Today's inflation figures show an annualised reading of 3%, at the top of RBA inflation band, to dampen likelihood of a rate cut.

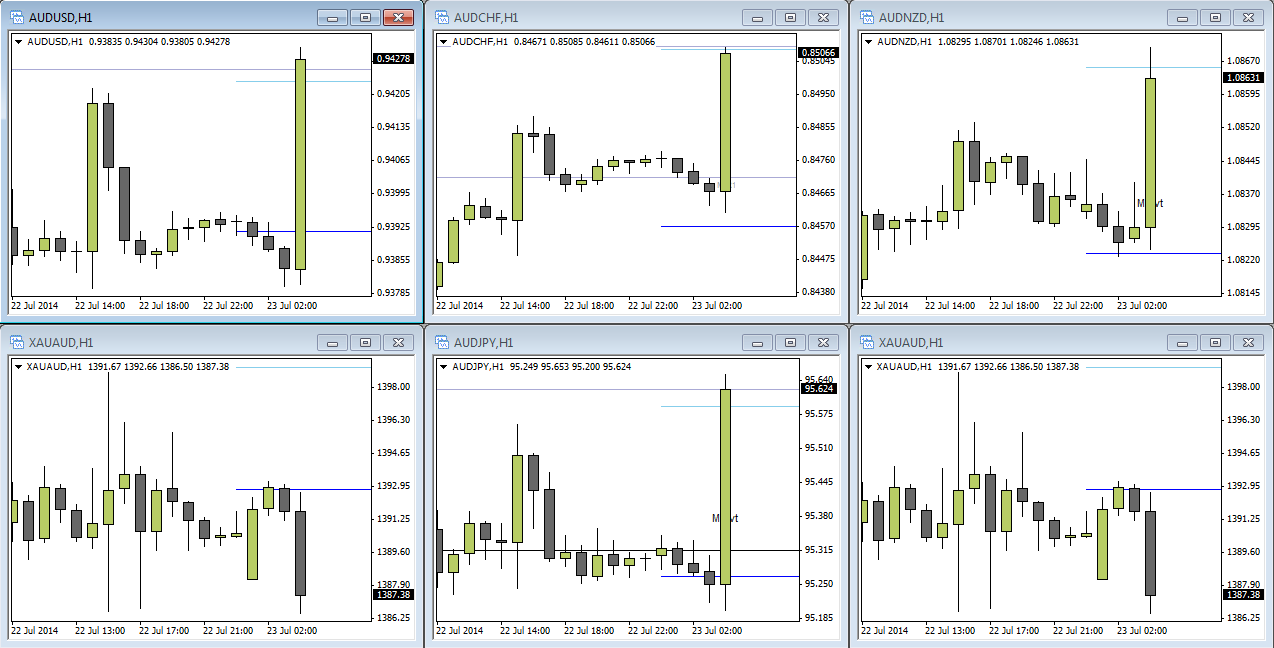

Until today's release the Aussie had lacked both volatility and direction, but following today's positive inflation data the Aussie is now trading at a 9-day highs and appears set to test 0.945. However I expect it to meet headwinds at this level as this could entice profit taking and entice bearish traders to enter short.

A bullish close today near current levels would add to the argument we are seeing a basing pattern forming above 0.9320. Since the bearish decline form 95c (and the 2 most bearish consecutive days in 6-months) bulls have successfully defended the 0.932 level with intraday bullish momentum clearly more bullish.

Tomorrow we have China PMI data which if positive should help support the A$ above 94c. A break back below 94c puts as back into 'no-man’s land' as this lacks any clear direction, with a break below 0.932 swing low to become bearish, keeping in mind we are just above the 93c level.

Does today's inflation raise pressure for a rate increase?

Annualised inflation is now at the top of the "2-3%" band targeted by the RBA, which will raise hopes of a rate increase. Looking at CPI annualised it certainly looks more rosy for Australia, now sitting higher for the 3rd consecutive quarter and at its highest since 2012. However 1 figure at or above this threshold does not necessarily mean rates have to be risen. For example RBA may want to wait for 2 or more quarters above this band before seriously considering it. There are also others factors in play.

Uncertainty remains as to the effectiveness of the current cash rate at 2.5% and it is too soon to completely rule out a rate cut from RBA over the coming months. As we progress further into the year and tapering winds up from the US then I expect this to weigh down heavily on both the A$ and NZD$. Whilst there is a hunt for yields globally from investors, a rate rise from a low yield US will be more significant than a lower rate cut from RBA in my opinion and we should see the A$ back below 90c.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.