EUR/USD

Recent strength still viewed as temporary.

EUR/USD is bouncing. The hourly resistance at 1.3621 has been breached. However, we continue to favour an eventual decline towards the support at 1.3503 as long as prices remain below the resistance at 1.3664 (03/07/2014 high). An hourly support can now be found at 1.3576.

In the longer term, the break of the long-term rising wedge (see also the support at 1.3673) indicates a clear deterioration of the technical structure. A long-term downside risk at 1.3379 (implied by the double-top formation) is favoured as long as prices remain below the resistance at 1.3775. Key supports can be found at 1.3477 (03/02/2014 low) and 1.3296 (07/11/2013 low).

Await fresh signal.

GBP/USD

Fading near the top of its rising channel.

GBP/USD has breached the hourly support at 1.7096 (01/07/2014 low) suggesting a weakening buying interest. Hourly supports lie at 1.7086 and 1.7007 (27/06/2014 low). Hourly resistances can now be found at 1.7148 (08/07/2014 high) and 1.7180 (04/07/2014 high).

In the longer term, the break of the major resistance at 1.7043 (05/08/2009 high) calls for further strength. Resistances can be found at 1.7332 (see the 50% retracement of the 2008 decline) and 1.7447 (11/09/2008 low). A support lies at 1.6923 (18/06/2014 low).

Buy stop 2 units at 1.7190, Obj: Close 1 unit at 1.7328, remaining at 1.7435, Stop: 1.7138.

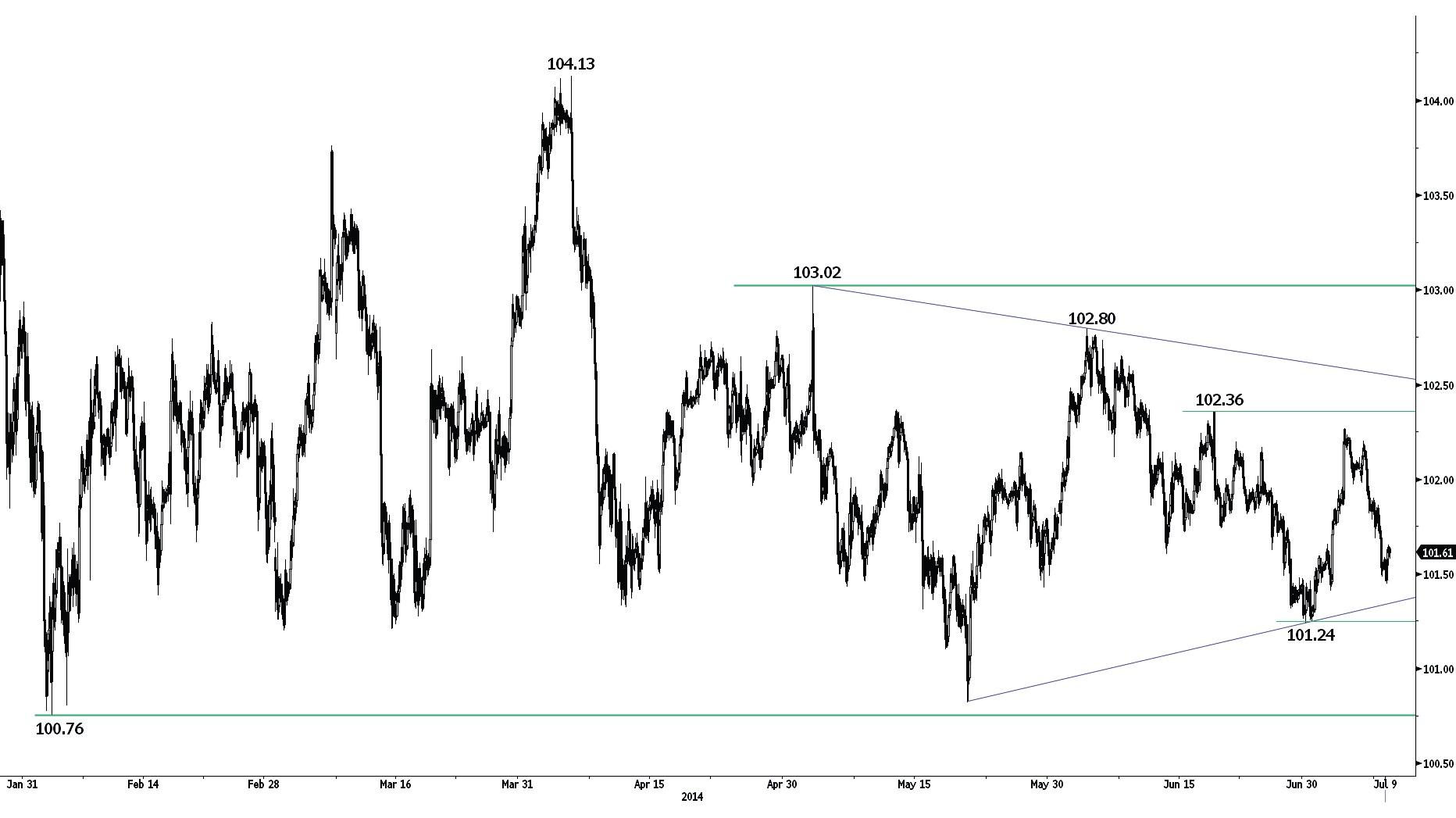

USD/JPY

Remains in a broad horizontal range.

USD/JPY has weakened near the resistance at 102.36 (18/06/2014 high). Prices are now approaching the support at 101.24. An hourly resistance lies at 101.86 (intraday high).

A long-term bullish bias is favoured as long as the key support 99.57 (19/11/2013 low) holds. However, a break to the upside out of the current consolidation phase between 100.76 (04/02/2014 low) and 103.02 is needed to resume the underlying bullish trend. A major resistance stands at 110.66 (15/08/2008 high).

Await fresh signal.

USD/CHF

Fading near its declining channel.

USD/CHF is fading near the resistance implied by its declining channel. The hourly supports at 0.8926 (intraday low) has been broken. Another support can be found at 0.8886 (intraday low). Resistances stand at 0.8959 (07/07/2014 high) and 0.8975.

From a longer term perspective, the bullish breakout of the key resistance at 0.8953 suggests the end of the large corrective phase that started in July 2012. The long-term upside potential implied by the double-bottom formation is 0.9207. A key resistance stands at 0.9156 (21/01/2014 high).

Await fresh signal.

USD/CAD

Trying to form a short-term base.

USD/CAD has bounced close to the key support implied by its long-term rising trendline. A break of the hourly resistance at 1.0697 (27/06/2014 high) would confirm a short-term rebound. Another resistance can be found at 1.0752 (25/06/2014 high). Hourly supports can now be found at 1.0649 (61.8% retracement of the recent bounce) and 1.0621.

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is at 1.1725. However, a break of the support area implied by the long-term rising trendline (around 1.0643) and 1.0559 (29/11/2013 low) would invalidate this long-term bullish configuration.

Await fresh signal.

AUD/USD

Temporary bounce likely underway.

AUD/USD is retracing part of its recent sharp decline. The break of the hourly resistance at 0.9388 (see also the 38.2% retracement of the recent decline) suggests a weakening short-term bearish momentum. Another hourly resistance can be found at 0.9444 (03/07/2014 high). Key supports stand at 0.9319 and 0.9206.

In the longer term, the false breakout at 0.9461 confirms a limited upside potential, favouring a bearish bias. However, a break of the key support at 0.9206 (03/04/2014 low) is needed to open the way for a new significant phase of decline.

Sell stop 2 units at 0.9309, Obj: Close 1 unit at 0.9212, remaining at 0.9007, Stop: 0.9348.

GBP/JPY

Weakening within its rising channel.

GBP/JPY is weakening within its rising channel. The support at 173.92 has been breached. Another support is given by the rising channel (around 173.28). Hourly resistances can be found at 174.57 (08/07/2014 high) and 175.37 (03/07/2014 high).

In the long-term, the break of the major resistance at 163.09 (07/08/2009 high) calls for further strength towards the resistance at 179.17 (15/08/2002 low). The long-term technical structure remains supportive as long as the key support area defined by 163.89 (04/02/2014 low) holds.

Yesterday's weakness has forced us to close the remaining of our long positions.

Remaining long position has been stopped.

EUR/JPY

Remains weak.

EUR/JPY remains below the resistance implied by the 200 day moving average (around 139.28). Prices need to break this resistance to indicate exhaustion in selling pressures. An hourly resistance now lies at 138.83 (07/07/2014 high). Monitor the support implied by the rising channel (around 138.13). Another support lies at 137.71.

Despite the strong support at 136.23 (04/02/2014 low), the long-term technical structure remains positive as long as the support at 134.11 (20/11/2013 low) holds. A strong resistance stands at 145.69 (27/12/2013 high).

Await fresh signal.

EUR/GBP

Weak bounce thus far.

EUR/GBP has broken the key support at 0.7961 (08/11/2012 low)/0.7959 (16/06/2014 low), opening the way for further weakness. An hourly resistance for a short-term bounce can be found at 0.7973 (03/07/2014 high). However, a break of the hourly resistance at 0.8034 is needed to invalidate the bearish technical structure. An hourly support now lies at 0.7915 (07/07/2014 low).

In the longer term, the break of the key support area between 0.8082 (01/01/2013 low) and 0.8065 (05/06/2014 low) opens the way for a full retracement of the rise that started at 0.7755 (23/07/2012 low). Another strong support stands at 0.7694 (20/10/2008 low). A break of the resistance at 0.8153 (29/05/2014 high) is needed to suggest some exhaustion in the long-term selling pressures.

Await fresh signal.

EUR/CHF

Fading near the resistance at 1.2166.

EUR/CHF is fading near the hourly resistance at 1.2166. Furthermore, as long as prices remain below the resistance at 1.2178 (20/06/2014 high), the technical structure continues to favour further weakness. Hourly supports now stand at 1.2148 (08/07/2014 low) and 1.2134.

In the longer term, prices are moving in a broad horizontal range between the key support at 1.2104 and the resistance at 1.2261.

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which is expected to hold in the foreseeable future.

Long 3 units at 1.2329, Objs: 1.2660/1.2985/1.3195, Stop: 1.1998 (Entered: 2013-01-23).

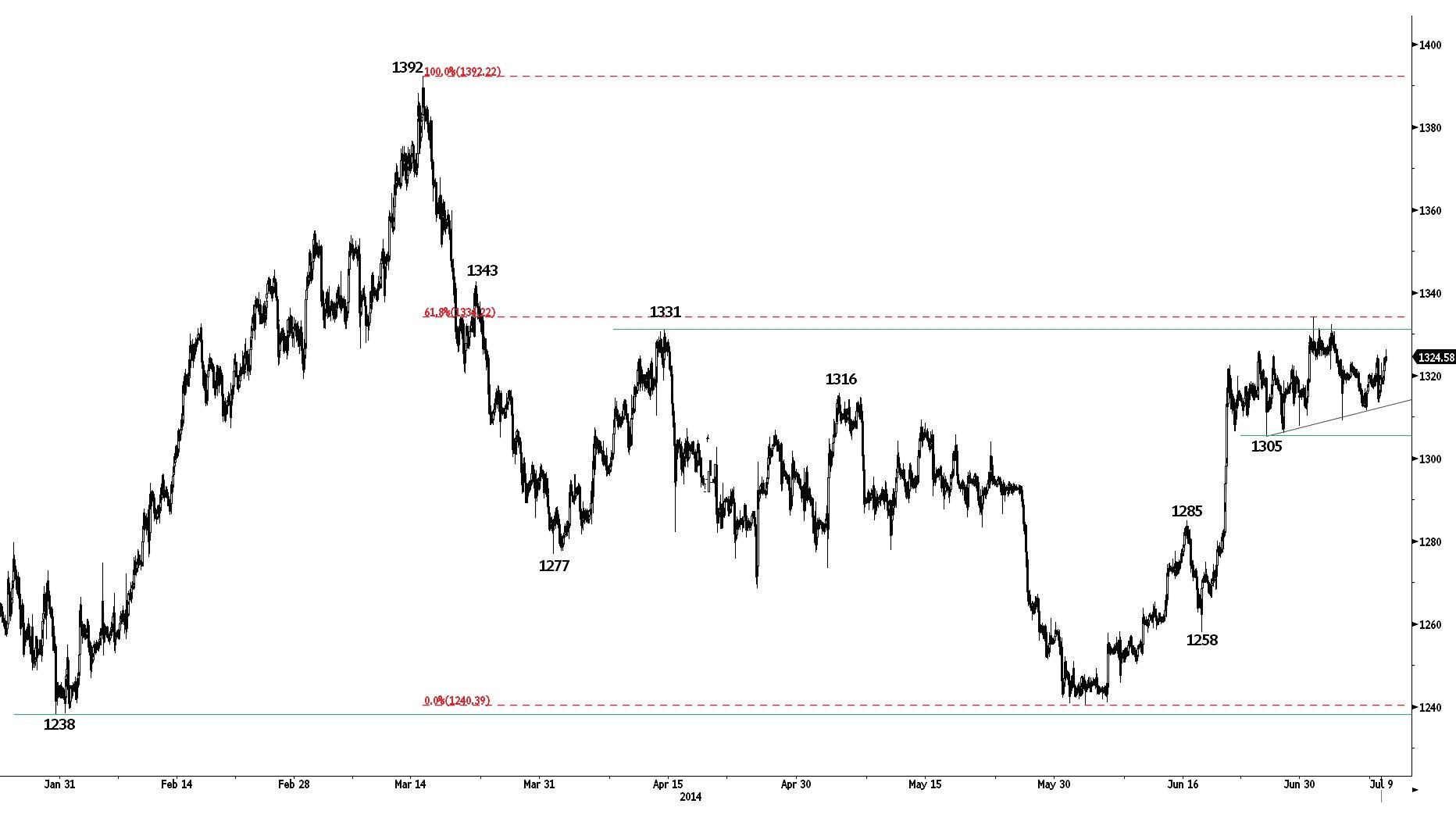

GOLD (in USD)

Buying interest remains strong.

Gold continues to consolidate near the key resistance at 1331 (see also the 61.8% retracement). The short-term succession of higher lows suggests persistent buying interest. Monitor the support at 1305, as a break lower would open the way for a deeper correction. Another resistance lies at 1343, whereas another support can be found at 1285.

In the long-term, we are sceptical that the horizontal range between the strong support at 1181 (28/06/2013 low) and the major resistance at 1434 (30/08/2013 high) is a long-term bullish reversal pattern. As a result, a decline towards the low of this range is eventually favoured.

Await fresh signal.

SILVER (in USD)

No higher high yet.

Silver has bounced near the supports implied by the short-term rising channel and the rising trendline. A failure to make a new higher high would suggest a weakening buying interest. A resistance lies at 21.29 (02/07/2014 high). Supports now stand at 20.83 (07/07/2014 low) and 20.58. Another resistance can be found at 21.79.

In the long-term, the trend is negative. However, the successful test of the strong support area between 18.84 and 18.23 (28/06/2013 low) and the break of the resistance at 20.41 (24/02/2014 high) indicate clear exhaustion in the selling pressures. A key resistance stands at 22.18 (24/02/2014 high).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.