The increased confidence investors acquired from the FOMC minutes regarding the high possibility of a US rate rise in December has led to investors unwinding their Dollar positions. While the unwinding of the USD may continue to encourage others to loosen USD positions, the fundamental case for USD strength remains supported, as long as the Federal Reserve raises US interest rates next month.

With the Fed moving closer to raise US rates in the near future, this short term USD weakness may provide an opportunity for devoted bullish investors to reinvest at a reduced price, especially if other central banks such as the Bank of Japan (BoJ) and European Central Bank (ECB) ease monetary policy further. The noticeable depreciation of the USD across the board has offered a false lifeline to assets that were previously being oppressed by Dollar dominance, such as an unexpected Euro that has risen to 1.0762 against the USD.

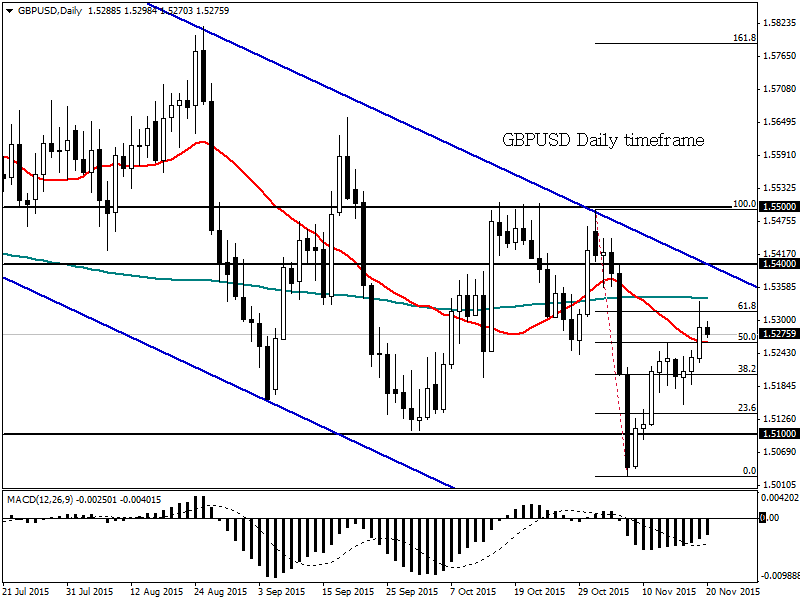

The GBPUSD has appreciated to weekly highs of 1.5335, which has been highly motivated by the unwinding of USD positions and has little to do with improved sentiment towards the Sterling. Recurrent fears over a potential slowdown in economic momentum in the UK economy complimented with the Bank of England’s hesitance towards committing itself to raising UK interest rates will encourage some profit-taking on the GBPUSD. With UK interest rate rise expectations pushed deep into 2016, this relief rally observed in the GBPUSD may offer an opportunity for sellers to send prices back lower.

Technically speaking the GBPUSD remains bearish on the daily timeframe and this rebound may extend to the 61.8% Fibonacci retracement level around 1.53 before sellers bring prices back down towards the relevant 1.5100 support.

Commodity spotlight – WTI

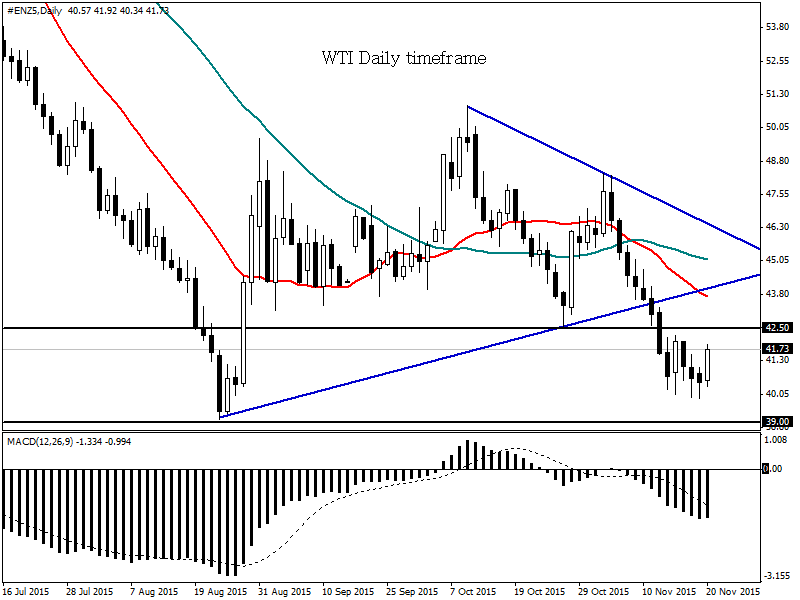

The combination of the persistent and clear signs of there being an aggressive oversupply in the markets and sluggish demand for the commodity due to global concerns have consistently punished the value of WTI oil sending it two month lows below $40. Investor sentiment towards WTI is weak and this relief rally may offer an opportunity for bearish investors to send prices back below $40.

Technically WTI is bearish on the daily timeframe the previous support at $42.50 may act as a dynamic resistance which should invite and opportunity for sellers to send price back down towards $39.00.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.