Global Market

A buildup of tension can be observed within the financial markets as the anxieties over China entering a deep economic downturn, in addition to emerging market weakness continue to have an adverse impact on investor sentiment. The Fed’s defiant action to not raise US rates in September lingers on, not only pressuring the markets further but also promoting a heightened level of sensitivity within the USD. With no clear direction offered to market participants, this has resulted in a case of jitters that has translated to a risk-off trading environment.

The risk-off trading environment has resulted in the Sterling experiencing an extended period of losses against the JPY. A string of negative PMI data from the UK economy this month has pushed back UK interest rate expectations which has exposed the GBP to further losses. The risk-off environment has promoted appetite for the JPY and because of this the GBPJPY has become fundamentally bearish. GBP weakness and JPY strength may result in the GBPJPY trading to the next relevant support at 180.00.

As a result of the risk averse trading environment, equities have received some punishment meandering between gains and losses. European equities have taken a hit, especially the FTSE100 which declined to levels not seen since the 24th of August. Soft data from Asia last week which resulted in a decline in mining stocks translated to an aggressive sell off within the FTSE100. This index remains technically bearish on the daily timeframe, and if the official September manufacturing managers index (PMI) and financial Caixin/Markit PMI for China fail to meet expectations this Thursday, then this should expose the FTSE100 to further vulnerability, opening a path to the 5850 support.

With the requirements of a US hike reverting back to a dependency on US data, the ADP Non-Farm employment change which will be released in the New York session may provide some clarity. An announcement which beats the expectations will not only promote an appreciation within the sensitive USD but may act as an attribute that may bring the Fed closer to a US rate hike before the end of 2015.

AUDNZD

The AUDNZD remains technically bearish on the daily timeframe as long as prices can keep below the 1.1200 resistance. A breakdown below the 1.0900 support may open a path to the next relevant support at 1.0700.

AUDJPY

The AUDJPY remains technically bearish on the daily timeframe as long as prices can keep below the 85.00 resistance. Prices are trading below the daily 20 SMA and the MACD has traded to the downside. The next relevant support may be based at 82.00.

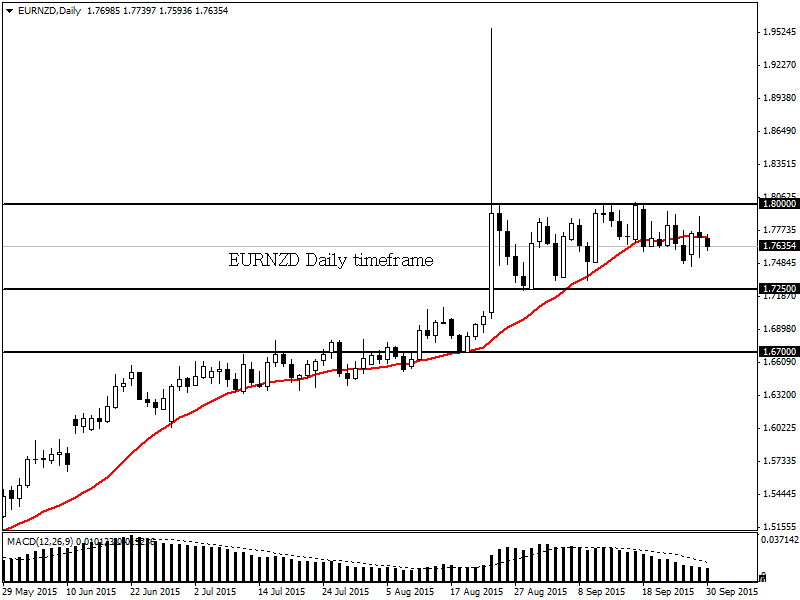

EURNZD

The EURNZD currently remains in a range. Support can be found at 1.7250 and resistance can be found at 1.8000. A breakdown below the 1.7250 support may open a path to the next relevant support at 1.6700.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.