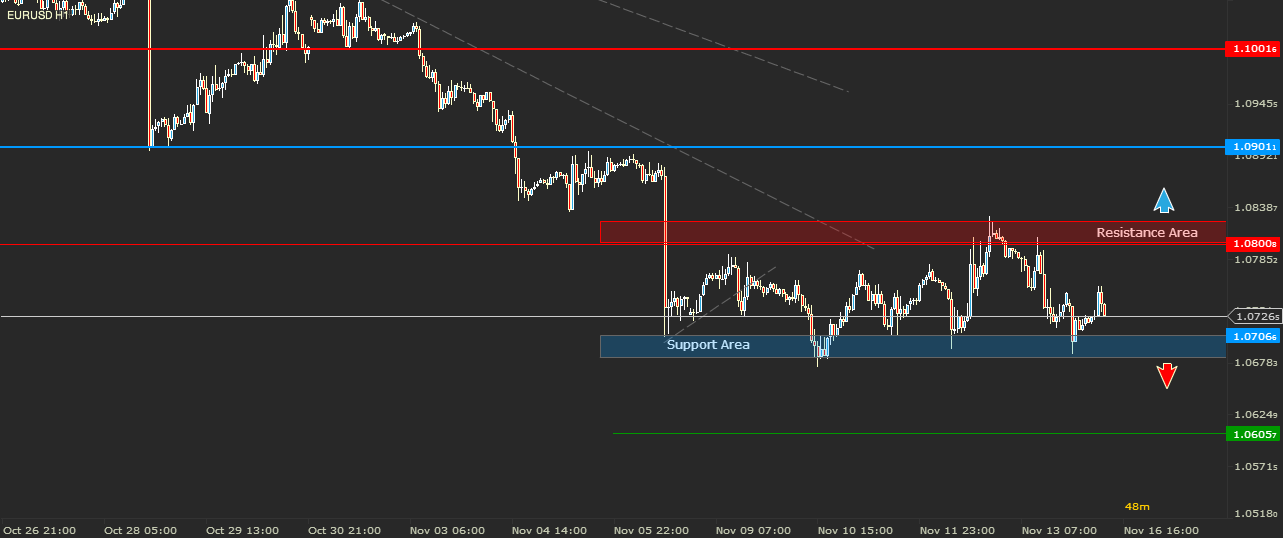

EURUSD - Sideways Move

In my last week’s article my favorite scenario was taking into consideration a break above 1.0800 and a rally towards 1.0900. Seems like bulls did not have enough power to do that. The price triggered the alternative scenario. The break below the lower line of the Flag triggered a fall towards 1.0700. After breaking this level the price fell 25 more pips, reaching a new low at 1.0675. Here it found a good support area from which bounced back towards 1.0800.

During the following days EURUSD traded sideways. The support area remained 1.0700 - 1.0675. While the resistance area is found between 1.0800 and 1.0825. Considering the fact that the main trend is still down, we can expect for the price to break below the support area and continue the fall towards 1.0600. This scenario could also be confirmed by a bigger CPI than expected release for the US economy.

AUDUSD - Respecting the Descending Channel

Two weeks ago the Aussie lost heavily against the US dollar. The price of AUDUSD dropped all the way to 0.7022, where it found a support. The Flag pattern on this instrument was also confirmed by a break below its lower line but its full target was nowhere near to be reached. The fall stopped after hitting a new low at 0.7015 and after that the price rallied to 0.7155.

For the last couple of trading days AUDUSD has been trading sideways under both the down channel trend line and the 0.7155 resistance. A local support is found at 0.7100. A break below this support line could signal the beginning of another impulse move which might aim for another lower low below 0.7000. On the other hand a break above 0.7155 would trigger my alternative scenario, a rally towards 0.7200 which is a very strong bullish signal.

USDJPY - Will we witness a new impulse?

The USDJPY found a resistance right at last Monday's high. As expected the price started to fall. It retested the 123.00 level and broke below after that. The fell continued all the way to the main trend line, where it found a support at 122.25. Bears did not have enough strength to get the price to the next round number level, 122.00.

This morning USDJPY rallied after the Japan GDP was released below expectations. The JPY lost more than 50 pips from the beginning from today’s opening. If a candle, on a 4 hour chart, will manage to close above the upper line of the Flag and especially above the 123.00 level, I will be expecting a rally of the greenback which could target the next round number level, from 124.00. On the other hand, a strong bearish signal I would consider to be a break below 122.00.

USDCAD - Strong Rising Wedge

From 16th of October USDCAD has been in an up trend. After finishing a corrective move on the 4th of November, the price started another rally, which for the moment stopped at 1.3346. This last impulse for the main trend was drawn as a Rising Wedge. The Wedge is accompanied also by a triangle drawn on the 14 periods RSI. This triangle shows also a strong divergence between the RSI and the price action.

Usually in these scenarios, the RSI tends to give a leading signal. If the lower line of the triangle will be broken on the downside, I will be expecting the USDCAD to break below the lower line of the Wedge and head towards 1.3200, found on the main trend line. On the other hand a break of the triangle on the upper side would invalidate the divergence and could signal that the USDCAD is not yet ready for another big corrective move. In this situation, a break above the current high would signal a rally towards 1.3400.

Risk Warning: Financial Derivative Instruments are complex instruments and leveraged products that involve a high level of risk which can result in high losses, including the risk of losing the entire capital invested by the Client. Such instruments might not be suitable for all Clients. The Client should not engage in transactions with such Financial Instruments unless he/she understands and accepts the risks involved by trading Financial Instruments, taking into account his/her investment objectives and level of experience. Forex Rally warns that the information published on this website shall not be considered as a recommendation to buy/sell/keep a certain financial instrument and that past performance of Financial Instruments is not a reliable indicator of future performances.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.