Crude

Despite the fact that the dovish members of the OPEC (Saudi Arabia, UAE, Kuwait) signalled in advance they would not be willing to cut oil production to prop-up prices, the final decision of the cartel to leave production quota unchanged at 30 million barrels per day took the market by surprise, judging at least from its reaction.

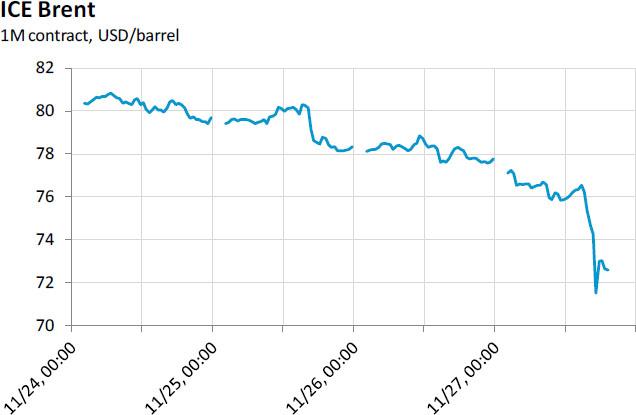

Oil price plunged by 6.65 % yesterday, i.e. by the most in more than 3 years, and price of the front-month contract on Brent (ICE) thus dipped to a new four-year low (71.12 USD/bbl). Maybe even more importantly, the sell-off also continued in longer-dated contracts (which should better reflect mood among oil producers) and the forward curve thus fell significantly across all maturities. For example, price of December 2017 contract on Brent (ICE) fell by 3.5 % and also volume of trades was significantly above average (in comparison with the most recent months). This in our view clearly reflects producers’ worries about future market balance (and oil prices).

As we already pointed out, yesterday’s reaction suggests that significant part of market was probably taken by surprise by OPEC’s decision. From this point of view, we think that high volatility is likely to persist in weeks to come. Moreover, one canot exclude further price declines, maybe even below a 70 USD/bbl level (which seems to be a natural target now).

Base Metals

Today in early trading, the copper price falls below 6500 USD/t and the three-month contract is therefore set to post price decline in the fifth consecutive session. All in all, copper will likely post the largest weekly loss since March.

Apart from an overall bearish mood in commodity markets related to plunge in oil prices, news that a strike at the World’s sixth largest copper mine in Peru ends is dragging prices down.

Chart of the day:

The oil price plunged by more than 6% after the OPEC decided not to cut its production quota yesterday.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD: A tough barrier remains around 0.6800

AUD/USD failed to maintain the earlier surpass of the 0.6800 barrier, eventually succumbing to the late rebound in the Greenback following the Fed’s decision to lower its interest rates by50 bps.

EUR/USD still targets the 2024 peaks around 1.1200

EUR/USD added to Tuesday’s losses after the post-FOMC rebound in the US Dollar prompted the pair to give away earlier gains to three-week highs in the 1.1185-1.1190 band.

Gold surrenders gains and drops to weekly lows near $2,550

Gold prices reverses the initial uptick to record highs around the $$2,600 per ounce troy, coming under renewed downside pressure and revisiting the $2,550 zone amidst the late recovery in the US Dollar.

Australian Unemployment Rate expected to hold steady at 4.2% in August

The Australian Bureau of Statistics will release the monthly employment report at 1:30 GMT on Thursday. The country is expected to have added 25K new positions in August, while the Unemployment Rate is foreseen to remain steady at 4.2%.

Ethereum could rally to $2,817 following Fed's 50 bps rate cut

Ethereum (ETH) is trading above $2,330 on Wednesday as the market is recovering following the Federal Reserve's (Fed) decision to cut interest rates by 50 basis points. Meanwhile, Ethereum exchange-traded funds (ETF) recorded $15.1 million in outflows.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.