- ETH/USD is currently priced at $174.25 in the early hours of Friday.

- Elliott oscillator and MACD indicator both hint at sustained bullish sentiment.

ETH/USD had a bullish start to Friday as the price went up slightly from $174 to $174.25. This follows a frustrating Thursday for the buyers where the price went down from $175 to $174. The hourly breakdown of Thursday shows us that the price managed to take the price down to $171.55, where it trended horizontally for a bit. After that, the bulls stepped in and took it up to $174.84, before a last-ditch rally by the bears brought it down to $174. Friday had a bearish start where the price went down to $173.30 before the bulls immediately stepped in and took it back up to $174.25.

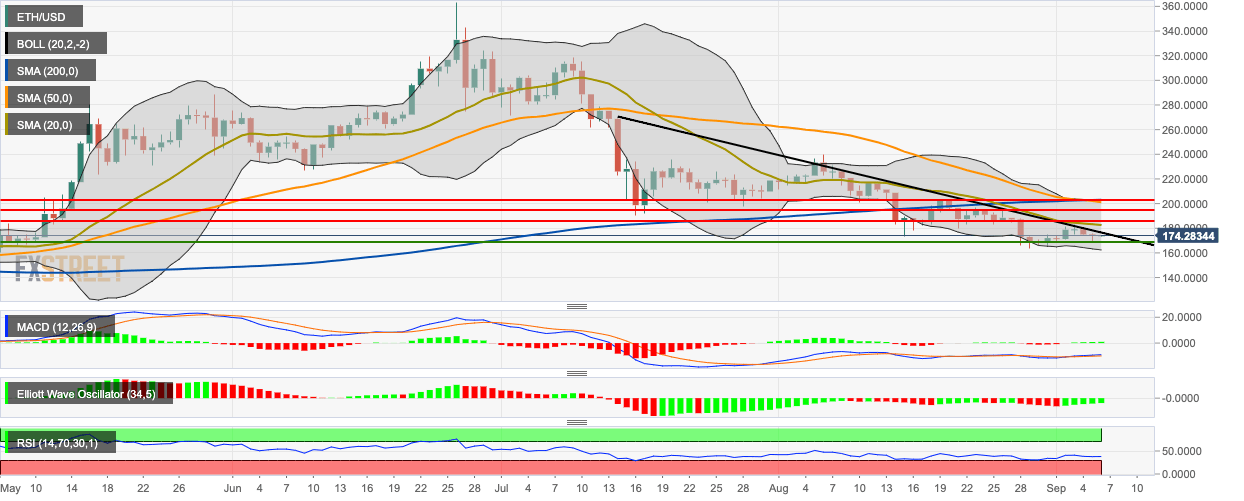

ETH/USD daily chart

The price has been checked on the upside by the downward trending line. The price is trending below the 200-day simple moving average (SMA 200), SMA 50 and SMA 20 curves. The 20-day Bollinger jaw is slightly widening, indicating increasing market volatility. The moving average convergence/divergence (MACD) and Elliott oscillator both show sustained bullish sentiment. The relative strength index (RSI) indicator is creeping along at 38.65.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Crypto traders brace for short-term volatility with $2.4 billion options expiry on Friday

Bitcoin and Ethereum options market looks bullish on Friday, according to data from intelligence tracker Greeks.live. The firm said it has identified two Bitcoin calls that show an underlying bullish sentiment among market participants.

XRP recovers from week-long decline following Ripple’s response to SEC motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

Lido adds 4% gains as protocol rolls out first step towards decentralization

Lido takes the first batch of simple DVT validators to live, a step taken to decentralize the protocol. Lido leveraged technology to expand the protocol to multiple node operators, inviting both solo and community stakers.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Bitcoin: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.