The US dollar got its bullish strength back against its G10 counterparts during the last week. It outperformed AUD, NZD, CAD, GBP, CHF, and EUR and it appeared that resistances and supports did not have any significance. It seems like investors, including large scale investment banks are back in the USD look as there is no development in Europe regarding the troubled Greek economy. As we said last week after the pair hit its 100% Fibonacci retracement zone at 1.1390, EURUSD rose almost as high as the high of February 2015, bouncing off the 1.1460 zone. The disappointing news came from Europe that there was no common agreement between the Greek PM Tsipras, German chancellor Merkel and the French President Hollande. It appears that only thing they did agree was the agreement to continue to talk while Greece has less than two weeks to pay a large payment to IMF

Technical outlook:

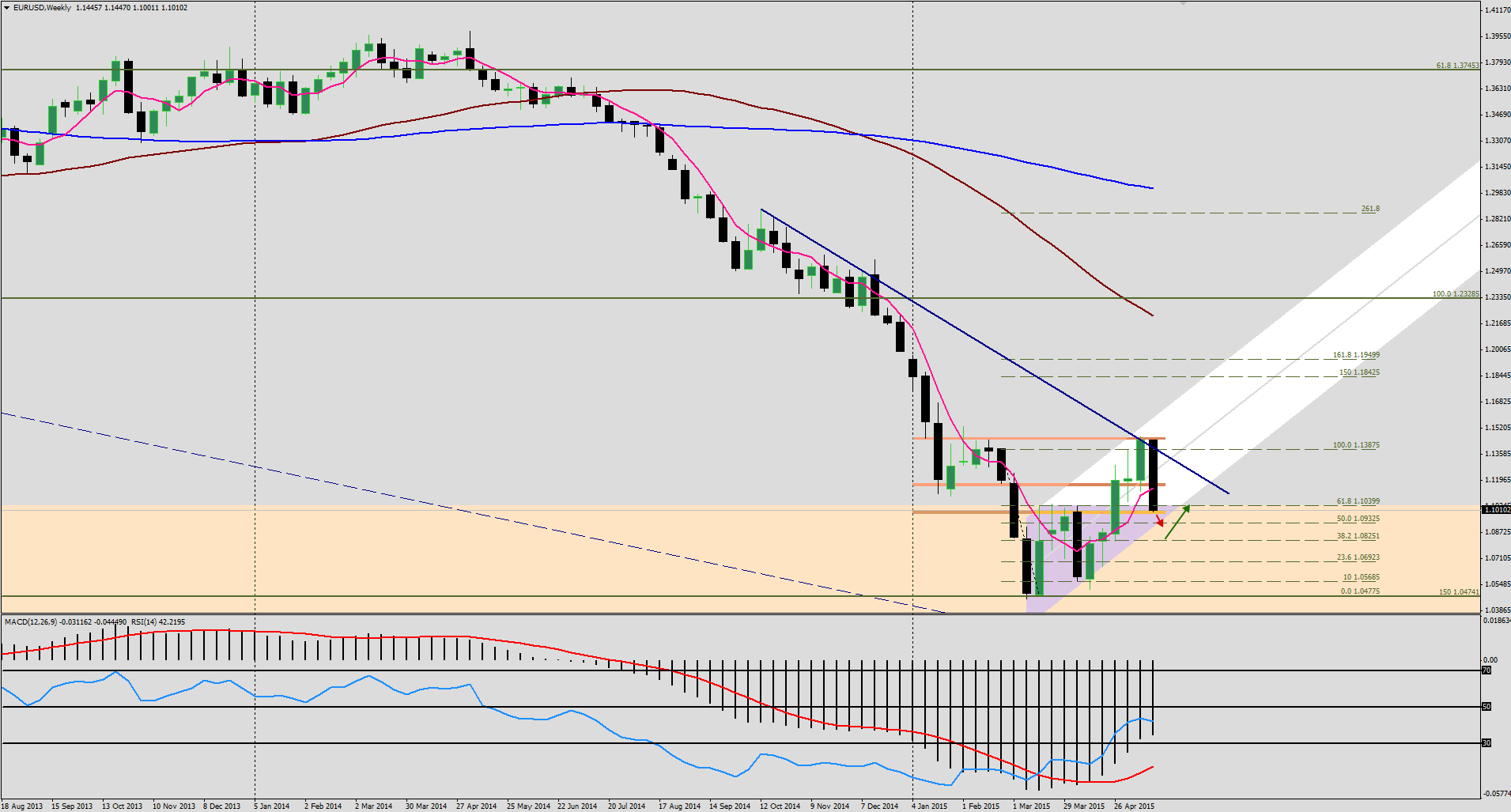

1- EURUSD could not break through its 1.15 psychological resistance level 2- The pair has bounced off the 1.1390 level, 100% Fibonacci retracement level and is now testing 1.10 psychological support zone 3- Technical indicators indicate possible continuation of the bearish movement as fundamentals are supporting stronger USD and weaker EUR

On weekly timeframe there is clear bearish rebound. The pair closed the weekly candle below its three week low at 1.1010 zone. MACD signal line is still below the MACD bars however RSI is sloping downwards. Our trend indicators 200, 50 and 5week SMAs are showing downwards which is a sign of bearish trend continuation.

Moving on to daily timeframe, we can see the strong support between 1.0810 – 1.1040 levels. Looking into our indicators and oscillators, MACD is above its zero line, however moving back to its zero level as it is forming lower bars below the signal line, RSI found itself a strong support at its 50 neutral zone, while 5 day SMA is acting as a dynamic resistance level. Meanwhile, our 50 day SMA is sloping upwards while 200 day SMA is still sloping downwards.

From hourly time-frame point we can see and feel weaker EURO and strengthening USD bulls. I am expecting the pair to test and most probably break below the 1.10 psychological support zone moving towards 1.0820 zone, before we see any bearish action. It is worth mentioning that 1.0825 zone has been a historically strong support/resistance zone. As we move towards vital IMF payment deadline of Greece, we should expect 1.08 level to be tested once again.

Trade expectations

If the pair breaks below 1.1000 zone, following support zones will be as 1.0930 at 50% Fibo retracement zone and 1.0825 zone at 38.2% Fibo retracement. May this level be broken as well, our following support will become as 1.05 zone.

Alternatively, the pair could slightly bounce off the 38.2% Fibonacci retracement zone, consolidating between 38.2% and 61.8* Fibonacci retracement zone.

Weekly Pivot Point: 1.1153

Weekly resistance levels: 1.1040 (R1), 1.1100 (R2), and 1.1180 (R3)

Weekly support levels: 1.1000 (S1), 1.0930 (S2) and 1.08250 (S3)

This market forecast is for general information only. It is not an investment advice or a solution to buy or sell securities.

Authors' opinions do not represent the ones of Orbex and its associates. Terms and Conditions and the Privacy Policy apply.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.