Fundamental Forecast for Pound: Neutral

British Pound technical forecast looks favorable

US Dollar may have finally turned, GBP may stage a recovery

For Real-Time SSI Updates and Potential Trade Setups on the British Pound, sign up for DailyFX on Demand

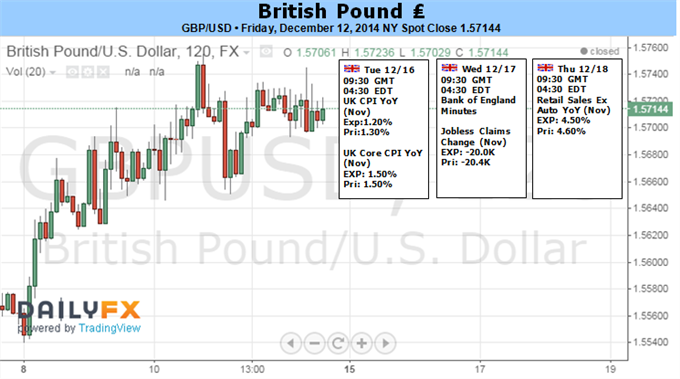

The British Pound finished the week modestly higher but continued to trade in a tight range versus the US Dollar. A busy week ahead threatens to force a decisive break in the GBPUSD and other pairs.

The simultaneous release of UK Jobless Claims and Earnings data with Bank of England Minutes will likely prove the highlight in the days ahead, and GBPUSD traders should likewise keep a close eye on a highly-anticipated US Federal Reserve interest rate decision that same day. Earlier-week UK Consumer Price Index inflation figures as well as late-week UK Retail Sales results could also elicit reactions from GBP pairs.

Whether or not the Sterling mounts a sustained recovery versus the US Dollar will likely depend on the direction of interest rate expectations for both the Bank of England and the US Federal Reserve. A sharp compression in the spread between UK and US government bond yields helps explain why the British Pound fell to fresh 14-month lows versus the Greenback through November. Yet a great deal of uncertainty surrounds both the Fed and BoE; any surprises out of the coming week’s economic data and central bank rhetoric could easily force a repricing of yields and the GBPUSD exchange rate.

The US Dollar in particular looks vulnerable on any disappointments from the Federal Reserve, and indeed the previously-unstoppable USD finally showed concrete signs of slowing through the past week of trade. And though the Sterling could itself see fairly significant volatility on UK event risk, we expect that the overall US Dollar trend will ultimately dictate whether the GBPUSD makes a sustained recovery.

FXCM, L.L.C.® assumes no responsibility for errors, inaccuracies or omissions in these materials. FXCM, L.L.C.® does not warrant the accuracy or completeness of the information, text, graphics, links or other items contained within these materials. FXCM, L.L.C.® shall not be liable for any special, indirect, incidental, or consequential damages, including without limitation losses, lost revenues, or lost profits that may result from these materials. Opinions and estimates constitute our judgment and are subject to change without notice. Past performance is not indicative of future results.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.