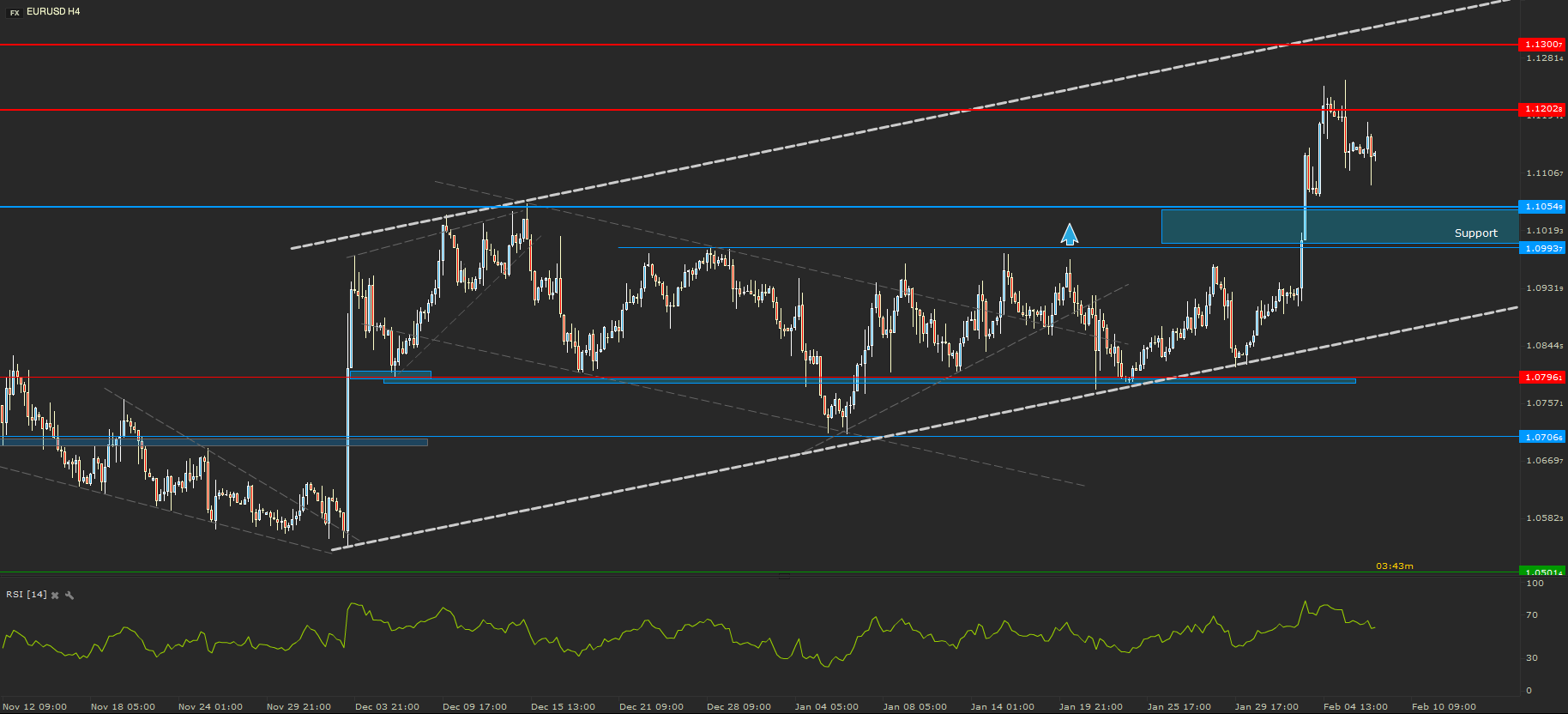

EURUSD - Finally Out

After along period of sideways move the price of EURUSD managed to break the pattern.The bulls won the tug of war with the bears, managing to break above the 1.1000 resistance and hit the next round number level from 1.1200. This resistance held on pretty ok, the price bounced from it back towards 1.1100.

Considering the current conditions of the market, I would expect for the price to continue the uptrend towards the next round number level and key resistance from 1.1300.This theory would be confirmed by another break above the local resistance from 1.1200.

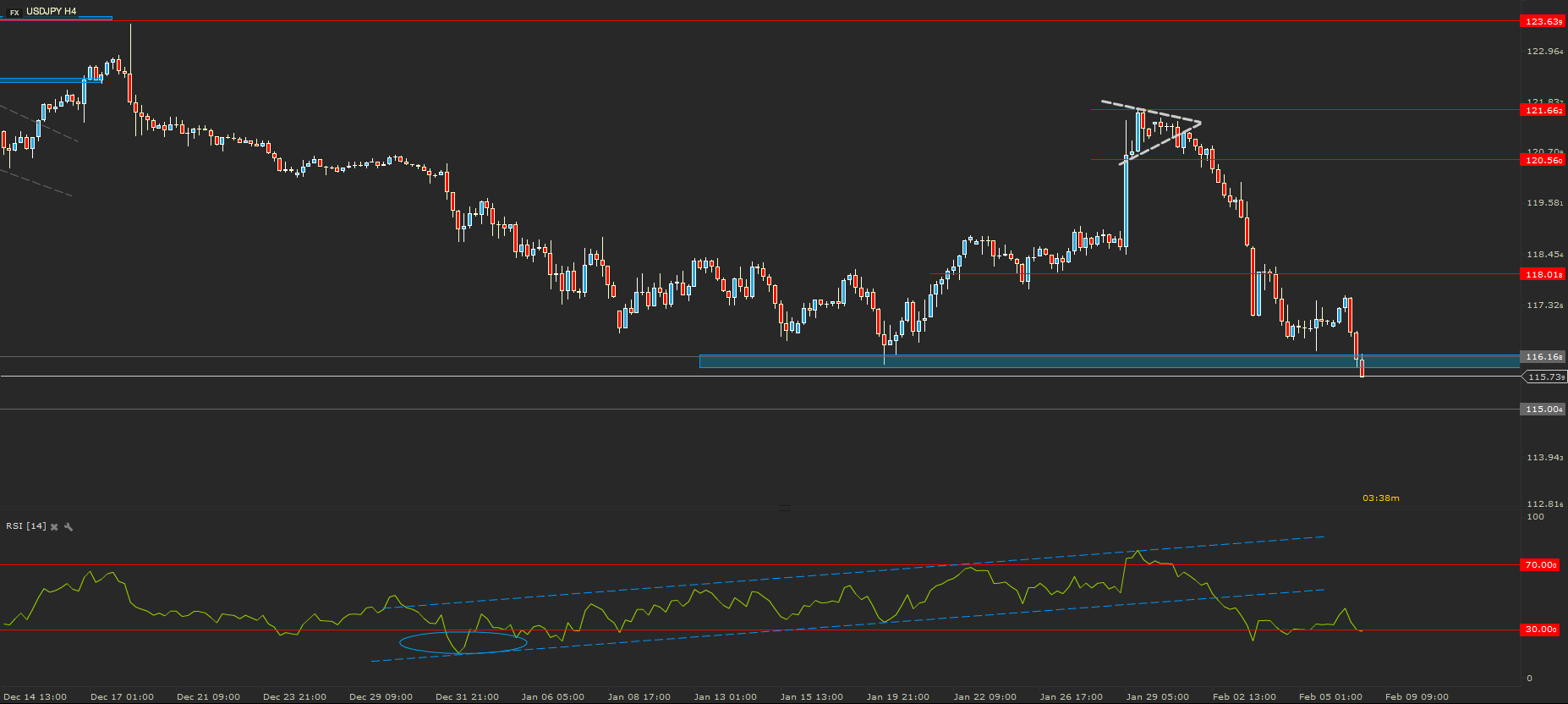

USDJPY - Strong Downward Pressure

Last week,I was expecting the USDJPY to break the upper line of the Pennant pattern and rally towards the next key resistance level from 123.63. Despite these expectations, based on technical conditions, the price broke below the lower line and plunged all the way back to the key support level from 116.16.

The plunge seems to not stop at this level this time. A break below the support already occurred. If the break will be confirmed by a close on a four hour time frame,below this support, I will expect the price to continue the drop all the way to 115.00, or even lower by the end of this week.

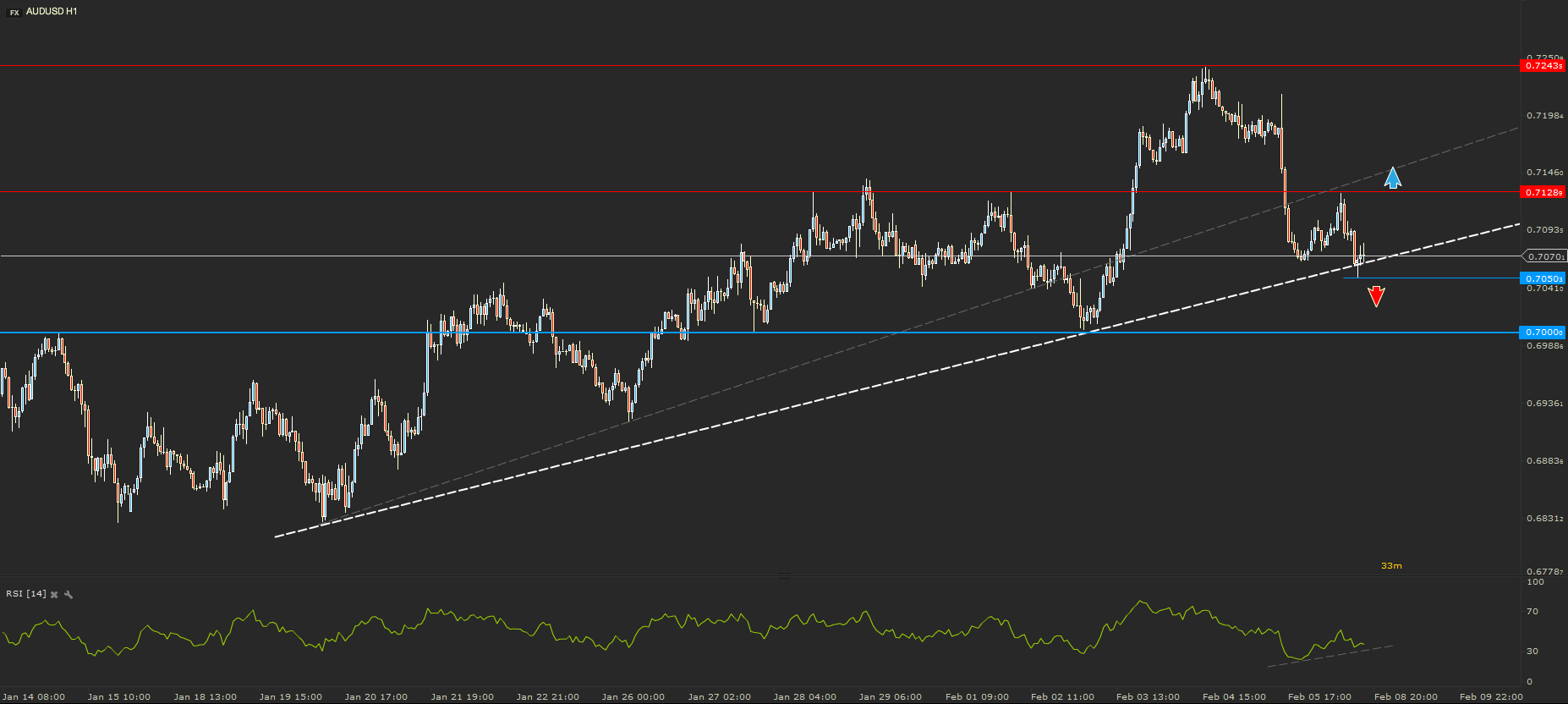

AUDUSD - Retesting the Trend Line

AUDUSD’s price has once more got to retest the main trend line of the current uptrend.The price dropped at the end of last week almost 200 pips, from 0.7240.Currently is trading on the second trend line, which now became the main one of the current trend.

A break below the local low set at 0.7050, would signal a continuation of the drop all the way to the key support of 0.7000. On the other hand a rally above the resistance set at 0.7128 would signal a rally towards the current highs, or maybe to a new higher high for the trend

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.