Interested in more FX key technical levels? Take a look at Swissquote's daily technical outlook.

EUR/USD

Recovery from the 1.1234 low seen correcting the drop from 1.1465 high. Above the 1.1300 level see resistance now at the 1.1327/46 area and regaining this needed to fade downside pressure and see return to the 1.1400 level. lower high sought for setback to the 1.1270 support then the 1.1234/20 area. [PL

EUR/CHF

Clear break above the 1.0900 level see stronger recovery underway though the upside still limited. Nearby see scope to target 1.0933 then 1.0954 high. Below the 1.0900 level see support at 1.0860/43 lows and break needed to weaken and expose the 1.0821/10 lows to retest. [PL]

USD/CHF

Pressure stays on the upside and clearing the .9688 high will trigger further strength from the .9499 low. Higher will see retest of .9763/88 then the 200-day MA at .9830. Would take setback below the .9638 and .9594 support to weaken and return focus to the downside. [PL]

GBP/USD

Intraday trade a touch weaker but prices are still within the perimeters of a wider triangular consolidation and break of support line of triangle at 1.4057 to trigger a bearish call. On the upside, lift above 1.4244 hurdle to expose gain to 1.4280 then 1.4348. [W.T]

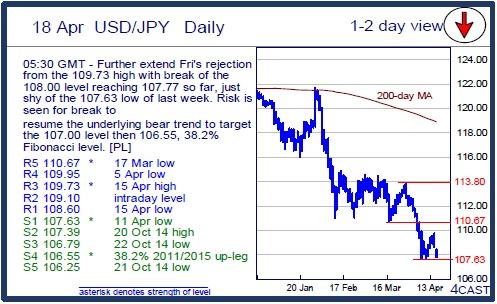

USD/JPY

Further extend Fri's rejection from the 109.73 high with break of the 108.00 level reaching 107.77 so far, just shy of the 107.63 low of last week. Risk is seen for break to resume the underlying bear trend to target the 107.00 level then 106.55, 38.2% Fibonacci level. [PL]

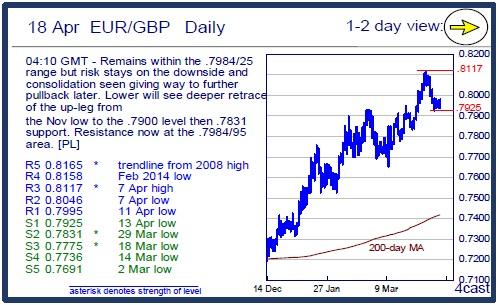

EUR/GBP

Remains within the .7984/25 range but risk stays on the downside and consolidation seen giving way to further pullback later. Lower will see deeper retrace of the up-leg from the Nov low to the .7900 level then .7831 support. Resistance now at the .7984/95 area. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.