Are you trading today? Read the Forex Trading Strategies for the Day.

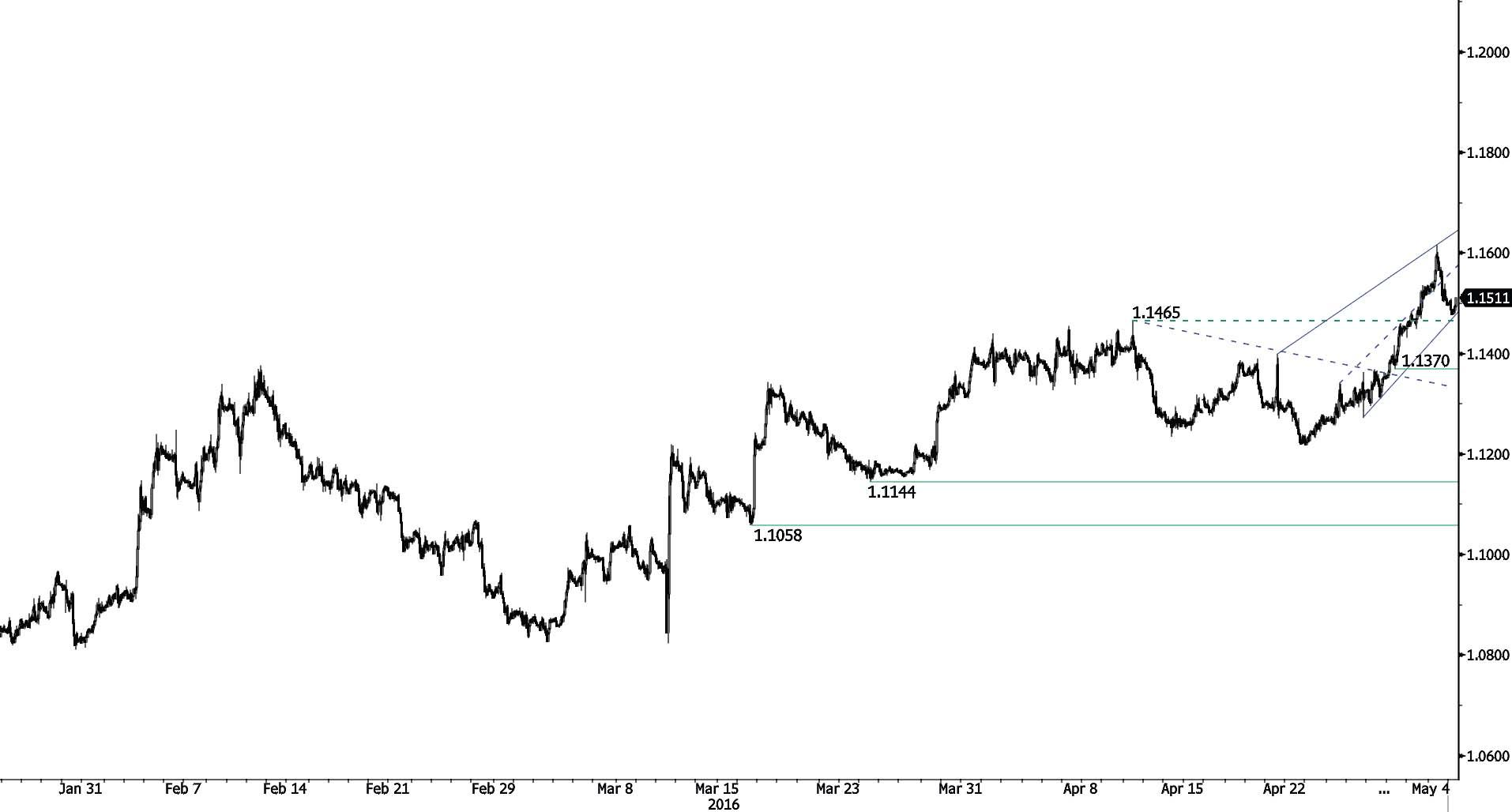

EUR/USD

Bearish retracement.

-

EUR/USD has moved lower after recent surge. Hourly resistance is located at 1.1616 (12/04/2016 high). Hourly support is located at 1.1370 (29/04/2016 low) and stronger support can be found at 1.1144 (24/03/2016 low). Expected to show further increase within the uptrend channel.

-

In the longer term, the technical structure favours a bearish bias as long as resistance at 1.1746 ( holds. Key resistance is located at 1.1640 (11/11/2005 low). The current technical appreciation implies a gradual increase.

GBP/USD

Monitoring hourly support at 1.4475.

-

GBP/USD has lost two figures yesterday and is now approaching support at 1.4475 (27/04/2016 low). Hourly resistance is given at 1.4770 (03/05/2016 high). Stronger resistance is given at 1.4969 (27/12/2016 high). Expected to show further consolidation before entering into another upside move.

-

The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY

Bouncing back.

-

USD/JPY has moved sharply higher. Hourly support lies at 105.55 (03/05/2016 low). Hourly resistance can be found at 107.42 (29/04/2016 high), stronger resistance can be found at 111.88 (28/04/2016 high). Expected to show further weakening.

-

We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

USD/CHF

Lack of follow-through.

-

USD/CHF is clearly oriented downwards on the medium-term and has broken multiple supports. Yet, the pair is bouncing back today towards hourly resistance at 0.9605 (02/05/2016 high). Hourly support is given at 09444 (03/05/2016 low). Expected to show further further weakening.

-

In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.

USD/CAD

Bullish retracement.

-

USD/CAD's bearish momentum is still on despite ongoing bullish retracement. Hour support is given at 1.2462 (03/05/2016 low) while hourly resistance is given at 1.2749 (intraday high). The volatility is increasing again. Expected to show continued weakness..

-

In the longer term, the pair is now trading well below the 200-day moving average. Strong resistance is given at 1.4948 (21/03/2003 high). Stronger support can be found at 1.1731 (06/01/2015 low).

AUD/USD

Bearish breakout.

-

AUD/USD has broken support implied by the lower bound of the uptrend channel. Next support is given at 0.7415 (16/03/2016 low). Strong resistance area can be found at 0.7835 (24/04/2016 high). Medium-term buying pressures remains important as long as the pair remains above support implied by the uptrend channel and 0.7415. Expected to show further decline in the short-term.

-

In the long-term, we are waiting for further signs that the current downtrend is ending. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair is now above the 200-dma which confirms our view that buying pressures are increasing.

EUR/CHF

Fading momentum around 1.1000.

-

EUR/CHF is trading around 1.1000 which is a strong resistance area. Selling pressures seem important at this level. Hourly support can be found at 1.0863 (23/03/2016 low) while hourly resistance is given at 1.1061 (17/02/2016 high). Expected to show continued monitoring of strong resistance area around 1.1000.

-

In the longer term, the technical structure remains positive. Resistance can be found at 1.1200 (04/02/2015 high). Yet,the ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

EUR/JPY

Short-term bullish.

-

EUR/JPY is consolidating after recent strong moves. Hourly support can be found at 121.60 (29/04/2016 low) and hourly resistance is given at 123.52 (intraday high). Expected to show continued weakness in the short-term.

-

In the longer term, the technical structure validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Strong support is given at 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Keep on riding higher.

-

EUR/GBP keeps on bouncing back from lower bound of the uptrend channel. For the time being, medium-term upside momentum prevails. Hourly resistance can be found at 0.7988 (18/04/2016 high). Hourly support can be found at 0.7822 (02/05/2016 low). Expected to reach resistance area at 0.8000 within the next few weeks.

-

In the long-term, the pair is currently recovering from recent lows in 2015. The technical structure suggests a growing upside momentum. The pair is trading well above its 200 DMA. Strong resistance can be found at 0.8815 (25/02/2013 high).

GOLD (in USD)

Consolidating.

-

Gold is now consolidating after exiting the short-term uptrend channel. Resistance is given at 1303 (02/05/2016 high). Support is given at 1279 (intraday low). Expected to show further increase.

-

In the long-term, the technical structure suggests that there is a growing upside momentum. A break of 1392 (17/03/2014) is necessary ton confirm it, A major support can be found at 1045 (05/02/2010 low).

SILVER (in USD)

Further bearish consoldiation.

-

Silver's momentum is clearly positive despite ongoing retracement. Daily resistance is given at 18.00 (02/05/2015 high) while hourly support can be found at 17.24 (04/05/2016 low). Expected to see further monitoring of the resistance at 18.00.

-

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Strong support can be found at 11.75 (20/04/2009). A key resistance stands at 18.89 (16/09/2014 high).

Crude Oil (in USD)

Ready to move again higher.

-

Crude's bearish retracement seems to fade. The pair is still within a medium-term uptrend channel which is clearly bullish. Hourly support can be found at 42.50 (26/04/2016 low) while resistance lies at 46.78 (29/04/2016 low). The technical structure suggests a further increase of the commodity.

-

In the long-term, crude oil is on a sharp decline but is now showing some signs of recovery. Strong support lies at 24.82 (13/11/2002). Crude oil is holding above its 200-Day Moving Average. Crude oil should recover during this year.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.