Global Markets

WTI Oil has tumbled to another fresh 6year low and visited prices not seen since 2009 at $36.61. Concerns over factors such as an aggressive oversupply in the markets and a reduced demand for oil are continuous, and are affecting any remaining investor attraction towards oil. The decision from OPEC late last week to leave production levels unchanged has left a damaging mark and with investor sentiment continuously weak, the gates have been left wide open for WTI Oil to trade to extremely low levels, the likes of which have not been seen since the beginning of 2009 when prices reached $35.

With OPEC willing to leave production unchanged once again in the hope of regaining market share in the longerterm, any optimism over an immediate production cut has rapidly diminished and this is allowing investors to squeeze prices as low as possible. The commodity remains fundamentally bearish and the dangerous combination of an excessive oversupply and sluggish demand in the markets has sabotaged any opportunity of a recovery in value. Prices are vulnerable to dropping further, which will consequently add pressure to those currencies that belong to economies which are reliant on oil exports.

From a technical standpoint, WTI remains heavily bearish on the daily timeframe and the breakdown below the $39 support has encouraged sellers to send prices towards $36.50. Prices are currently trading below the daily 20 SMA, while the MACD has also crossed to the downside.

Sentiment towards the Sterling received a heavy blow during trading on Tuesday following the unexpected decline in UK manufacturing output for October, which renewed concerns over a potential slowdown in UK economic momentum. The steep decline in UK manufacturing output has signaled a potential weak start for the manufacturing industry as the final quarter of the year continues, and also adds to the variety of reasons that have provided the Bank of England (BoE) a compelling case to repeatedly push back raising UK interest rates.

Investor attraction towards the Sterling continues to be limited by the BoE’s clear reluctance and hesitance to raise UK interest rates and with UK manufacturing output on a potential route to declining further, sellers may be encouraged to attack the Sterling once again.

The GBPUSD experienced a sharp decline with prices cutting through the 1.50 support as investors digested the fact that a decline in UK manufacturing output could be viewed negatively be the BoE. The pair was already bearish and technically vulnerable to a decline, but the bears have been installed with additional momentum and this should encourage a further decline back towards 1.49. Recurrent fears about the UK economy have threatened the Sterling, and with expectations still strong that the Fed may raise US interest rate next week, the GBPUSD remains open to further losses.

Following further weak trade data from China to begin the week, there has been some positive inflation data from China in the early hours of this morning after inflation picked up by 1.5% in November.

While there is no disputing that the China economy is slowing down, this release at least provides optimism that the multiple measures taken by both the PBoC and Beijing to uplift the economy have had some sort of positive impact on inflation.

The positive data from China has currently allowed most Asian markets to venture into green territory, but whether this also trickles down to European markets depends on how investors react to the price of oil slumping to further lows. Focusing on today, there are no major economic data releases in the Europe and United States trading sessions, which means that investor sentiment might be directed on how the markets digest the recent data from China or the oil markets falling to further milestone lows.

EURAUD

The EURAUD has become technically bullish on the daily timeframe. Prices have breached above the daily 20 and 200 SMA and the MACD has crossed to the upside. Previous resistance at 1.500 may become a dynamic support which should encourage buyers to send prices towards 1.5250.

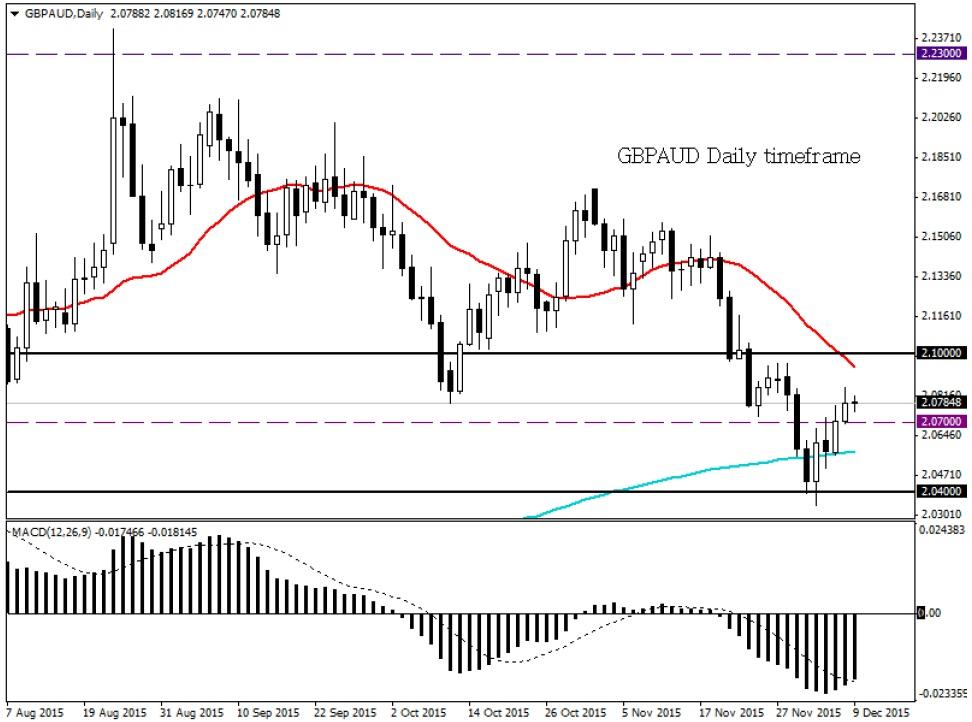

GBPAUD

The GBPAUD remains bearish as long as prices can keep below the 2.100 resistance. A breakdown back below 2.0700 may encourage sellers to send prices back down towards the next relevant support at 2.0400. Prices are trading below the daily 20 SMA and the MACD trades to the downside.

AUDCAD

This pair is technically bullish on the daily timeframe as there have been consistent higher highs and higher lows. Prices may continue to appreciate to the 0.988 level.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.