This week we present two strategies: sell EUR/USD and buy USD/RUB.

EUR/USD – 2 year rising wedge break weakens the outlook further

Summary – Sell into any short-term rallies for weakness to 1.3249 and then 1.3020. Place a stop above 1.3701.

EUR/USD has broken down through a two year trendline to complete a major rising wedge pattern. This follows earlier negative signals from a 1.3967/1.3995 double top and a shorter timed framed rising wedge. 90 and 50 day moving averages have also crossed lower to support/confirm the negative structure. Below the 3 Feb 2014 low at 1.3477 is now also seeing the market register fresh year-to-date lows.

Momentum has clearly turned lower and the loss of 1.3477 has shifted the immediate focus onto 1.3399, the 21 November 2013 reaction low. A further loss here will then sight 1.3295, the 7 November 2013 spike low, ahead of 1.3249, the 38.2% retracement level of the major 1.2042 to 1.3995 rise. Further out, 1.3105 and 1.3020, the 6 September 2013 low and 50% retracement point, are also likely to be tested.

Above, 1.3549 provides a lower ceiling that should cap any immediate rallies. However, to shift the longer-term focus higher again the early July lower top at 1.3701 must be breached.

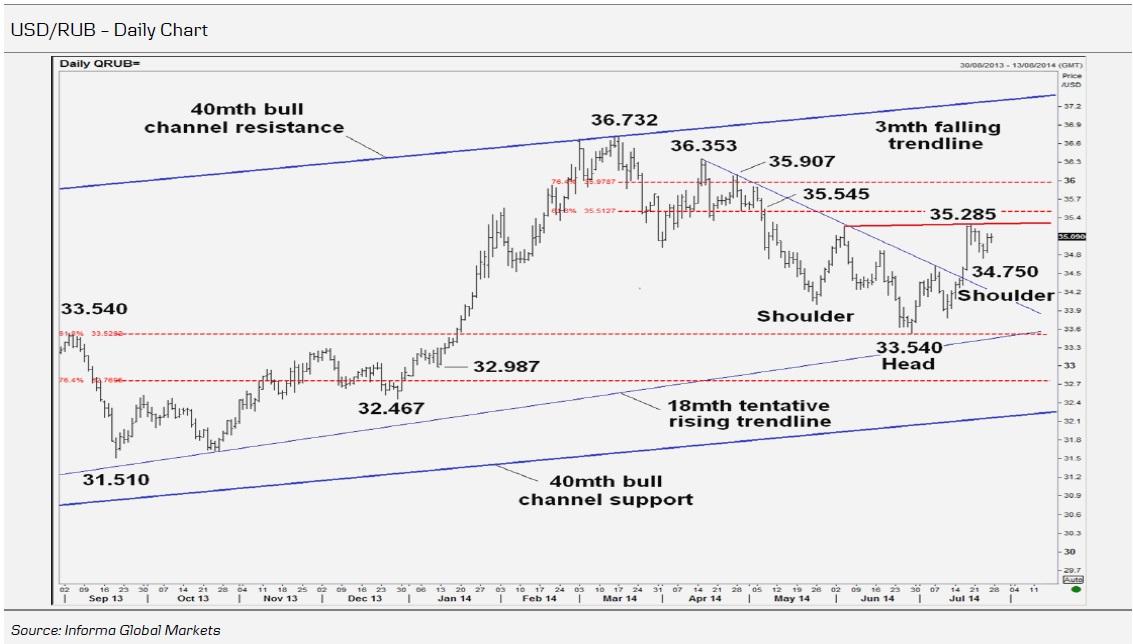

USD/RUB – A clearance of 35.285 completes a higher base/opens 35.907

Strategy Summary – Look to buy into near-term weakness for an extension of the lterm uptrend through 35.285 targeting 35.907 then 36.732. Place stops below a former broken 3mth falling trendline now at 34.134.Corrected from 36.732 (17 March record high, also 40mth bull channel top) to 33.540 (27 June low, also 3 September 2013 high and near 61.8% of 31.510/36.732) before bouncing. A multi-tested three month falling trendline was breached in mid July and the market has since extended to reach 35.285 (18 July high, nr 50% retracement of 36.732/33.540), before ranging. Daily/weekly and monthly studies (not shown) are all building in confirmation of the l-term uptrend resumption and a sustained clearance of 35.285 would complete a potential 2-1/2mth inverted head and shoulders base formation over the key 33.540 low and project an initial advance to 35.545 (7 May high/ 61.8% retrace) then 35.907 (2 May high/nr 76.4% retrace). Beyond would re-open 36.353 (15 April lower high), which protects the 36.732 record high.

It would take a return through the former multi tested 3mth falling trendline at 34.134 (nr 61.8% retrace of the 33.540/35.285) to compromise thoughts of an inverted head and shoulders base and re-open very significant support at 33.540 (also nr an 18mth rising trendline). Below negates upside scope and risks 32.987 (10 January higher low), possibly 32.742 (76.4% retrace of 31.510/36.732).

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD: A tough barrier remains around 0.6800

AUD/USD failed to maintain the earlier surpass of the 0.6800 barrier, eventually succumbing to the late rebound in the Greenback following the Fed’s decision to lower its interest rates by 50 bps.

EUR/USD still targets the 2024 peaks around 1.1200

EUR/USD added to Tuesday’s losses after the post-FOMC rebound in the US Dollar prompted the pair to give away earlier gains to three-week highs in the 1.1185-1.1190 band.

Gold surrenders gains and drops to weekly lows near $2,550

Gold prices reverses the initial uptick to record highs around the $$2,600 per ounce troy, coming under renewed downside pressure and revisiting the $2,550 zone amidst the late recovery in the US Dollar.

Australian Unemployment Rate expected to hold steady at 4.2% in August

The Australian Bureau of Statistics will release the monthly employment report at 1:30 GMT on Thursday. The country is expected to have added 25K new positions in August, while the Unemployment Rate is foreseen to remain steady at 4.2%.

Ethereum could rally to $2,817 following Fed's 50 bps rate cut

Ethereum (ETH) is trading above $2,330 on Wednesday as the market is recovering following the Federal Reserve's (Fed) decision to cut interest rates by 50 basis points. Meanwhile, Ethereum exchange-traded funds (ETF) recorded $15.1 million in outflows.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.