During our development years, we are taught/conditioned to think certain ways. Our years in grammar school, high school and university are key belief system building years. One of the major conflicts during these years occurs when we are taught how to buy into markets and then how we are taught to buy and sell anything else in our life.

The basic principle of buying low and selling high or selling high and buying low is how we derive profit when buying and selling anything. When we buy cars or houses, we never offer what the seller is asking. We always offer a lower price and typically end up somewhere in the middle. Smart shoppers look for deals where they can buy what they are looking for at a lower price than others pay. We all typically try or desire to buy at “wholesale” prices and sell at “retail” prices, just like any successful company does. At this point, most of you are thinking that I am wasting your time because you know this already, and that’s true. However, during the years that we are conditioned to buy low and sell high, we are almost always taught to take the opposite action with our investments whether long term or in short term trading.

For example, at every level in school when we are taught to buy stocks as investments, we are told to wait for certain criteria to become true BEFORE we buy. These criteria include but are not limited to:

-

Good company

-

Strong earnings

-

Healthy balance sheet

-

Quality management

-

Stock price trending up

-

Moving averages sloping higher

When all these criteria are true, WHERE DO YOU THINK THE PRICE OF THE STOCK IS? Market timing using this criteria means the market will almost always be high, at or near retail prices when these criteria are true which means you will be paying $50,000 for the $25,000 car and the seller is the big winner, not you. The way we are taught to buy stocks and into markets is completely opposite of how we are taught to buy and sell anything else, and therein lies the major conflict and the reason most investors never come close to achieving their financial goals… When news is bad, people want to sell. When it’s perceived to be good, people generally want to buy. Last Wednesday everyone was waiting for the Fed to release interest rate news in the afternoon. There was more and more talk about what the Fed would say regarding the direction of interest rates.

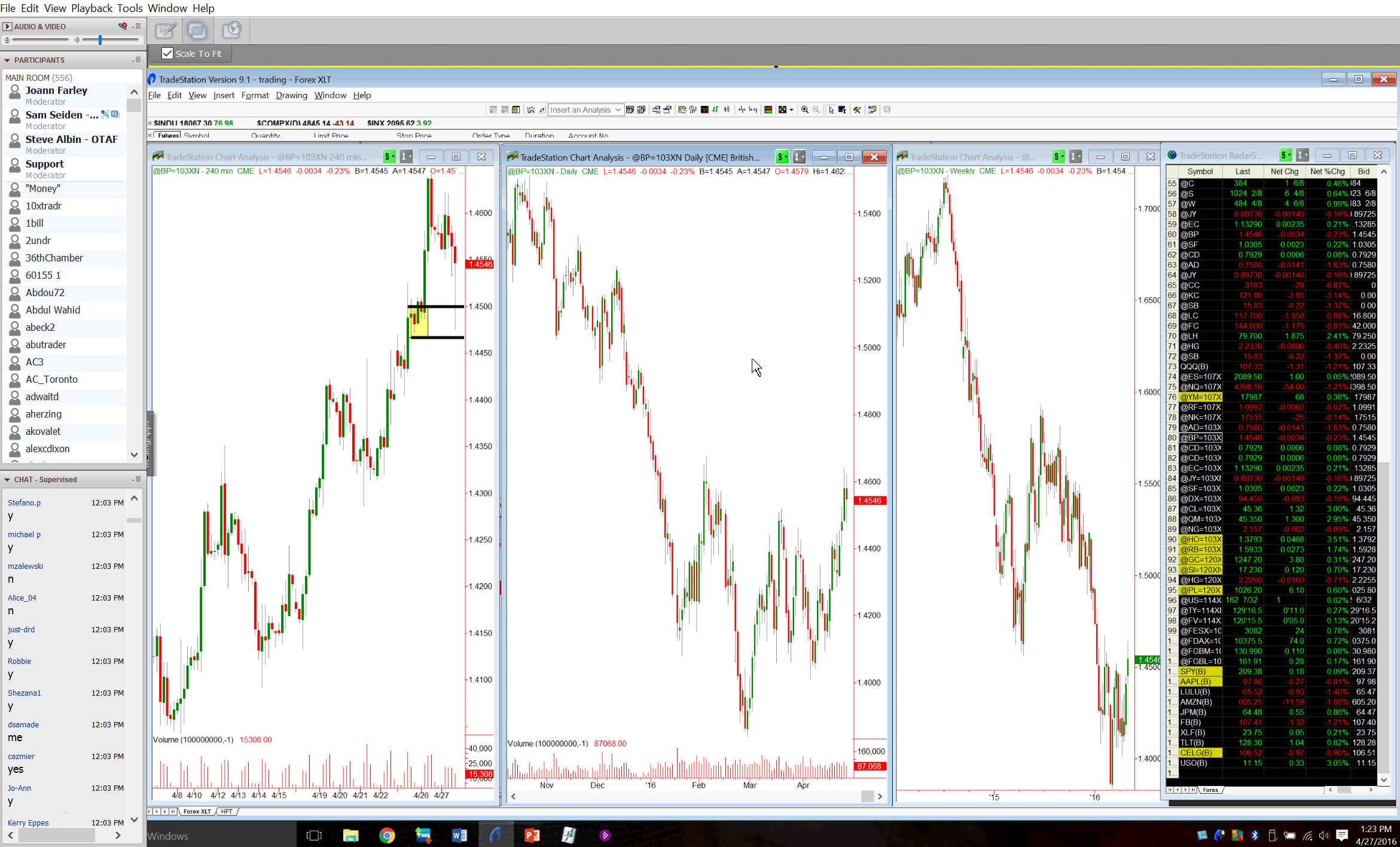

April 27th, Fed Interest Rate News Day/XLT Live Market Session – GBPUSD FX Market

April 27th, Fed Interest Rate News Day/XLT Live Market Session – Gold Market

That day, our Supply/Demand levels in the XLT were a demand level in the British Pound and a supply level in Gold. Prior to the interest rate announcement, neither market was near these levels. Then, the big moment… The Fed announces and the markets really start moving. However, once it reached our levels of demand in the Pound and supply in Gold, both markets turned and moved quickly in the opposite direction, offering our students the opportunity to profit which some of them did. What we didn’t focus on was what the Fed said or any news around that. Actually, I was leading the session and didn’t know what the Fed did until about 30 minutes later after asking the students in that session what happened.

How can I explain these moves and all the others that happened that day right after the interest rate news? Simple; in the Pound, sellers did sell in big numbers on the release of that news, overwhelming the demand at those price levels. However, once price declined to a level where demand exceeded supply, as seen on the chart above, and the last of the sell orders at that level was filled, there was only one direction for price to go – up. And, since all the sellers that were going to sell on that news had sold, there was no real supply left to stop the rally. As I have said so many times, it’s all about quantifying the buy and sell orders (demand and supply). The news just sped up what was going to happen anyway.

Most people are so consumed with pattern recognition, conventional technical and fundamental analysis they forget the simple buying and selling action they take at the grocery store each week where they regularly try to buy things on sale. Whether it’s Costco, Walmart, Goldman Sachs, your local convenience store, or the 6 year old selling lemonade in front of their house, how price changes in markets and how money is made and lost in markets never changes.

Hope this was helpful. Have a great day.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

EUR/USD treads water above 1.1850 amid thin trading

EUR/USD stays defensive but holds 1.1850 amid quiet markets in the European hours on Monday. The US Dollar is struggling for direction due to thin liquidity conditions as US markets are closed in observance of Presidents' Day.

GBP/USD flat lines as traders await key UK and US macro data

GBP/USD kicks off a new week on a subdued note and oscillates in a narrow range near 1.365 in Monday's European trading. The mixed fundamental backdrop warrants some caution for aggressive traders as the market focus now shifts to this week's important releases from the UK and the US.

Gold slides below $5,000 amid USD uptick and positive risk tone; downside seems limited

Gold attracts fresh sellers at the start of a new week and reverses a part of Friday's strong move up of over $150 from sub-$4,900 levels. The commodity slides back below the $5,000 psychological mark during the Asian session, though the downside potential seems limited amid a combination of supporting factors.

Bitcoin, Ethereum and Ripple consolidate within key ranges as selling pressure eases

Bitcoin and Ethereum prices have been trading sideways within key ranges following the massive correction. Meanwhile, XRP recovers slightly, breaking above the key resistance zone. The top three cryptocurrencies hint at a potential short-term recovery, with momentum indicators showing fading bearish signs.

Global inflation watch: Signs of cooling services inflation

Realized inflation landed close to expectations in January, as negative base effects weighed on the annual rates. Remaining sticky inflation is largely explained by services, while tariff-driven goods inflation remains limited even in the US.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.