Bitcoin miners go into selling spree while BTC price is held by weak support

- Bitcoin price continues trading just above $18,000 defending the support level.

- It seems that BTC miners are selling significant sums of Bitcoin in the OTC market or exchanges.

It seems that the most recent Bitcoin sell-off could have been caused by miners selling large quantities of Bitcoin on exchanges. According to a recent chart provided by Cryptoquant, the BTC Miners’ Position Index has hit a three-year high, indicating that they are taking profits.

Bitcoin price faces strong selling pressure

The BTC Miner’s Position Index measures the ratio of Bitcoin that leaves the wallets of miners which usually indicates they are ready to sell. It seems that this metric just hit a three-year high after a massive spike which can usually indicate that a significant sell-off is underway.

$BTC Miners' Position Index hit the three-year high.

— CryptoQuant.com (@cryptoquant_com) December 10, 2020

It seems miners are selling $BTC to the OTC market or exchanges.

Chart https://t.co/ovjhSRuFiN pic.twitter.com/a97wJXmSzf

On top of that, we know that Mt.Gox could be on the verge of releasing around 140,000 BTC into the market which further increases selling pressure over the digital asset. Many analysts believe Bitcoin price is bounded for a steeper correction, potentially as low as $13,000.

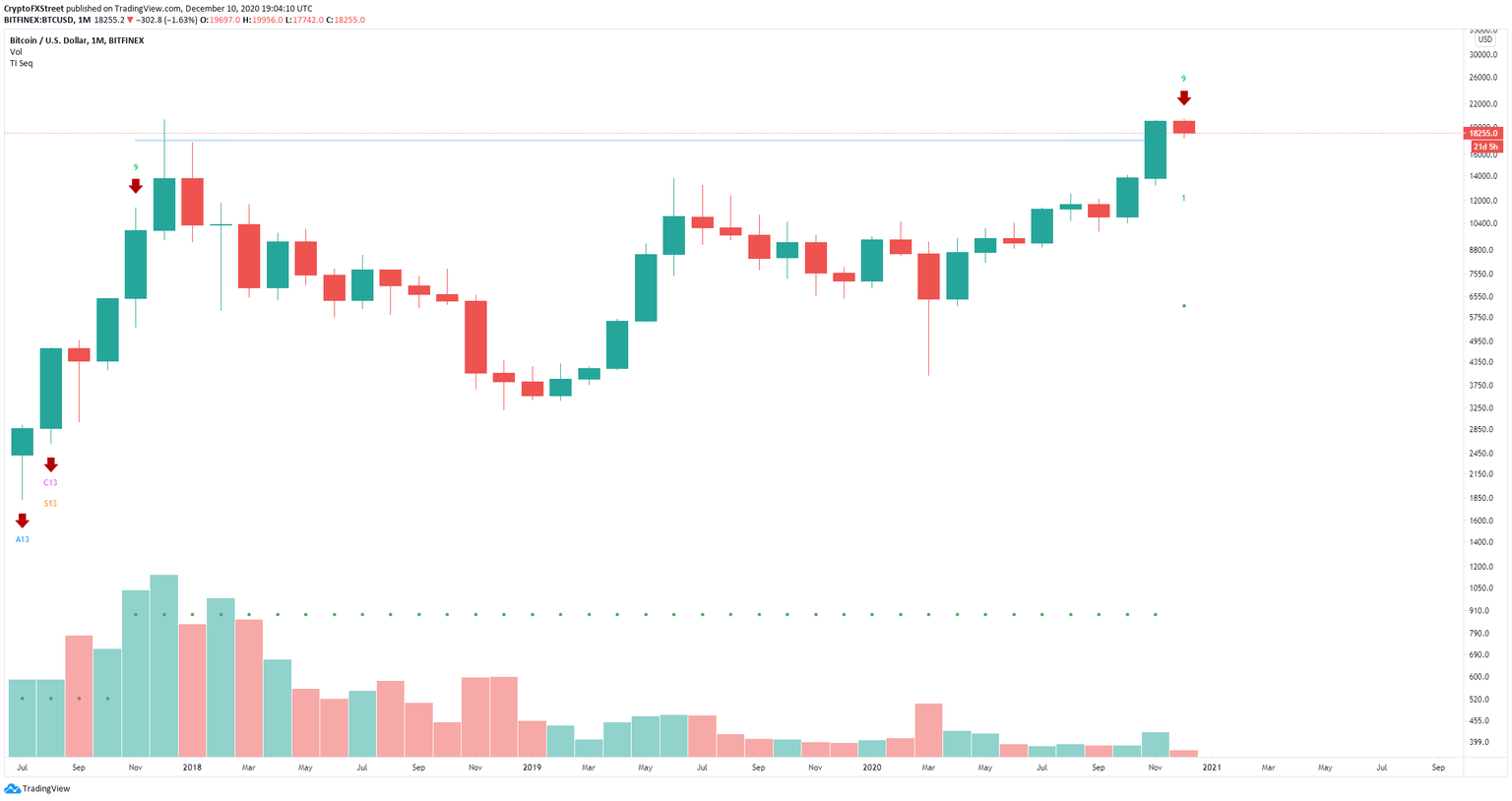

BTC/USD monthly chart

On the monthly chart, the TD Sequential indicator has presented a sell signal for the first time since October 2017. Validation of this signal could quickly drive Bitcoin price to that $13,000 price target.

BTC Holders Distribution chart

Selling pressure doesn’t seem to end here as the number of whales holding between 10,000 and 100,000 coins has significantly decreased from 113 on November 18 to 106 currently, indicating that large investors are selling.

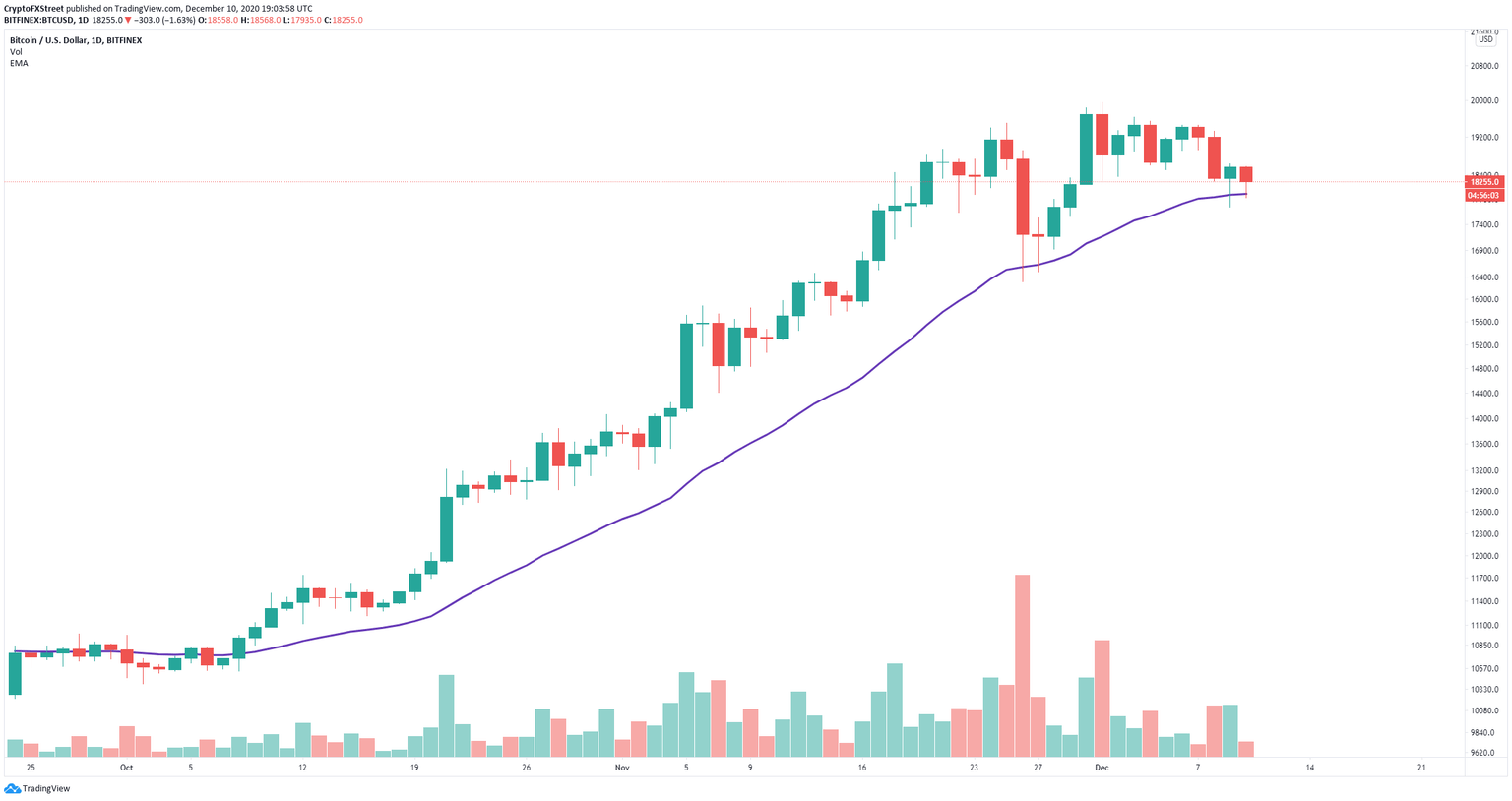

BTC/USD daily chart

On the other hand, if Bitcoin bulls continue defending the 26-EMA support level on the daily chart, Bitcoin price has the potential to climb towards the all-time high again at $19,956 in the short-term.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B20.02.55%2C%252010%2520Dec%2C%25202020%5D-637432238969146294.png&w=1536&q=95)