EURUSD SO FAR TODAY:

After two days of rather volatile intraday sessions but with inconclusive moves we got a more decisive and possibly more significant move up for EURUSD during yesterday’s session. Whether or not this represents a better footing for the pair and an outlook for June at a higher level than the “spring range” seen over the last 3 months we shall discuss in the Insider this weekend. Ahead of that we have a final session this week and this month that is packed with influential data releases.

First out is German retail sales which both for the month of April and for the last 12 months are expected to be up on March.

Italian unemployment figures are expected to have been higher in April than March but rather marginally.

More critical to the expectations for the ECB meeting next week are CPI data for the Euro-zone which should come out a bit higher for May than those seen in April. That goes for both the month and the last 12 months.

Released at the same time as CPI data are the unemployment figures for April for the Euro-zone. They are expected to show increased unemployment and therefore could neutralize the positive EURUSD effect that could come from the CPI data.

The US session holds the release of some of the GDP components we saw the first revision for 1st quarter yesterday but today for the month of April. While the annualized GDP for 1st quarter showed a “healthy” 2.4% growth rate, more critical the 2nd quarter will be. As such, the figures for April are interesting. PCE and Core PCE are expected a touch down for April compared to March, the same goes for personal income and personal spending. IF confirmed, that could add a bit more to USD sales at the end of this week.

Critical for the finish this week might also be Michigan Consumer Sentiment Index, which has shown some unexpected strength of lately and therefore will be more in focus today.

EURUSD EVENT RISK TO PAY ATTENTION TO:

(the list is not complete but limited to those scheduled data/news releases that historically have influenced EURUSD in terms of volatility and/or trend). The first figure is the consensus among forecast and the second figure is the last release:

06:00 Retail Sales MoM - Germany 0.2% -0.3%

06:00 Retail Sales YoY - Germany 0.0% -2.8%

08:00 Unemployment Rate - Italy 11.6% 11.5%

09:00 Unemployment Rate - Euro-zone 12.2% 12.1%

09:00 CPI YoY - Euro-zone 1.4% 1.2%

09:00 Core CPI YoY - Euro-zone 1.1% 1.0%

12:30 Personal Spending - US 0.1% 0.2%

12:30 Personal Income - US 0.1% 0.2%

12:20 Core PCE YoY - US 1.0% 1.1%

13:45 Chicago PMI - US 50.0 49.0

13:55 Michigan Consumer Sentiment - US 83.7 76.4

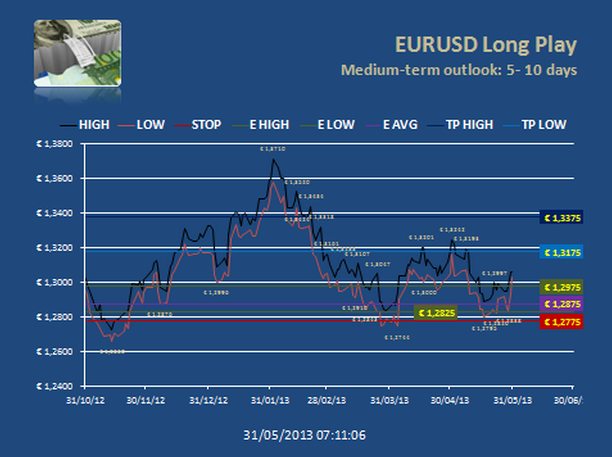

EURUSD LEVELS TO PAY ATTENTION TO:

The levels are set as: (*) not particularly strong level and one that could be broken even on a first attempt, (**) a more solid level which might hold on a couple of attempts to go through, (***) a level assumed to be solid and likely only to be broken through from significant news, data releases or strong change in risk sentiment

- Support by 1.30-1.2995 (**)

- Support by 1.2980-65 in layers (**)

- Resistance by 1.3060-80 in layers (**)

- Resistance by 1.3115-45 in layers (***)

OUTLOOK FOR THE REST OF THE DAY:

It has been a volatile week for EURUSD but also one where the pair has found a better footing for reasons of a bit lower general USD strength, a mixed bag of US releases but likely more from a “two split” market being highlighted.

Shorts as expressed though recent COT statistics and the more tiny data we have for cash positions are predominantly made up from those with a short-term outlook and rather technically argued positions.

Longs – which are predominantly cash positions with a long-term outlook – have more than absorbed the selling conducted by bears and offered none of those EURUSD back to the market when shorts started closing out their positions.

It became a race among bears to close their shorts with stops adding to the length of the spikes.

As of this morning we should have more of balanced positions between those with a short-term outlook while for the long-term bulls we are still far short of their objectives. Nor are they stressed on time.

Ahead of today’s data release I would think EURUSD would be pretty capped and then the releases might add a bit of choppy conditions throughout both the European and US sessions. I think it is too early to conclude what the net effect today will be before we have seen all the releases through.

Should they be EURUSD supportive I would still think the week should be capped by 1.3130 as this likely contain some rather strong offerings and thereby resistance.

Should event risks today be EURUSD negative, then I think support levels will be found in pretty tight intervals from 1.2990 and below. The downside below that level looks to be rather limited.

Due to travelling arrangements I will just be following this morning’s session and there will regrettably be no postings in the afternoon.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.