Crude

The oil price was only little changed yesterday and the front-month contract on Brent thus again settled above 66 USD/bbl. Regarding news, the market more or less ignores news that Saudi Arabia may call a truce in specific areas in Yemen as well as reports about a possible closure of a port in Libya.

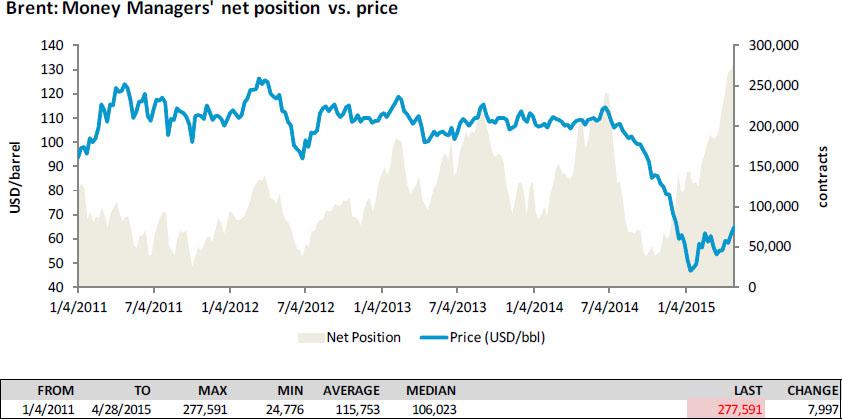

Clearly, market focuses mainly on the situation in the US, namely on the evolution of crude oil inventories. Though the official data is to be released tomorrow, the API will release its own report later today; expectations are set for a relatively modest (in comparison with previous months) increase in crude oil inventories. Figures from the latest ICE Commitment of Traders report suggest that - in spite of a record-high net speculative position in Brent futures (see the chart below) – room may still exist for further increase in the oil price should the inventories growth disappoint as number of traders betting on a decline in prices remain quite high (it, in fact, did not change last week).

Metals

Today in early trading, the copper price falls from a 4-1/2 month high hit on Friday, probably in a response to the weaker than expected data from China. Yesterday, the HSBC China manufacturing PMI was revised lower from a preliminary reading of 49.2 to 48.9, signalling an ongoing loss of momentum in the sector (recall that the LME was closed due to a holiday yesterday so that the reaction is delayed).

On the other hand, news about lower copper production of mining division of Glencore could at least partially offset negative data from China.

Chart of the day:

Net speculative positions in Brent futures hit yet-another all-time high last week.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.