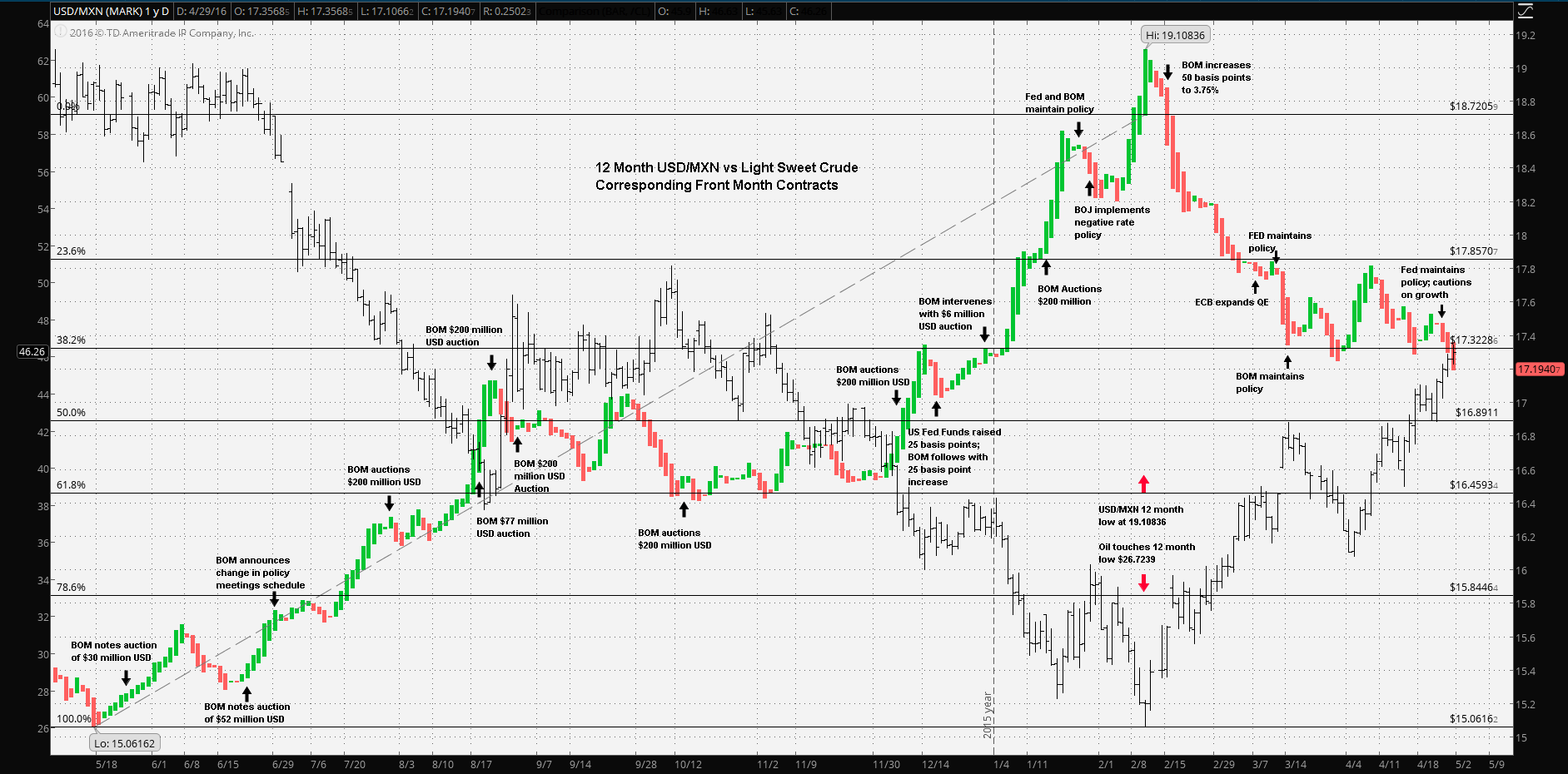

On 18 February, 2016 Bank of Mexico Governor Agustin Carstens surprised markets with a 50 basis point overnight target rate increase to 3.75%. Up until the action, the BOM had been intervening in currency markets, at first indirectly by auctioning off up to $400 million of US Dollar reserves a day based on USD/MXN percentage moves. Along with the rate increase the BOM announced direct currency intervention . The 17 February action was a hammer blow on Peso devaluation as demonstrated in the chart below. The Peso steadily devalued vs the US Dollar over the past 52 weeks from the high of 15.06162 per, 15 May 2015 to the low of 19.10836 per USD, 11 February 2016; a 26.868% decline. After the intra-meeting decision, the Peso recovered from its low of 19.10836 thus gaining 9.34%, meeting resistance at Fibonacci retracement of 17.3228 per USD; i.e. the Fibonacci 38.2% level.

The USD/MXN trend had been a thorn in the side of Governor Carstens for some time. There had been repeated calls for the BOM to drop the rule based auction in favor of direct intervention for some time . However, the BOM may have been experiencing the same phenomenon as has many other central banks, in particular, the unresponsiveness of the currency or sovereign bond rates after policy actions.

The USD/MXN chart below is compared with light sweet crude front month contracts over the previous 12 months. There is clearly a correlation. The 12 month Peso high vs the USD corresponds with the 52 week contract high of about $60.7624. Conversely, the 52 week Peso low corresponds with the 52 week light sweet crude contract low of about $26.7593 per barrel. The oil contract low might have been a trigger from the BOM as the unexpected action followed just five days later.

The dynamic is simple. Over 75% of Mexican exports are destined for US markets. Further, 73% of Mexico’s oil exports are destined for the United States. Clearly, a strengthening US Dollar, plus the fact that oil trades in US Dollars, plus the fact that US Dollar revenue flow into Mexico is dependent on the market price of oil has a serious impact on the relative value of the Peso.

Observe that as the price of oil began to recover from the 11 February 12 month low, the Peso also recovers in as close to a mirror reflection which may be had when comparing a currency to an industrial commodity.

Having the US as a major trade partners has its advantages as well as its disadvantages. A strong US Dollar against a Mexican Peso is a positive for the US import market as it keeps the cost of durable goods sold in the US low as well as creating demand for those durables manufactured in Mexico. On the other hand, the closely related trade partnership and the price of oil greatly affect Mexican government revenue.

The BOM targets a 3.00% annual rate of inflation. Up until the unexpected 17 February action the strategy the BOM maintained a 3.00% overnight rate, and auctioned US Dollars to banks in exchange for Pesos in order to reduce Peso liquidity in the economy. The strategy was reasonable successful and kept CPI either side of the target for the past year. However, changes were in the works as observed by Alanzo Cervera of Credit Suisse, Latin America. He remarked that the 4 February statement “...has a hawkish feel as the bank noted the significant additional depreciation of the peso... ...If the peso were to continue to weaken, no one should be surprised if the central bank were to increase the overnight rate eventually, even if the Fed is on hold...”

Mr. Cervera may have been referring to the BOM monetary policy board’s comment that it, “...will follow very closely the evolution of all determinants of inflation and its mid and long-term expectations, especially the exchange rate and its possible pass-through to consumer prices...” There was one other possible clue as to the BOM’s concern over the strong dollar. An accident of scheduling caused the BOM to meet just days before the regularly scheduled US Fed meeting. A particularly difficult situation since the BOM would most likely wish to respond to Fed actions rather than anticipate Fed actions. In July 2015, the BOM announced that it would indeed reschedule to meet after the scheduled Fed meetings . Indeed, when the Fed moved in December, the BOM immediately ‘followed suit’.

Hence, it’s fair to say that under the leadership of Governor Carstens, the BOM has taken some extraordinary measures to keep the economy functioning as well as possible with a benchmark interest rate as low as practicable for as long as possible; it has applied an innovative strategy to maintain a trade parity with its major trade partner for as long as possible and has acted decisively when the current policy was stretched to the limit and inflation nearing a risky point.

What the BOM cannot control is the price of its major export, light sweet crude which is nearly half of its crude production. Further, as the chart demonstrates, as much as the BOM has done extraordinarily well to manage the economy, the USD/MXN exchange may also be subject to that unmanageable petroleum variable. Hence it’s worth keeping tabs on light sweet crude prices when considering the Dollar-Peso exchange.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.