I was teaching a Professional Trader course in our Philadelphia office a couple of weeks ago and was discussing the market action on the stock Ebay. The students were doing well in the class by shorting the stock during the week the Dow was making new record highs. We decided to look at the bigger picture to see if Ebay was showing signs of a major trend reversal or just a correction before another move higher.

To trade properly, we need to focus on two major components: the trend of the security and the supply or demand zones. The trend tells us when we should be a buyer or a seller. The supply or demand zones tell us where we should actually take action. Mastering how to read these components is part of the Online Trading Academy core strategy.

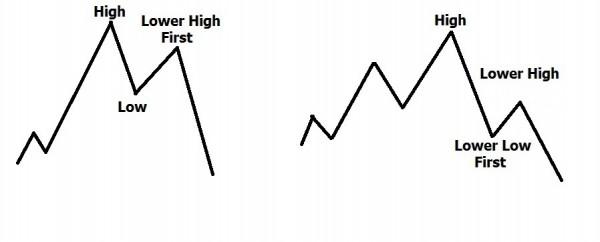

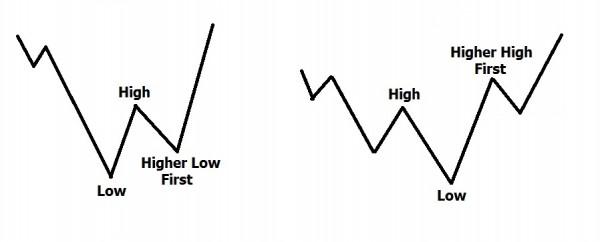

A bullish trend is a series of higher highs and higher lows. A bearish trend is when you have lower highs and lower lows. When the trend shifts from bullish to bearish or vice versa, we see that definition of the trend broken by price. But how it breaks may offer a clue as to how far the new movement may travel before a large reversal.

When looking at the reversal of a bullish trend, we know that the trend is officially over when lower lows are put in. But if price makes a lower high before making the first lower low, then it shows the lack of buying pressure in the markets and a larger likelihood that the resulting bearish trend will be stronger.

As seen in the preceding picture, when price breaks to a new low first before making a lower high, the breakdown is likely to pause and retest before continuing. It could even have a much shorter movement downward before reversing again.

Ebay’s daily chart warned of weakness on both the daily and weekly charts. Looking at the daily chart, price made the classic lower high before breaking to a lower low. This makes buying the stock at the demand zone incredibly risky. Had price dropped first into the demand zone it would have likely offered a better opportunity

While teaching a Professional Futures Trader course recently, we applied the same rationale to the S&P 500 futures. In the morning, the lower highs signaled that the trend was to be down for the day.

Later in the morning, I shorted a break of a demand zone and targeted two lower demand zones. I was able to take profits at the first demand for half of the position. To protect the remaining contracts, I moved the stop on the remaining position to the first target once that demand zone was broken. Unfortunately that was where I was stopped out but it was still for a profit.

The same strategy is true for bullish reversals of a downtrend. When there is a higher low put in first before a higher high, then the rally is more likely to continue as the sellers have given up and buying pressure has been building. But if the higher high is made before a higher low, you are likely to see a correction and retest of the breakout. You may also see a weak bullish trend resulting from this.

So learn from the markets and from your instructors at Online Trading Academy. You want the best chances for success and the use of odds enhancers is one way to do that.

Neither Freedom Management Partners nor any of its personnel are registered broker-dealers or investment advisers. I will mention that I consider certain securities or positions to be good candidates for the types of strategies we are discussing or illustrating. Because I consider the securities or positions appropriate to the discussion or for illustration purposes does not mean that I am telling you to trade the strategies or securities. Keep in mind that we are not providing you with recommendations or personalized advice about your trading activities. The information we are providing is not tailored to any individual. Any mention of a particular security is not a recommendation to buy, sell, or hold that or any other security or a suggestion that it is suitable for any specific person. Keep in mind that all trading involves a risk of loss, and this will always be the situation, regardless of whether we are discussing strategies that are intended to limit risk. Also, Freedom Management Partners’ personnel are not subject to trading restrictions. I and others at Freedom Management Partners could have a position in a security or initiate a position in a security at any time.

Editors’ Picks

EUR/USD bounces toward 1.1750 as US Dollar loses strength

EUR/USD returned to the 1.1750 price zone in the American session on Friday, despite falling Wall Street, which indicates risk aversion. Trading conditions remain thin following the New Year holiday and ahead of the weekend, with the focus shifting to US employment and European data scheduled for next week.

GBP/USD nears 1.3500, holds within familiar levels

After testing 1.3400 on the last day of 2025, GBP/USD managed to stage a rebound. Nevertheless, the pair finds it difficult to gather momentum and trades with modest intraday gains at around 1.3490 as market participants remain in holiday mood.

Gold trims intraday gains, approaches $4,300

Gold retreated sharply from the $4,400 area and trades flat for the day in the $4,320 price zone. Choppy trading conditions exacerbated the intraday decline, although XAU/USD bearish case is out of the picture, considering growing expectations for a dovish Fed and persistent geopolitical tensions.

Cardano gains early New Year momentum, bulls target falling wedge breakout

Cardano kicks off the New Year on a positive note and is extending gains, trading above $0.36 at the time of writing on Friday. Improving on-chain and derivatives data point to growing bullish interest, while the technical outlook keeps an upside breakout in focus.

Economic outlook 2026-2027 in advanced countries: Solidity test

After a year marked by global economic resilience and ending on a note of optimism, 2026 looks promising and could be a year of solid economic performance. In our baseline scenario, we expect most of the supportive factors at work in 2025 to continue to play a role in 2026.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.