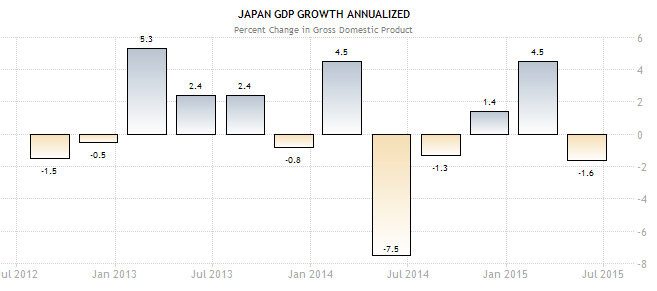

The case for further easing by the Bank of Japan is building. Japanese economy contracted in Q2. GDP fell by an annualized 1.6%. Japan’s export growth slowed in July, while private sector demand is low.

On Friday, Japan will release inflation and retail sales figures. According to the Reuters poll, core consumer prices in Japan have slipped in July, the first fall in more than 2 years. Other data may to provide some positive news: according to the forecasts, household spending probably rose in July as hot weather spurred sales of summer clothing and air conditioners. Retail sales are expected to show a 1.1% gain in July on-year, up for the four straight month, though the pace of growth has moderated in the past few months.

There are some expectations of the Bank of Japan’s additional monetary stimulus in October. These expectations will provide some support for the pair. However, the central bank is very unlikely to make any new steps before the Federal Reserve’s meeting on September 17.

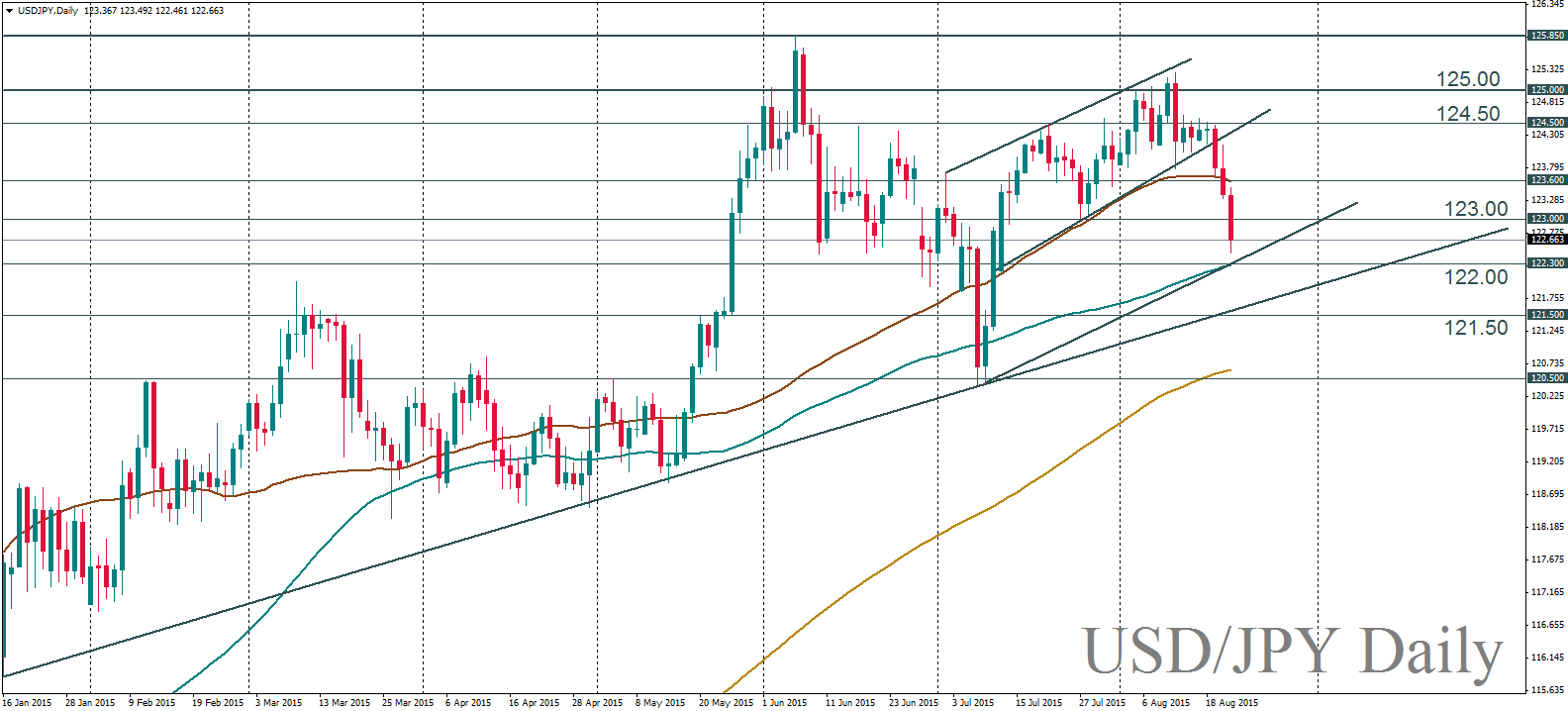

All in all, we expect USD/JPY to remain under pressure. Next support is in the 122.30/00 psychological area and at 121.50 (2015 uptrend line). On the upside resistance is at 123.60 and 124.50.

USD/JPY, daily

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.