In October 2014, prices for WTI oil were more than $90 a barrel. By December, prices were below $60 a barrel. A price not seen before 2010. What was more incredible, the price for oil kept falling. Last month, the price of oil fell below $44 a barrel.

Recently oil traders are seeing extremely large daily moves up and down. For example, last week futures traders watched oil prices fall 8.7 percent on Wednesday after they had risen 7 percent on Tuesday!

If traders want to capitalize on this market volatility, they could trade options as an alternative to trading oil futures contracts. The benefit of buying options is the ability to take a position without getting stopped-out due to high volatility.

Please refer to my lessons on The Call Option and The Put Option for buy option basics.

Understanding WTI Oil Buy Call Options

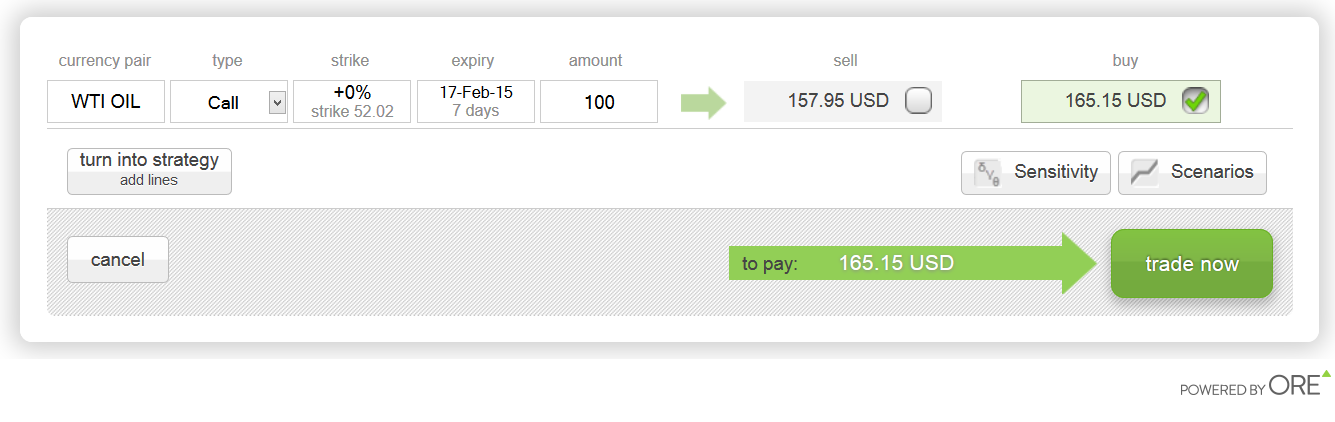

Let’s start by showing you an image of a WTI Oil Buy Call trade:

Take a close look at the trade, what do you see? What comprises the WTI Oil Buy Call trade above? Here is a quick breakdown:

1. Underlying Asset – The financial instrument upon which the option’s price is derived. In the example above, WTI OIL is the underlying asset.

2. Strike Rate - The agreed sell/buy price available to an option holder (buyer). The strike rate at +0% is at-the-money (ATM).

3. Amount – How much the holder invests in the transaction (the higher the amount, the higher the risk). This is amount above states 100, which is 100 option contracts (which contain 1000 barrels of oil each).

4. Expiry – The last day the option is valid before it expires. If I opened this trade on February 10th, it would only be valid until its expiry on February 17th (7 days).

5. Premium - When buying an option, you pay a premium - the ‘open premium’. Whilst you hold an option, the premium value changes depending on changes in the underlying market.

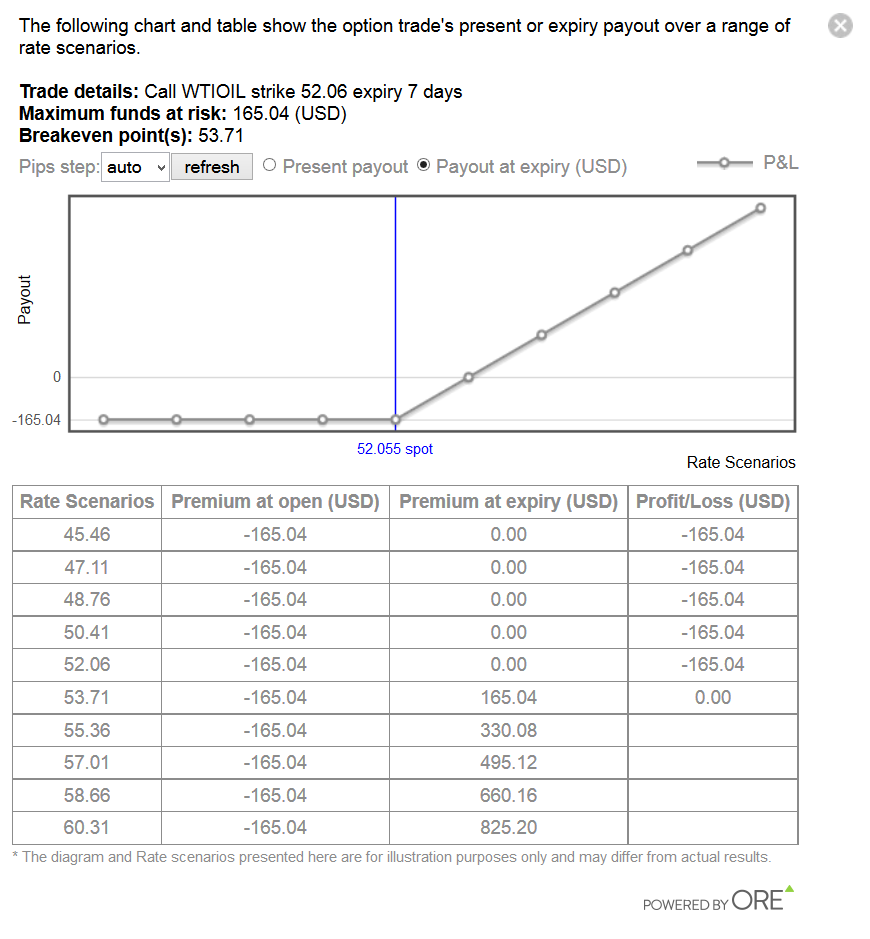

In the chart below, you can see your “Premium at expiry” if you traded this option. There will only be a payout if the strike rate is below the underlying market rate.

Payout/premium is calculated by taking the difference between rates and multiplying it to the amount of the transaction.

Premium at expiry = (Market rate – Strike rate) * Amount of transaction

Example = (57.01 – 52.06) * 100 = 495 USD

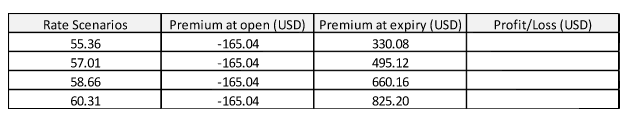

I have purposely blanked out several of the fields in the scenario graph above to help you practice calculating your profit/loss at expiry. Here is a grid for you to fill-in the missing Profit/Loss numbers based on the scenario chart above:

*Notice in the table above how the “Premium at open” is a negative value. It is because the amount was debited from your free balance to pay for the option.

To get you started in your calculations, let me give you the formula!

Premium at open + Premium at expiry = Profit/Loss

Still want a hint to get you started?

For Rate 55.36, -165.04 + 330.08 = 165.04

Now, it’s your turn! Calculate the remaining Profit/Loss at expiry for this WTI Oil Buy Call option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Editors’ Picks

NZD/USD slides toward 0.6000; RBNZ Breman's presser eyed

NZD/USD is meeting fresh supply and closes in on 0.6000 early Wednesday, in an initial reacton to the Reserve Bank of New Zealand's (RBNZ) expected interest rate on hold decision. The RBNZ kept the OCR unchanged at 2.25%. The focus is on Gowernor Breman's debut at press conference.

AUD/USD consolidates below 0.7100 as traders await FOMC Minutes

AUD/USD struggles to capitalize on the previous day's bounce from over a one-week low, trading under 0.7100 in Wednesday's Asian session. Traders await more cues about the US Fed's rate-cut path before placing fresh directional bets. Hence, the focus will be on the FOMC Minutes, due for release later today, which will drive the US Dollar and the currency pair. In the meantime, the RBA's hawkish stance and a generally positive risk tone might continue to cap the Aussie's downside amid hopes for additional stimulus from China.

Gold bounces back toward $4,900, looks to FOMC Minutes

Gold is attempting a bounce from the $4,850 level, having touched a one-week low on Tuesday. Signs of progress in US–Iran talks dented demand for the traditional safe-haven bullion, weighing on Gold in early trades. However, rising bets for more Fed rate cuts keep the US Dollar bulls on the defensive and act as a tailwind for the non-yielding yellow metal. Traders now seem reluctant ahead of the FOMC Minutes, which would offer cues about the Fed's rate-cut path and provide some meaningful impetus.

DeFi could lift crypto market from current bear phase: Bitwise

Bitwise Chief Investment Officer Matt Hougan hinted that the decentralized finance sector could lead the crypto market out of the current bear phase, citing Aave Labs’ latest community proposal as a potential signal of good things to come.

UK jobs market weakens, bolstering rate cut hopes

In the UK, the latest jobs report made for difficult reading. Nonetheless, this represents yet another reminder for the Bank of England that they need to act swiftly given the collapse in inflation expected over the coming months.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.