EUR/USD Daily

View unchanged from this morning with break of 1.0984 hurdle last session triggered extended upmove to 1.0993 high and prices now lower in consolidation. Current setback need to stay above 1.0946 support to keep upside momentum in play. [W.T]

USD/CHF Daily

Daily technical tools seen at neutral ground and extending consolidation seen last few sessions and slip of 0.9853 support will expose setback towards the strong support at 0.9786. Resistance seen at 0.9917 and above latter to expose gain to 0.9946 then 0.9976. [W.T]

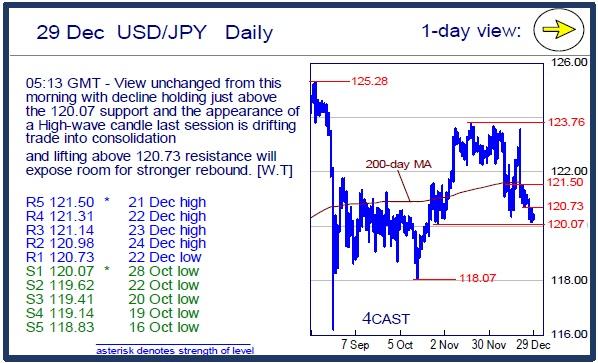

USD/JPY Daily

View unchanged from this morning with decline holding just above the 120.07 support and the appearance of a High-wave candle last session is drifting trade into consolidation and lifting above 120.73 resistance will expose room for stronger rebound. [W.T]

EUR/CHF Daily

Strong rally last session with the positive cut-up seen on daily MACD are turning threat towards the 1.0859 congestion high and clearance above latter will help garner stronger momentum to 1.0877 then 1.0916. Good support is now seen at 1.0800. [W.T]

GBP/USD Daily

Intraday trade turned into consolidation but the strong rejection from yesterday's high of 1.4970 in the appearance of a long upper shadow is fading further rebound and slip of 1.4863 support will expose deeper setback towards strong support at 1.4806. [W.T]

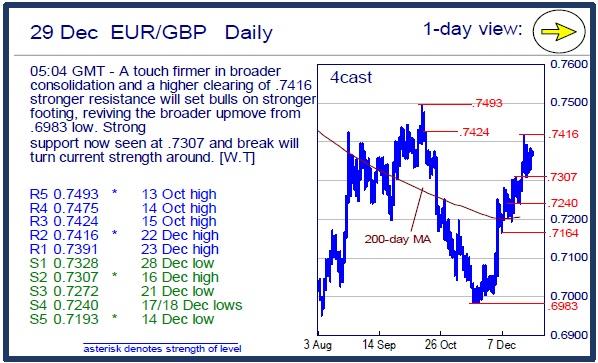

EUR/GBP Daily

A touch firmer in broader consolidation and a higher clearing of .7416 stronger resistance will set bulls on stronger footing, reviving the broader upmove from .6983 low. Strong support now seen at .7307 and break will turn current strength around. [W.T]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.