In “Inside Bars – Part One” last week we introduced this classic price pattern and discussed some basic uses of it, we now follow on from that piece by exploring some issues to take note of when trading the pattern as well as looking at a further way to trade the pattern…

Points To Consider

Key thing to remember, as with our breakout trading, is that the actual velocity of the breakout signal candle (the candle that closes outside of the Mother candle range) will vary and won’t always be trade-able, so some discretion is needed. If the breakout signal candle closes to far from the range perimeter then it compromises our risk:reward on the trade as price is less likely to run much further. I would much rather avoid a trades that appears less than favorable than take an unnecessary loser for fear of missing out. There is more than enough opportunity in the markets with chasing after sub-par trades so certainly bear that in mind.

Another way that we can look to maximize our chances of success is to look to trade with the trend. As you can see with the EURUSD example above, price was already moving lower before we established our inside bar setup and so with price moving in a downward trend, the highest probability trade would be a break down to the downside whereas if price was moving in a bullish trend and we got an inside bar setup, the highest probability outcome would be a breakout to the upside. Looking to capitalize on the direction of a prevailing trend is a recipe for long-term success and using a really simple yet solid setup such as the inside bar can be a fantastic way to catch entry points into fluid markets.

Trading The Fakeout

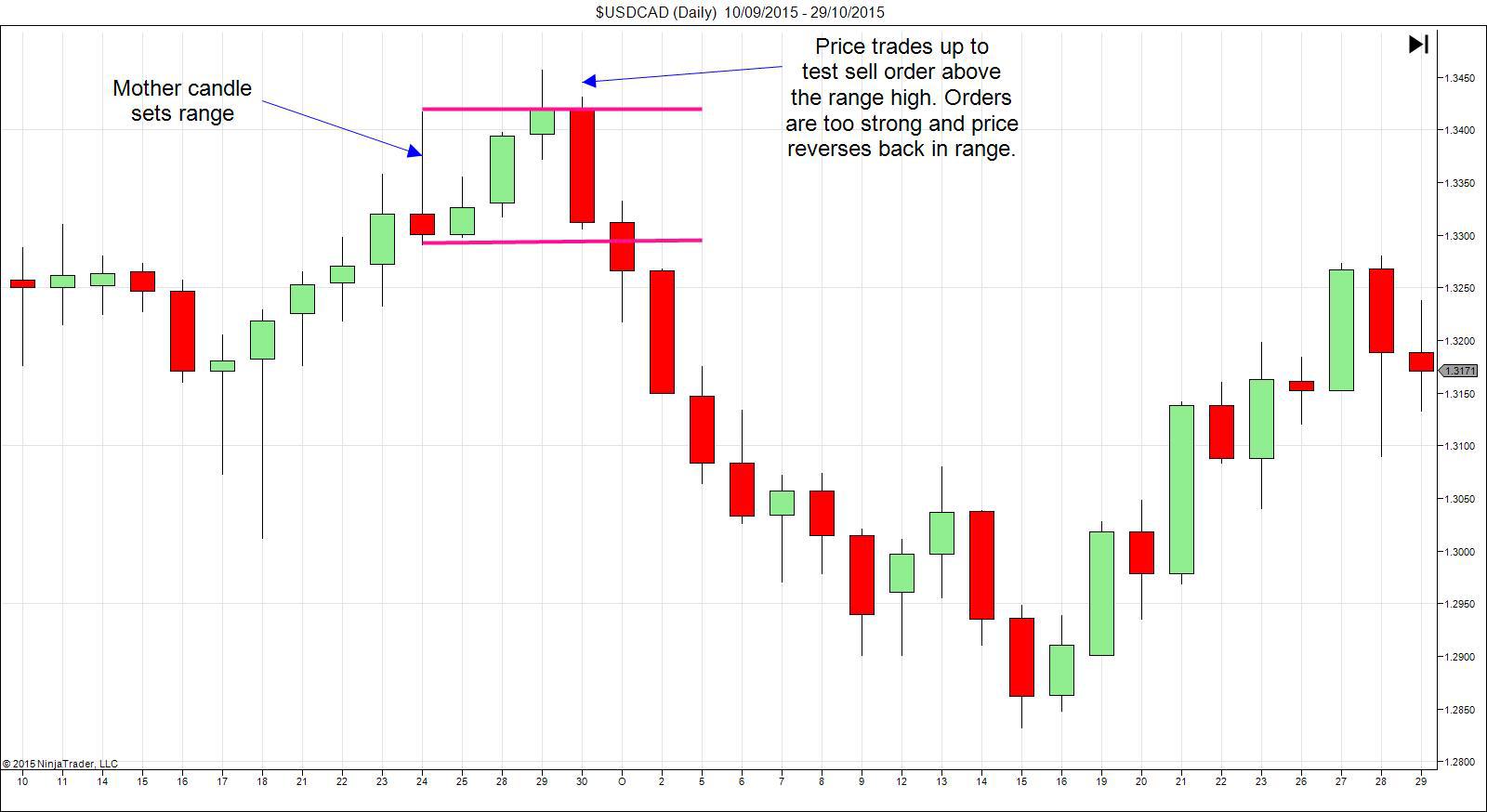

In part one we discussed one aspect of trading inside bars that needs to be carefully navigated for success and that was the Fake-out. We identified that if you simply look to trade a break of the Mother candle range without looking for a candle close then you leave yourself open to experience a fake-out whereby price actually reverses and trades back down into the range. However, once you start to become familiar with trading inside bars and understanding the market mechanics at play when they form then you can actually take advantage of the fakeout.

Where we see price trade through one side of the range to test order but reverse and trade back inside the range we can actually take a reversal trade in these circumstances anticipating a proper reversal.

How is this possible?

Remember the order flow dynamic we identified in part one. Order build up on either side of our trading range to keep price hemmed in. However, price starts to build momentum and trades through the range to test orders on a particular side but the momentum is not enough to break through these order and so price reverses. In these instances we can assume that the market has run out of steam and look to profit from the ensuing moves.

In the above example we can see we have a neat little range of inside bars formed. Price then runs up to pierce the high of the range and test sell orders sitting above the range. Sell order are too strong and buyers run out of steam so price reverses back into the range. We can sell price here anticipating that the weight of sell orders will indeed drive price lower. In these instances we can either target a move back to the other side of the range in a simple range-rotation play or we can hold and anticipate the materialisation of a full break-out through the opposite end of the range. Again as with our traditional inside bar trading, the more inside bars that form the better these trades tend to work out as the build up of orders tend to be much larger.

The beauty of using inside bars, whether trading a traditional breakout play or fading the fake-out is that it is an incredibly simplistic way to capitalise on underlying order flow and can work extremely well on all timeframes. For best results however, I suggest sticking to Daily, H4 & H1 setups as these tend to yield more solid results and where possible, look to trade in line with the overall market trend.

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Editors’ Picks

USD/JPY rebounds above 153.00 ahead of US inflation data

USD/JPY stages a comeback and regains 153.00 in the Asian session, snapping a four-day losing streak amid some repositioning ahead of the US CPI report. However, expectations that Japan's PM Sanae Takaichi could be more fiscally responsible, along with bets that the BoJ will stick to its policy normalization path and the risk-off mood, could support the safe-haven Japanese Yen, capping the pair's upside.

Gold: Will US CPI data trigger a range breakout?

Gold retakes $5,000 early Friday amid a turnaround from weekly lows as US CPI data loom. The US Dollar consolidates weekly losses as AI concerns-driven risk-off mood stalls downside. Technically, Gold appears primed for a big range breakout, with risks skewed toward a bullish break.

AUD/USD consolidates below 0.7100 as traders await US CPI report

AUD/USD consolidates the previous day's retracement slide from the vicinity of mid-0.7100s, or a three-year high, holding below 0.7100 as traders move to the sidelines ahead of Friday's release of the US consumer inflation figures. In the meantime, the divergent RBA-Fed outlooks might continue to support spot prices amid subdued US Dollar demand, though the risk-off impulse could act as a headwind for the Aussie.

Top Crypto Gainers: River faces resistance, Humanity Protocol steadies, Polygon rebounds

Altcoins, including River, Humanity Protocol and Polygon, rank as top-performing cryptocurrencies in the last 24 hours, defying the broader market pullback as Bitcoin dropped below $67,000.

A tale of two labour markets: Headline strength masks underlying weakness

Undoubtedly, yesterday’s delayed US January jobs report delivered a strong headline – one that surpassed most estimates. However, optimism quickly faded amid sobering benchmark revisions.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.