There has been much anticipation on tonight’s FOMC staff projections and FED speech, with many analysts and participants expecting the FED to drop ‘considerable time’ in a speech, to suggest the initial interest rate rise will indeed “rise sooner than later”.

Expectations require fulfilling...

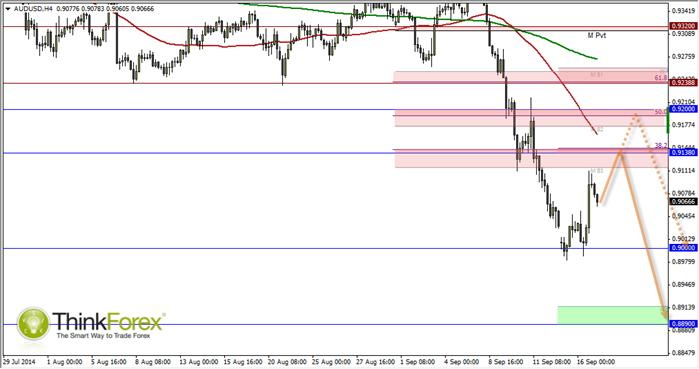

Of course with so much anticipation and expectations of these key words being dropped it does leave the market up for a huge disappointment if the FED fails to deliver, causing the Greenback to fall from current highs as a consequence. With the Greenback amid its best bull-run since May ’11 lows it wouldn’t hurt too much to see a USD pullback. This would help support the A$ above 90c which was successfully defended by bears booking profits, following the 6th consecutive session of declines. OECD cut growth forecasts for the US, so if FOMC Staff projections back up a further growth cut forecast tonight and the FED also fails to deliver a Hawkish tone then expect some rapid USD selling. AUDUSD could retest the 92c level, a key level for the bears to defend. However if this level holds as resistance then we can expect fresh short positions to be initiated as bearish traders seek to drive the Aussie below 90c. Like the RBA many traders believe the Aussie to be overvalued and it could be time for the A$ to catch up Iron Ore prices which sits at 5-year lows. Even of the FED do fail to deliver tonight I only see this as a temporary blip, so A$ gains should be short lived.

Alternatively - what of they deliver?

That said, the FED many finally deliver what traders have been asking for. A refined and more clear message of forward guidance. This should further fuel the bullish Greenback fire, putting extra pressure on the A$.

Technically:

The H&S shoulders confirmed below 92c targets 89c. Any rallies towards 92 are likely to attract bearish interest for the larger move down. This may provide bullish opportunities on intraday timeframes until a clear level of resistance has been respected.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.