This Week's Highlights

Scots say No to independence

Markets say Yes to sterling strength

FX Market Overview

So the answer was 'Yes'. What a massive change. I was so shocked. Who knew the Royal and Ancient Golf club could be so...so....so...what is that word.... 'modern' as to allow women into the membership. It is only the 21st century after all. Gosh they are progressive.

Oh and in the other important vote, the Scots voted to stay in the United Kingdom by a surprisingly large margin. Well done to them for being so engaged (85% turnout) and for making the right decision. Now comes the horse trading that occurs after hasty promises are made and battles are won.

The effect of the latter vote has been to strengthen Sterling right across the board. It had started to happen as the polls closed in on a No vote yesterday but the push overnight has triggered a whole heap of orders and has refocused traders on other matters.

Those matters include the weakness of the Eurozone economies. The Euro has remained relatively strong during the last few weeks as traders concentrated on all things Scottish but with that excitement abating, we have to rethink the strength of the euro. Sterling pushed up to €1.2750 overnight and the US Dollar managed to push the euro down to $1.28. On the Sterling side, the break above €1.27 could have huge consequences. It is the first time the Pound has been above the long term trendline and if the Pound closes above that line this week, there is scope for a push to 1.3000 and maybe even 1.3250.

The Sterling - US Dollar rate has broken above the short term trend and that opens the door to a rally to 1.6650; the previous support line.

The lack of data today will give most traders time to reassess the future and others time to lick their wounds if they bet on a Yes vote. I think very few did but this is a market of contrarians so some must have.

We are moving offices over the weekend. Hopefully you received an email from me overnight confirming the new address details. Thankfully we have been able to retain our phone numbers so nothing changes there although there may be a slight drop in call quality at some stage this afternoon as we transition the service provider. By the way, I have never seen so much bubble wrap and the temptation to dive in for a popping frenzy is quite overwhelming. I shall resist. No really.... I will.

Have a great weekend everyone.

Currency - GBP/Australian Dollar

The bounce we have seen in the Sterling - Australian Dollar rate over the last 11 days is pretty dramatic. Sterling rallied from A$1.72 on 8th September to A$1.8460 overnight. That was the knee jerk reaction to the 'No' vote in the Scottish referendum but the fact that the Pound is now comprehensively above the downtrend which started in January makes it easier to see further gains. In the short term, don't be surprised if we see a correction back to the top of the trend line at A$1.8000 but, as long as the Pound stays above there, A$1.8580 beckons. The converse is also true though, a break back below A$1.80 puts us back into the downtrend that dominated this exchange rate up until 3 days ago.

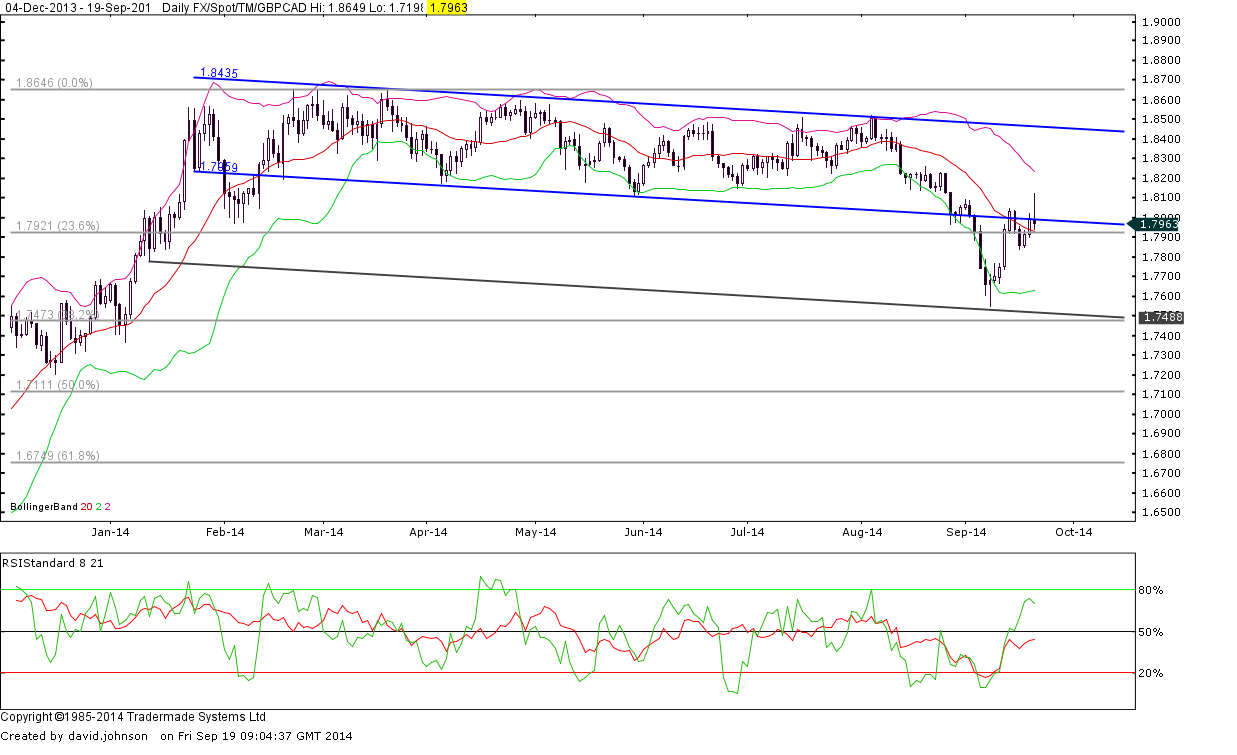

Currency - GBP/Canadian Dollar

The pattern of the year in this GBP-CAD exchange rate altered in late August when the Pound dropped below C$1.80. Other than the spike after the referendum results overnight, there has been no reason to expect a rebound. We are awaiting Canadian inflation this afternoon and that ought to be a tad weaker than last month. If so, Sterling might just maintain its position in positive territory against the Canadian Dollar. If we go into the weekend with the Pound above C$1.80, there is a chance but no guarantee that we will see another rally. So, in short, the current range is C$1.74 to C$1.80 and the potential upper range is C$1.80 to C$1.8425 if this pair stays above C$1.80 at the close of the day. Clear as mud I suspect.

Currency - GBP/Euro

This could be a momentous time for the Sterling – Euro exchange rate. Since the initial weakness in 2000, the Euro has been strengthening in a pattern topped by the red line on the chart above. That resistance line has been breached for the first time in the wake of the Scottish referendum and, at the time of writing, Sterling is still in that uncharted territory. If that line is broken, Sterling has the potential to rally significantly. €1.30 and €1.3250 are the initial targets but the trend has changed at that point and the longer term direction of this pair looks far from clear. For those needing to buy Euros, the targets are above but there should be some consideration of what might happen if the support for sterling slips. Risk management is a good policy at this point. For Euro sellers, protect against the possibility of not just €1.30 but much higher levels if the Eurozone's dramas continue to weigh on the Euro.

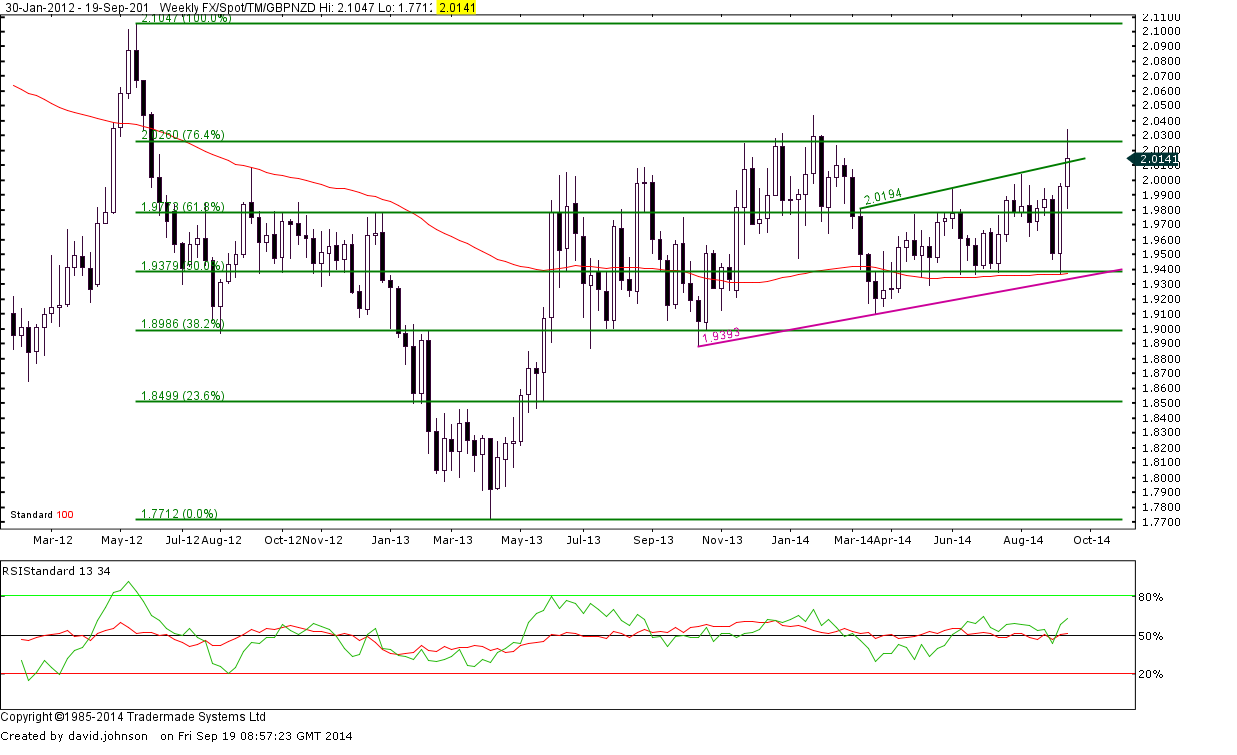

Currency - GBP/New Zealand Dollar

This exchange rate is a stubborn little sucker. Traders appear to have a real mental block when it comes to the NZ Dollar reaching anything above 2.00 to the Pound. We saw a spike through that level yesterday and, almost on cue, the Pound drops back to NZ$2.00 again just as it did in November, December and January. The trend us upward, the strength in the UK economy and the conclusion of the Scottish independence question are helping Sterling to strengthen and NZ data is rather erratic so there are reasons for the direction of travel in the GBP-NZD rate. Could Sterling slacken off? Yes it could. And is there a case for saying the Bank of England may delay their first interest rate hike? Yes there is. So nothing is certain but another test above NZ$2.00 is very likely in the days ahead.

Currency - GBP/US Dollar

As soon as it became clear that the Scots had rejected independence, the Pound rose against the US Dollar. The Spike to $1.6450 was short lived though and a slow decline ensued. Nevertheless, this pair remains above at the top of its recent downward trend and may yet make a push to $1.6633. If that doesn't happen, the current trading range is $1.6050 to $1.6450 but, without that break to higher levels, the trajectory is downward.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.