1. What is Overconfidence?

To illustrate the point at hand, here is an example. In a confidence-intervals task, subjects had to judge quantities such as the total egg production of the U.S. or the total number of physicians and surgeons in the Boston Yellow Pages. The subjects expected that they could get a 98% accuracy on their answers. The real accuracy rate was 54%. Once subjects had been thoroughly warned about the bias, they still showed a high degree of overconfidence. This is quite similar to the situation in trading, where an inordinate amount of people attempt to “beat the market” by trading their own funds, knowing that over 90% of newcomers blow 90% of their account in 90 days. It's the “90-90-90 rule” which many forex brokers and dealers cite. Tom Cargill of Bell Labs would be fascinated by this pearl. Yet, the inflow of would-be traders continues, despite the warning.

But for the sake of this article, we're going to talk about traders that have found their footing and that have a set of rules to follow. Yes: experienced traders can fall into the overconfidence trap just like newcomers...but in another fashion. Experienced traders are much more likely to overtrade relative to newcomers, that are more prone to analysis paralysis. So how do you know you're overtrading?

Signs of overtrading...

Source: http://www.ellen-may.com/v2/images/stories/overtrade%202.jpg

2. Being confident vs. being Overconfident

There's no doubt that self-esteem and feeling good about ourselves is positive and can help us progress through our life. But there's a difference between being confident and falling into overconfidence. If we want to improve our trading for example, we need to consider the impact that constructive criticism can have on us – we need to be able to admit that we can actually be wrong! Overconfidence can also lead us to make decisions without properly considering that things might not go according to plan.

In particular, overconfidence can lead to overtrading. And overtrading is hazardous to your health and your wealth! Lets start with something funny, to understand what overtrading is: when I was working as a broker, I had a client that would call in 120 times/day on average and trade GbpJpy (a 300 pip mover back in the day). Here is how the conversations would go:

“good morning AGAIN, the market is just where you left it...nothing major to report. You can go ahead with your business day and if something pops up, I'll call you later”

“Good morning again...hey why don't we exchange jobs? Seems like you've got a lot of spare time! The markets are just where you left them...nothing interesting going on today...i think you can really relax today and take a breather..”

Overtrading comes in the form of a near obsession in trading any/all news-based surprizes (to the upside and downside) being confident that you have the ability to understand the reaction perfectly, and by chart gazing (i.e. staring at charts long enough to “find an entry”). To find out if you're prone to overtrading, try to answer these questions:

1. Do you find it difficult to not be in a trade?

2. Do you find that you're unable to remove yourself from the computer after entering a trade, or that it is very difficult to do so?

3. Do you exceed your daily drawdown limit?

4. The minute your trade goes into profit, do you want to move your stop to breakeven? (trading your equity instead of the market)

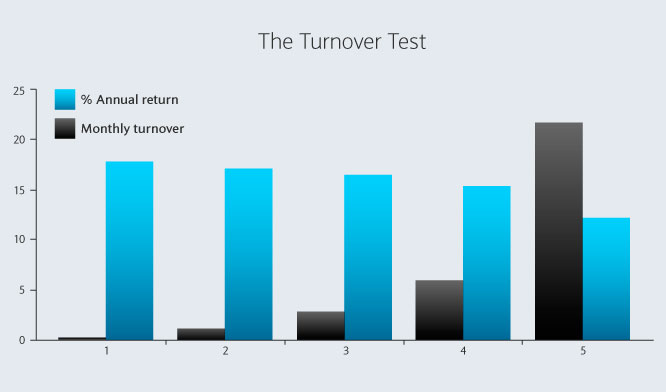

3. The Turnover Test

The "Turnover Test" is a famous study which arranged real investors into five groups according to the proportion of their portfolio they turned over every month. The results shown below shows that group one barely traded at all, while group five changed nearly 25% of their portfolio every month (black bars).

Overconfidence can lead to overtrading. And overtrading leads to less accurate decision making, more transaction costs and more timing risk (as you are entering the market various times, hence leveraging your confidence in market timing abilities).

Source: Barcap.com

Bottom Line: trading really brings out the worst from us, so that we can see ourselves at our worst and work to change our habits and bring out the best of us. Bringing any kind of unjustified confidence into your trading habits will cost you a lot. Not just commissions, but actual losses in your trading account. Instead of trading like a sniper, waiting for the market to come to you, you will be shooting like a machine gunner, targeting anything and everything. Obviously, this is a recipe for disaster! So calm down, be humble, and realize that you cannot possibly know all there is to know about the market's uncerlying conditions at any point in time. Hence, uncertainty is always present and all you need is the confidence to act according to plan.

Good Luck!

References:

1. Haigh, M. S., & List, J. A. (2005). Do Professional Traders Exhibit Myopic Loss Aversion? An Experimental Analysis. Journal of Finance, 60(1), 523-534

2. Judgment under uncertainty: Heuristics and biases. Cambridge University Press. pp. 294–305.

3. http://en.wikipedia.org/wiki/Overconfidence_effect

4. Investor Overconfidence and Trading Volume, Meir Statman, Steven Thorley and Keith Vorkink, 2003

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD revisits 1.1780, or daily lows

EUR/USD now comes under further selling pressure, breaking below the 1.1800 support to reach daily troughs on Thursday. The pair’s decline comes in response to a sudden bout of USD strength amid steady geopolitical tensions. Ealier in the day, the ECB’s Lagarde delivered cautious remarks, although the currency remained apathetic.

GBP/USD makes a U-turn, challenges 1.3500

GBP/USD rapidly leaves behind Wednesday’s strong advance, putting the 1.3500 support to the test on Thursday. Cable’s deep pullback follows the strong gains in the Greenback, while investors continue to pencil in a potential BoE rate cut in March.

Gold sticks to the bid bias, flirts with $5,200

Gold is now facing some downside pressure, hovering around the $5,170 region on Thursday. The precious metal adds to Wednesday’s optimism despite the Greenback trades in a firm fashion, although geopolitical tensions in the Middle East keep the yellow metal bid for now.

Stellar: Relief bounce fades as bearish undertone persists

Stellar is trading around $0.16 at the time of writing on Thursday after rebounding more than 8% in the previous day. Derivatives data paints a negative picture as XLM’s short bets hit a monthly high while Open Interest continues to decline.

Changing the game: International implications of recent tariff developments

The Supreme Court ruling on International Emergency Economic Powers Act (IEEPA) tariffs provides limited relief for the rest of the world, with weighted average tariff rates modestly lower.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.