In the past I discussed about a different type of trading analysis called Gann Theory. This is a popular style of analysis that looks at patterns and repeatable price action based on time. After receiving some emails on the subject, I decided it best to examine Gann Theory a bit further in my articles. I am not going to go into the history of Gann Theory or give a biography of W.D. Gann. Instead I will discuss some practical applications of some of his theory.

There are three trends applicable to any timeframe which you are analyzing: Minor, Intermediate and Major. That also means that there are three types of swing highs and lows that correspond with these trends. In my article, the Gann swing highs and swing lows I labeled as Gann Swings are actually intermediate swings. Let’s examine the definitions of the swing bottoms (lows) and swing tops (highs).

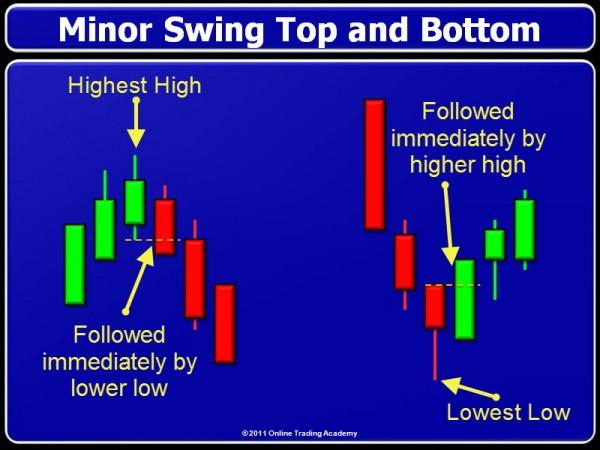

Gann Minor Swings:

A minor bottom is a low price compared to previous lows followed immediately on the next bar or candle by a higher low and a higher high. The minor top is a higher high compared to previous highs in price followed immediately by a lower high with a lower low.

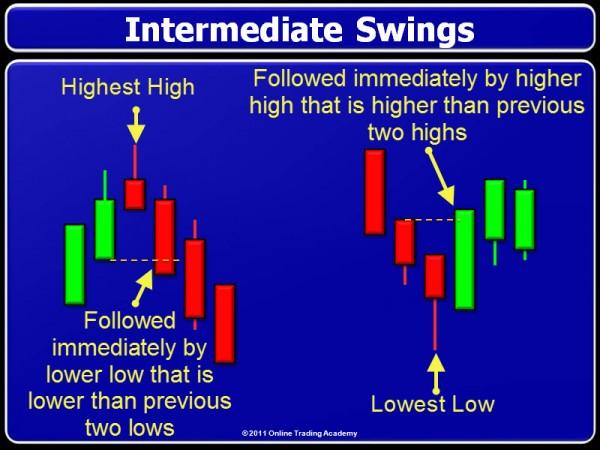

Gann Intermediate Swings:

The intermediate bottom is also a lower low compared to previous lows. However, it differs in that the immediate high that follows must be higher than the previous two bars or candles. The intermediate top is a higher high than previous highs that is immediately followed by a low that is lower than the previous two lows.

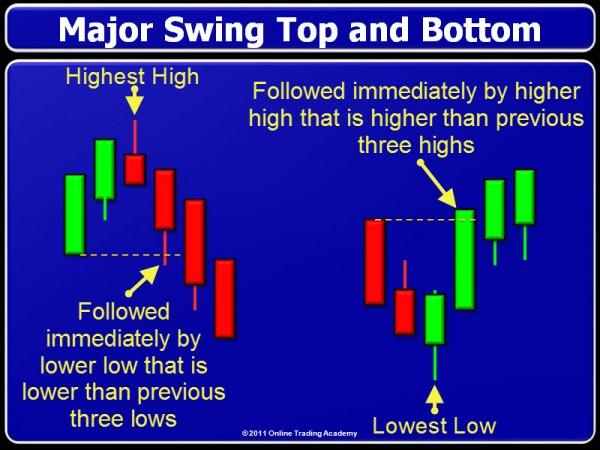

Gann Major Swings:

A major bottom will hold much significance to a trader using Gann Theory for their analysis. A major bottom would be a low price on a bar or candle that is lower than previous lows but is immediately followed by… you guessed it, a high that is higher than the previous three bars or candle highs. The major top is a high that is higher than previous price action followed immediately by a low that is lower than the previous three bars or candles.

Identifying Trend:

If you see price breaking a previous swing top, then you are in an uptrend in the timeframe and level (minor, intermediate, or major) that you are trading in. You would continue to trade only in the long direction until you break a previous swing bottom of the same degree. For instance, the following chart of USO opens the day with a minor swing bottom. If we were already in an intermediate uptrend, a trader could use that as an opportunity to trade long intraday until a swing bottom is broken. In fact, they may want to enter or add to longs when a new swing bottom is formed. After the minor swing bottom is broken a trader should wait for a new intermediate or major swing bottom to form before entering any more long positions.

In Gann trend analysis, a downtrend occurs when price breaks a swing bottom. If price moves downward in a defined uptrend but does not break a swing bottom, it is called a correction and the trader has no need to exit their long. A break of a swing bottom would constitute an exit signal.

The rules would be the same for a downtrend. Once a major downtrend has been established for the timeframe you are trading in, you could look to short intermediate or minor swing tops until they are broken.

In future articles I will explore more uses of Gann Theory for trading. Until then, trade safe and trade well!

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

AUD/USD extends the bounce, focus back to 0.7100

AUD/USD adds to Monday’s optimism and approaches the key 0.7100 barrier ahead of the opening bell in Asia. The pair’s positive performance comes as investors keep assessing the hawkish tilt from the RBA Minutes and despite humble gains in the Greenback. Next in Oz will be the Westpac Leading Index and the Wage Price Index.

EUR/USD meets initial support around 1.1800

EUR/USD remains on the back foot, although it has managed to reverse the initial strong pullback toward the 1.1800 region and regain some balance, hovering around the 1.1850 zone as the NA session draws to a close on Tuesday. Moving forward, market participants will now shift their attention to the release of the FOMC Minutes and US hard data on Wednesday.

Gold remains offered below $5,000

Gold stays on the defensive on Tuesday, receding to the sub-$5,000 region per troy ounce on the back of the persistent move higher in the Greenback. The precious metal’s decline is also underpinned by the modest uptick in US Treasury yields across the spectrum.

Ethereum Price Forecast: BitMine extends ETH buying streak, says long-term outlook remains positive

Ethereum (ETH) treasury firm BitMine Immersion continued its weekly purchase of the top altcoin last week after acquiring 45,759 ETH.

UK jobs market weakens, bolstering rate cut hopes

In the UK, the latest jobs report made for difficult reading. Nonetheless, this represents yet another reminder for the Bank of England that they need to act swiftly given the collapse in inflation expected over the coming months.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.