I was teaching a Professional Trader course in our Philadelphia office a couple of weeks ago and was discussing the market action on the stock Ebay. The students were doing well in the class by shorting the stock during the week the Dow was making new record highs. We decided to look at the bigger picture to see if Ebay was showing signs of a major trend reversal or just a correction before another move higher.

To trade properly, we need to focus on two major components: the trend of the security and the supply or demand zones. The trend tells us when we should be a buyer or a seller. The supply or demand zones tell us where we should actually take action. Mastering how to read these components is part of the Online Trading Academy core strategy.

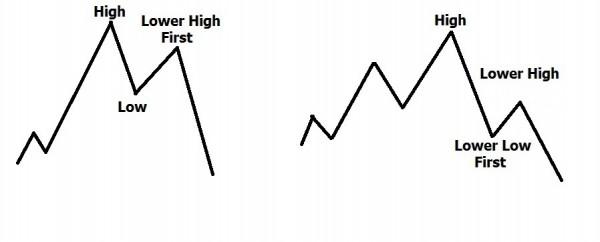

A bullish trend is a series of higher highs and higher lows. A bearish trend is when you have lower highs and lower lows. When the trend shifts from bullish to bearish or vice versa, we see that definition of the trend broken by price. But how it breaks may offer a clue as to how far the new movement may travel before a large reversal.

When looking at the reversal of a bullish trend, we know that the trend is officially over when lower lows are put in. But if price makes a lower high before making the first lower low, then it shows the lack of buying pressure in the markets and a larger likelihood that the resulting bearish trend will be stronger.

As seen in the preceding picture, when price breaks to a new low first before making a lower high, the breakdown is likely to pause and retest before continuing. It could even have a much shorter movement downward before reversing again.

Ebay’s daily chart warned of weakness on both the daily and weekly charts. Looking at the daily chart, price made the classic lower high before breaking to a lower low. This makes buying the stock at the demand zone incredibly risky. Had price dropped first into the demand zone it would have likely offered a better opportunity

While teaching a Professional Futures Trader course recently, we applied the same rationale to the S&P 500 futures. In the morning, the lower highs signaled that the trend was to be down for the day.

Later in the morning, I shorted a break of a demand zone and targeted two lower demand zones. I was able to take profits at the first demand for half of the position. To protect the remaining contracts, I moved the stop on the remaining position to the first target once that demand zone was broken. Unfortunately that was where I was stopped out but it was still for a profit.

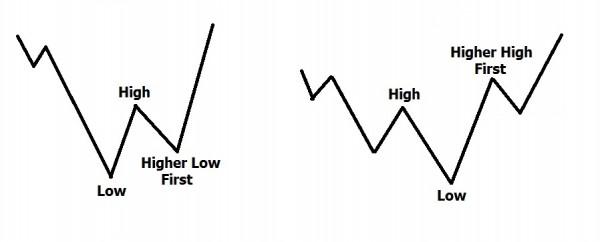

The same strategy is true for bullish reversals of a downtrend. When there is a higher low put in first before a higher high, then the rally is more likely to continue as the sellers have given up and buying pressure has been building. But if the higher high is made before a higher low, you are likely to see a correction and retest of the breakout. You may also see a weak bullish trend resulting from this.

So learn from the markets and from your instructors at Online Trading Academy. You want the best chances for success and the use of odds enhancers is one way to do that.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

WTI jumps above $70.50 on fears of Iran supply disruption

West Texas Intermediate, the US crude oil benchmark, is trading around $70.65 during the early European trading hours on Friday. The WTI jumps to its highest since June 2025 after joint military strikes by the US and Israel against Iran over the weekend. Traders brace for the release of the American Petroleum Institute report, which will be released later on Tuesday.

Gold jumps over 2% toward $5,400 after US, Israel attack Iran

Gold is on fire at the start of the week, a widely expected move, as investors seek harbor in the traditional store of value, following the continued US and Israel attacks on Iran. The bright metal opened with a bullish gap of about $17 and rallied toward the $5,400 level as Asian traders hit their desks and reacted negatively to the weekend news of the Middle East conflict, rushing for cover in Gold.

AUD/USD pares recent losses despite Middle-East conflict

AUD/USD recovers after opening at a gap down, trading around 0.7070 during the Asian hours on Monday. The risk-sensitive pair plunged as risk aversion heightened after the United States and Israel carried out coordinated strikes on Iran over the weekend.

Iran escalation: Quick thoughts on markets

Markets are likely to open the week with risk-off, with declines led by airlines, cyclicals and trade-exposed names, while energy, defense and “strategic” sectors may be relatively steadier.

Crisis in the Middle East: The market reaction

A primer on how markets will open on Monday, and why geopolitical risk may not be easily absorbed by financial markets this time around. Geopolitics and events between Iran, the US and the wider Middle East will dominate financial markets on Monday. The situation has continued to escalate as we move through Sunday.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.