Daily Forecast - 18 February 2015

Gilts March contract

Gilts key to today's direction is important support at 119.39/35. Although yesterday's action was very negative we are oversold and this is good support, so could still hold today. However be ready to go with a break lower to target 119.20/17 then 119.05/00. Any further losses risk a slide to 118.80/70 then 118.58/55.

Above 119.55 is slightly more positive and can target resistance at 119.72/82. If this does not hold a move higher we may take it as far as 120.04/08. We can try shorts here with a stop above 120.20. Any further gains meet an excellent selling opportunity at 120.38/43.

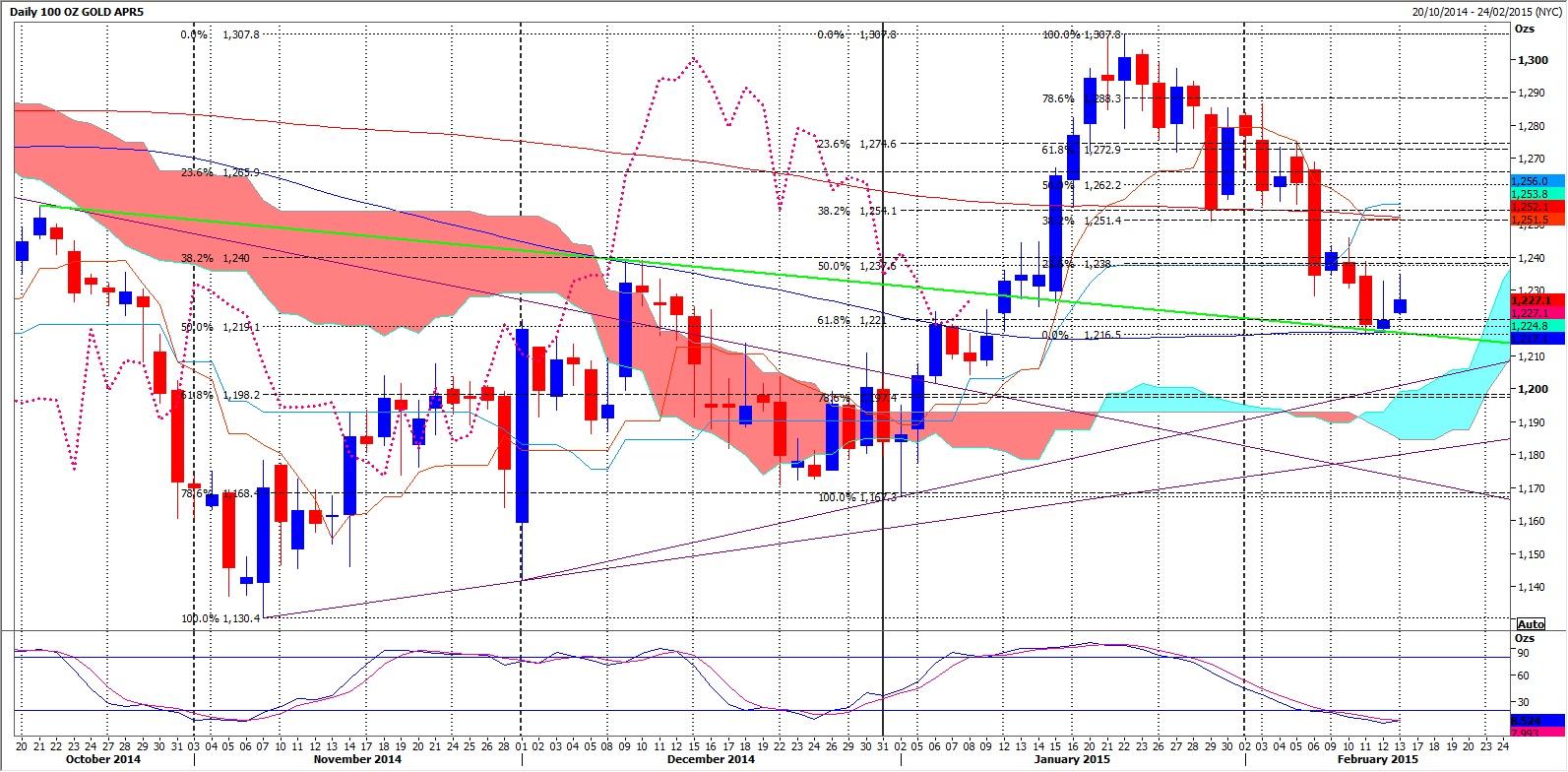

Gold April Contract

Gold outlook now negative despite being severely oversold. Any recovery meets first resistance at 1213/14 then the 100 day moving average at 1217. If however we manage further gains look for a selling opportunity at 1220/1221. A high for the day is expected here but shorts need a stop above 1224. An unexpected break higher would be more positive and if we were to then hold above 1221 we could target 1228/1229.

A break below yesterday’s low of 1203 targets first support at 1998/97. Be ready to go with a break below 1995 to target 1189/88 and perhaps as far as 1185/1184.

Bund March contract

Bund holding below 158.55 targets yesterday's low at 157.30/29 then the 158.19/11 support area. This is the most important support of the day. Try longs with stops below 158.00. Just be aware that a break lower is a negative signal & targets 157.85/84 then support at 157.77/75. Any longs here need a stop below 157.65 as prices could then collapse further to good support at 157.35/30. A bounce from here is expected and is worth trying longs with a stop below 157.20

Above 158.55 is a bit more positive and targets resistance at 158.80/85. A high for the day is possible here but shorts need a stop above 158.95 to target 159.24/25 then this week's high of 159.36/37 before a retest of all-time highs at 159.50/54. We should struggle here again this week but on a break higher today we target resistance at 159.70 then 159.90. I guess a break higher cannot be ruled out even at these yields & could target to target strong resistance at 160.15/20.

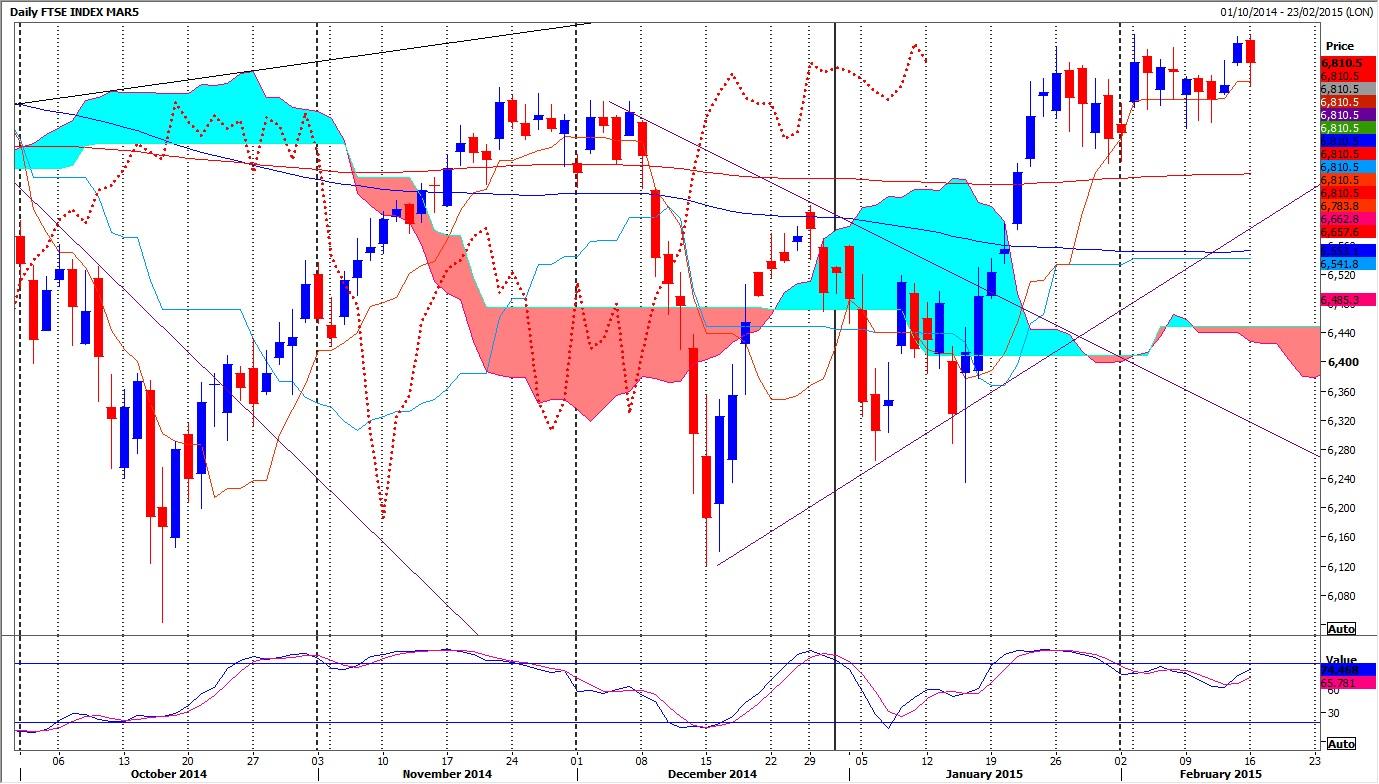

Ftse March contract

FTSE could bounce around between 6800 & resistance at 6847/6849 a little longer today. Again shorts need stops above 6860. Above is more positive for this week & targets 6870/80 then 2014 highs at 6900/6907. Obviously a break & close above here is a positive buy signal & targets 6770.

First support at 6800/95 but below here risks a retest of 2 day lows at 6778/73. Longs need stops below 6765. Be ready to go with a break lower today to target strong short term support at 6750/47. Try longs with stops below 6735. Be ready to go with a break lower again however to target 6720 then very good support at 6705/6700. Buy here with a stop below 6685. A break lower this week however is a sell signal. 6705 should then work as resistance for a move towards 6675/70.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.