Gold surges on safe-haven demand, rises above $5,400

Gold benefits from intense risk-aversion on Monday and climbs above $5,400, setting a fresh monthly-high in the process. Tensions in the Middle East remain high as Israel and Hezbollah continue to exchange strikes following the US-Israel joint attack on Iran over the weekend.

Oil retreats from seven-month high, WTI holds above $71.00

Cure oil prices started the week with a huge bullish gap and the barrel of West Texas Intermediate (WTI) touched its highest level since June above $75 as markets reacted to the closure of Strait of Hormuz following the US and Israel attacks on Iran. Although WTI retreats in the Euroepan morning, it holds comfortably above $71.

EUR/USD slumps below 1.1750 as USD benefits from risk-aversion

EUR/USD comes under renewed bearish pressure in the European session and trades below 1.1750 following a recovery attempt earlier in the day. The US Dollar gathers strength and weighs on the pair as investors seek refuge in the wake of Israel and the United States' joint attack on Iran.

Bitcoin, Ethereum and Ripple under pressure as key supports face breakdown risk

Bitcoin, Ethereum, and Ripple prices trade on the back foot at the start of this week on Monday, after extending losses in the previous week. BTC is on the brink of a breakdown, ETH is capped below key resistance, and XRP risks a crack of the trendline.

The market is paying for insurance, not apocalypse

As expected, this morning felt less like a Monday market open and more like a fire drill. Futures screens flickered red. S&P contracts down almost 1%. Nasdaq off 1.2%. Brent leaped 13% through $80. Gold rose 1.6% toward $5350 before paring some gains. The dollar is strutting mildly. The Swiss franc is quietly doing what it always does in a storm, catching some safe-haven flows.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.