Global Markets

Monday the 24th August will go down as an historic day for the FX markets, where global markets suffered extensive losses and investors liquidated positions due to the exposure of risks in the market becoming too much to ignore any longer. The concerns over the China economy slowing down are continuing to intensify to new levels and with this occurring at the same time that commodity prices are collapsing to milestone lows, while Europe is stagnating and Japan is failing to improve, investors have begun to panic. This changing market sentiment has resulted in the liquidation of many Euro selling options, and encouraged renewed appetite for a currency that practically everyone expected to hit parity against the USD this year. The manner in which the Euro has bounced over the past couple of sessions can be compared to what investors would usually expect from a safe-haven asset.

With global equities performing under severe uncertainties and concerns remaining that the PBoC will need to take further easing measures to attain some sort of market stability, the risk-off environment has provided renewed interest in safe-haven instruments such as the JPY and even inspired reintroduced appetite for the Euro. The PMI data from China late last week furthered anxieties that the China economy is in a period of deceleration, while also confirming that the economy is both exposed and appearing increasingly vulnerable to falling below the Chinese government’s GDP target of 7% before the end of this year. As a result of this, the PBoC are going to remain under intense pressure to reinvigorate economic momentum and I expect the central bank to do whatever it takes to defend the GDP target.

The PBoC have a great deal of ammunition at their disposal to reinvigorate economic growth, and the expectations are going to remain for more interest rate cuts from China or possibly even further currency devaluation. The uncertainty over China is now intensifying expectations that the Federal Reserve will have to postpone or at least delay any US interest rate rises, which means that the USD is still exposed to further weakness. This extends the paradigm shift to the Euro because the EU currency remains the main benefiter to the falling rate expectations from the Federal Reserve.

What was interesting from the intense volatility was that this failed to have any impact on Gold. The metal gained heavily last week but was unable to build any further momentum despite equity markets falling globally and the USD suffering from an extreme round of weakness. The USD on the other hand felt the full brunt of the market environment with risk aversion hammering down on the US stock markets. The Dow Jones Industrial Average (DJIA) closed over 3% lower, while the USD index plunged to lows not seen since the beginning of 2015. The market sentiment for a September US interest rate rise has drastically changed with any expectations for this to occur being taken out of the picture.

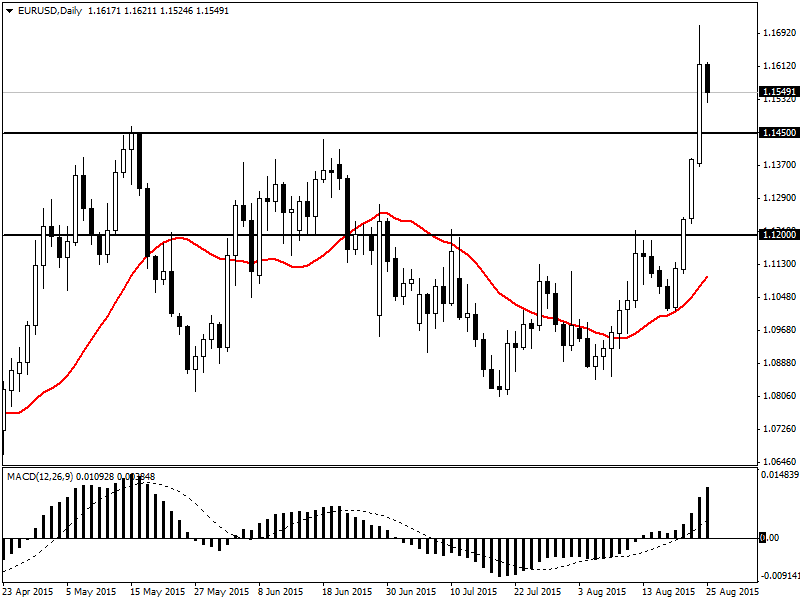

EURUSD

Due to the weakening US interest rate expectations, the EURUSD has become fundamentally bullish. The pair has rallied aggressively to the upside as the Euro behaves similar to a safe-haven currency and the previous bullish sentiment on the USD is chipped away. Prices hit the highs of 1.1713 in yesterday’s session, levels not seen since the first week of January 2015. Technically this is a heavily bull dominated market as prices have sliced through the previous resistance identified at the 1.1450 level. Leading and lagging indicators all point to the upside and suggest for a further incline to unexpected highs. Prices reside above the daily 20 SMA and the MACD trades to the upside, while some support may be found around the previous monthly R2 resistance around the 1.1450 regions and could encourage the EURUSD bulls to enter positions. A correction to the identified level of previous resistance or a breakout may offer opportunities. The current trend defining level holds at 1.1200.

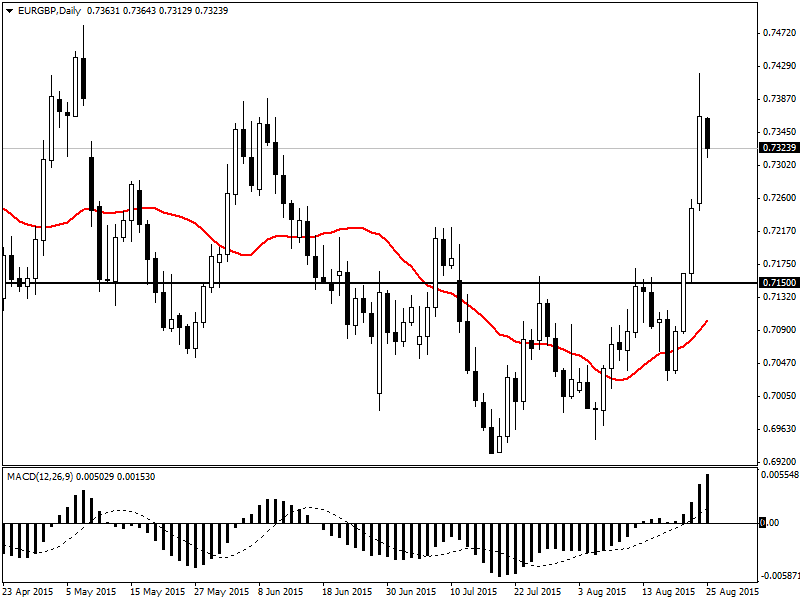

EURGBP

The move in EURGBP caught most by surprise as prices surged to the 0.7400 level. Any move over 100 pips for the EURGBP is relevant and yesterday the pair reached almost 150 pips on one single candle. This move was fueled by the EUR gaining from renewed appetite. As of now the EURGBP is still fundamentally flat due to the consistently strong GBP but technically bullish. The previous lower high around 0.7150 was breached which signaled the end of the daily downtrend and start of an uptrend. Prices trade above the 20 SMA and the MACD crosses to the upside. With current candlesticks riding the outer skin of the Bollinger bands, a breakout above 0.7400 may open a path to the next relevant resistance based at 0.7750. There is a possibility for prices to correct at least to the 50% Fibonacci level before bulls take the front seat once more. 0.7100 remains as the trend-defining level for this daily bullish outlook to hold.

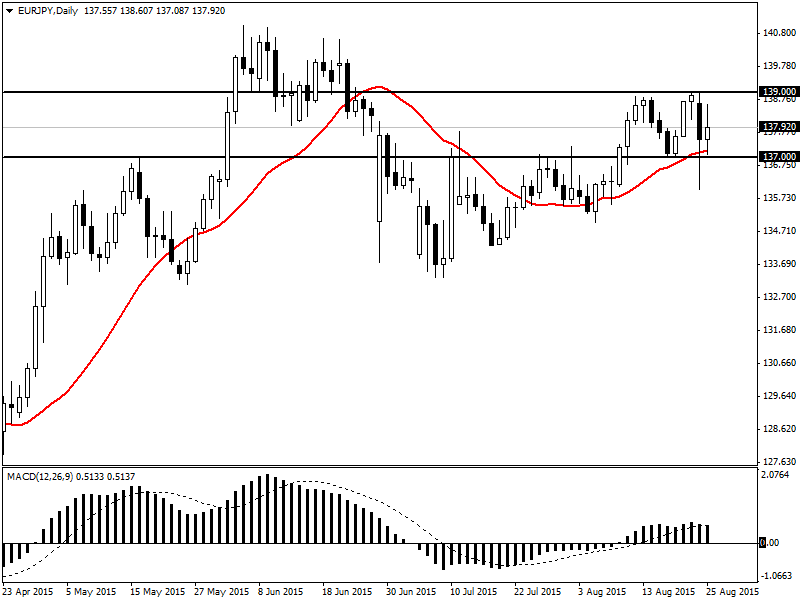

EURJPY

A battle within this currency pair currently exists. Both the EUR and JPY are both gaining from heavy demand across the board. Fundamentally and technically the EURJPY is currently flat. On the daily time frame, some resistance can be found around 139.0 and support around 137.0. The leading and lagging indicators are illustrating mixed signals. Prices trade above the 20 SMA but the MACD is about to cross to the downside with some resistance found above the weekly pivot. The range on the EURJPY may extend as long as demand holds for both these assets due to the global events. The best strategy to tackle the EURJPY may be the breakout/down strategy above or below the identified level of support and resistance.

EURAUD

A huge move to the upside has seen the EURAUD jump 1000 pips from 1.5560 to 1.6580 in just one trading session. This is a level not seen since 2009 and while the outlook for this pair is still for further gains, the Daily chart suggests a correction to the 50% Fibonacci level at 1.58 might be experienced before a further incline to the upside. Technical leading and lagging indicators go in sync with this. The previous monthly R2 is also coincidently where the 50% Fibonacci level can be seen, while prices also trade above the 20 SMA. As identified earlier, it looks like market participants have lost some appetite for Gold as a safe haven instrument and because of this, AUD weakness is very visible within the EURAUD.

EURCAD

Renewed appetite for the Euro versus a currency which is constantly suffering due to the falling prices of oil can only be of benefit to the bulls. This pair has surged with might to the highs of 1.5560, not very far from the highs of March 2014 which was the 1.5586 level. Things are looking very bullish on the EURCAD and two things may be expected. The price may either breakout above the highs of yesterday’s candle at 1.5560 or simply correct to regain some bullish momentum before surging back up again. Falling prices of oil and the current state of the Canadian economy reflect on the CAD weakness which in turn make this a fundamentally bearish single currency. This bearish sentiment on the CAD translates to the EURCAD being fundamentally bullish. A price dip back above the 1.52 regions may suggest the start of a correction phase with first targets residing around the psychological 1.5000 level. The trend defining level for the EURCAD holds around the 1.4500 level.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.