Global Markets

The resumption in optimism that the Federal Reserve might finally begin raising US interest rates in December has encouraged devoted bullish investors to reinvest back into the Dollar. Sentiment remains bullish towards the US economy and with the acquired clarity from the mildly hawkish FOMC minutes concerning the potential US interest rate rise timings, Dollar strength may take center stage in the global currency markets. There is an event risk for the Dollar on Tuesday with the release of the latest US Q3 GDP which may shed more light on the health of the American economy.With Fed board members placing a strong emphasis on the strength of US data as a condition to raise US interest rates in December, a US Q3 GDP that exceeds expectations may provide the Fed with another compelling reason to move ahead with raising rates before year end.

The elevated expectations around the Fed raising US interest rates have translated to the Dollar Index almost clipping the psychological 100 resistance. Many see the 100.0 level on the USD index as a critical resistance, and the profit-taking on the Dollar last week brings some support to this. Whilst most believe that the USD has reached its “top” already, it is the contrast in monetary sentiment elsewhere and threat that other central banks could ease monetary policy further that is leading to expectations that the USD could still increase in value in the longer-term.

This index is technically bullish and a breakout above the key 100.0 resistance may invite an opportunity for buyers to send prices towards the next relevant level at 102.0, and the highs of March 2003. Technical indicators such as the MACD point to the upside and prices are also above both the 20 and 200 SMA.

WTI Oil continues to trade with heightened sensitivity following Saudi Arabia’s cabinet announcing on Monday that it was ready to cooperate with OPEC and non-OPEC countries to achieve market stability. Prices dipped below $40.50 during the European trading session before bouncing back to trade around $42.60 as of writing.The ceaseless theme of an aggressive oversupply in the markets and faltering global demand for WTI oil will continue to depress prices moving forward.The OPEC meeting scheduled for December may offer the clarity investors have sought on how the organizations plans to tackle the global oversupply, especially with this new development.

USDCAD

The USDCAD is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. A breakout above the 1.3450 resistance may open a path to the next relevant level at 1.3750.

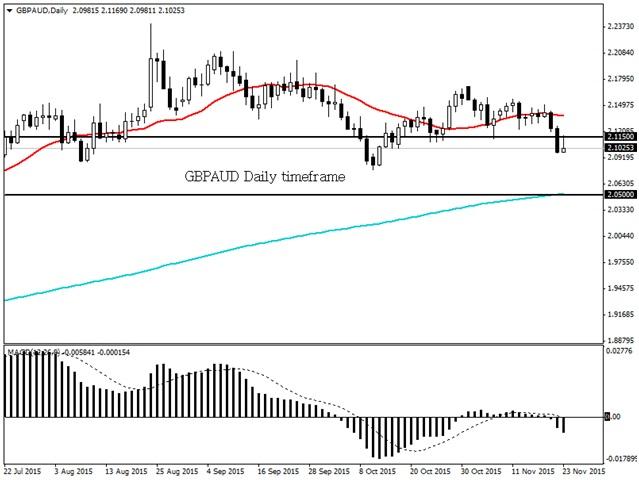

GBPAUD

The GBPAUD is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. Previous support at 2.1150 may act as a dynamic resistance which should invite sellers to send prices towards 2.0500.

EURAUD

The EURAUD is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. The breakdown below the 200 SMA may act as a signal that prices may decline further down to the next relevant support at 1.4450.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.