The Australian dollar has a experienced a bad last month moving from resistance around 0.88 down to multi year lows right on 0.8200 in the last half day. Over the last week the Australian dollar has been able to halt the strong decline a little allowing it to consolidate and establish a narrow range below 0.83. It is presently receiving some much needed support around 0.8200 as it appears to have its eyes firmly fixed on the 0.80 level. A few weeks ago it enjoyed some temporary support from 0.85, however this eventually gave way to overwhelming supply. To start that week it rallied back above 0.8650 again before falling lower throughout the rest of the week. In the week prior the Australian dollar was able to rally higher and bounce off multi year lows around 0.8550 and in doing so move back within the previously well established trading range between 0.8650 and 0.88 however it all seems some distance away now.

For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650. Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory. The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year.

Australia’s government forecast a wider budget gap this year as plunging iron ore prices erode tax revenue and spending cuts are blocked by opposition lawmakers. The underlying cash deficit will deteriorate to A$40.4 billion ($33.2 billion) in the fiscal year ending June 30, 2015 from a May estimate of A$29.8 billion, Treasurer Joe Hockey said in the mid-year economic and fiscal outlook today. The government forecast unemployment will climb to 6.5 percent by mid 2015, higher than its May projection of 6.25 percent. “We are now witnessing the largest fall in the terms of trade since records began in 1959,” Hockey told reporters in Canberra, referring to export prices relative to import prices. “This has been faster and deeper than anyone expected.”

(Daily chart / 4 hourly chart below)

AUD/USD December 15 at 21:40 GMT 0.8218 H: 0.8267 L: 0.8201

AUD/USD Technical

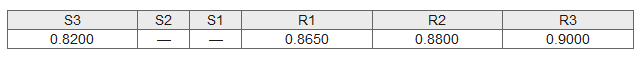

During the early hours of the Asian trading session on Tuesday, the AUD/USD is resting on support around 0.8200 after dropping sharply from around 0.8370. Current range: trading right around 0.8220.

Further levels in both directions:

- Below: 0.8200.

- Above: 0.8650, 0.8800, and 0.9000.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.