Today, the Bank of England (BoE) decided not to affect interest rates. They based this on their inflationary outlook of the economy. If interest rates had been raised (they weren’t), it would have been seen as good for the economy and bullish for the market. Then, the GBP may have become stronger against other currencies.

This afternoon’s announcement from the BoE was pre-scheduled and the consensus was that the interest rate would stay at 0.5%. This is what the BoE did announce. But as we had seen from Australia earlier this week, when the Reserve Bank cut interest rates and devalued the Australian dollar (AUD), countries are looking to their long-term economic policy which can lead to unforeseen announcements and market movements.

As a company, investor, or trader, how can you protect yourself if you know an interest rate announcement is coming? You can hedge using option contracts.

What is a hedge?

A hedge is an investment position intended to offset potential losses which may be incurred by an adverse move in the market.

A good hedging tool is a vanilla option. You would use the option to neutralize your overall risk. For example, if you had an open long position in GBP/USD before the announcement, you could open a buy Put in GBP/USD. If the market rate falls, the Put will payout covering any loss from the long GBP/USD position. On the other hand, if you have an open short position in GBP/USD before the announcement, you could open a buy Call in GBP/USD. If the market rate rises, the Call will payout covering any loss from the short GBP/USD position.

For more information on the payouts of Puts and Calls visit my lessons: The Call Option and The Put Option.

How to execute a hedge using options?

Most interest rate announcements are scheduled and if you want to protect your foreign-exchange investment with a hedge, it can be done. Just like taking out insurance against your investment, you can use options as insurance against a movement in the market shifting out of your favour.

Let’s look at both scenarios – You hold either a buy or sell position with a profit and don’t want to close it before the announcement. You pay a premium to buy an option for both Calls and Puts. The premium of the option is the cost of the hedge.

You have an open buy GBP/USD position:

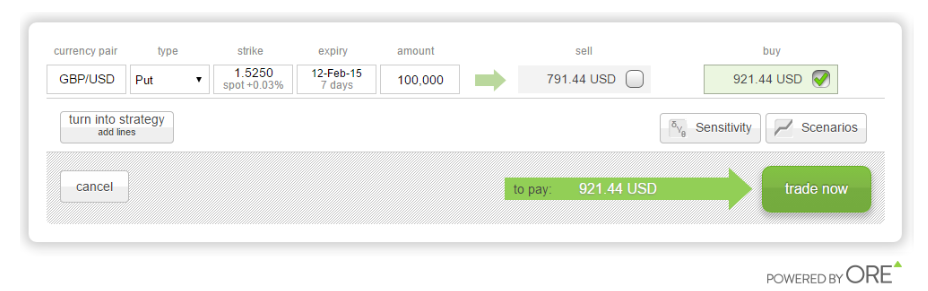

Assuming you held a long 100,000 GBP/USD spot position from 1.5000 and the current price is 1.5250, you would be in profit by $2500 (100,000 x 0.0250). To lock-in this profit without closing the trade, you could hedge by buying a Put with a strike of 1.5250 and amount of 100,000 as displayed in the diagram below.

If the market price continues to go up, your long 100,000 GBP/USD position will make $10 for every 1-point increase in the underlying market (100,000 x 0.0001 = $10). If the market falls, your GBP/USD position will lose $10 for every 1 point down, but the Put option will payout and cover (or hedge) any loss.

You have an open sell GBP/USD position:

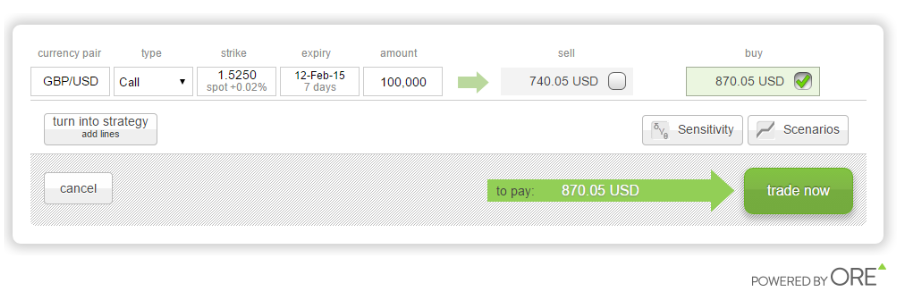

Assuming you held a sell 100,000 GBP/USD spot position from 1.5500 and the current price is 1.5250, you would be in profit by $2500 (100,000 x 0.0250). To lock-in this profit without closing the trade, you could hedge by buying a Call with a strike of 1.5250 and amount of 100,000 as displayed in the diagram below.

If the market price continues to go down, your short 100,000 GBP/USD position will make $10 for every 1-point decrease in the underlying market (100,000 x 0.0001 = $10). If the market rises, your GBP/USD position will lose $10 for every 1 point down, but the Call option will payout and cover (or hedge) any loss.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Editors’ Picks

EUR/USD treads water above 1.1850 amid thin trading

EUR/USD stays defensive but holds 1.1850 amid quiet markets in the European hours on Monday. The US Dollar is struggling for direction due to thin liquidity conditions as US markets are closed in observance of Presidents' Day.

GBP/USD flat lines as traders await key UK and US macro data

GBP/USD kicks off a new week on a subdued note and oscillates in a narrow range near 1.365 in Monday's European trading. The mixed fundamental backdrop warrants some caution for aggressive traders as the market focus now shifts to this week's important releases from the UK and the US.

Gold sticks to intraday losses; lacks follow-through

Gold remains depressed through the early European session on Monday, though it has managed to rebound from the daily trough and currently trades around the $5,000 psychological mark. Moreover, a combination of supporting factors warrants some caution for aggressive bearish traders, and before positioning for deeper losses.

Bitcoin, Ethereum and Ripple consolidate within key ranges as selling pressure eases

Bitcoin and Ethereum prices have been trading sideways within key ranges following the massive correction. Meanwhile, XRP recovers slightly, breaking above the key resistance zone. The top three cryptocurrencies hint at a potential short-term recovery, with momentum indicators showing fading bearish signs.

Global inflation watch: Signs of cooling services inflation

Realized inflation landed close to expectations in January, as negative base effects weighed on the annual rates. Remaining sticky inflation is largely explained by services, while tariff-driven goods inflation remains limited even in the US.

RECOMMENDED LESSONS

Making money in forex is easy if you know how the bankers trade!

I’m often mystified in my educational forex articles why so many traders struggle to make consistent money out of forex trading. The answer has more to do with what they don’t know than what they do know. After working in investment banks for 20 years many of which were as a Chief trader its second knowledge how to extract cash out of the market.

5 Forex News Events You Need To Know

In the fast moving world of currency markets where huge moves can seemingly come from nowhere, it is extremely important for new traders to learn about the various economic indicators and forex news events and releases that shape the markets. Indeed, quickly getting a handle on which data to look out for, what it means, and how to trade it can see new traders quickly become far more profitable and sets up the road to long term success.

Top 10 Chart Patterns Every Trader Should Know

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying buying and selling pressure. Chart patterns have a proven track-record, and traders use them to identify continuation or reversal signals, to open positions and identify price targets.

7 Ways to Avoid Forex Scams

The forex industry is recently seeing more and more scams. Here are 7 ways to avoid losing your money in such scams: Forex scams are becoming frequent. Michael Greenberg reports on luxurious expenses, including a submarine bought from the money taken from forex traders. Here’s another report of a forex fraud. So, how can we avoid falling in such forex scams?

What Are the 10 Fatal Mistakes Traders Make

Trading is exciting. Trading is hard. Trading is extremely hard. Some say that it takes more than 10,000 hours to master. Others believe that trading is the way to quick riches. They might be both wrong. What is important to know that no matter how experienced you are, mistakes will be part of the trading process.

The challenge: Timing the market and trader psychology

Successful trading often comes down to timing – entering and exiting trades at the right moments. Yet timing the market is notoriously difficult, largely because human psychology can derail even the best plans. Two powerful emotions in particular – fear and greed – tend to drive trading decisions off course.