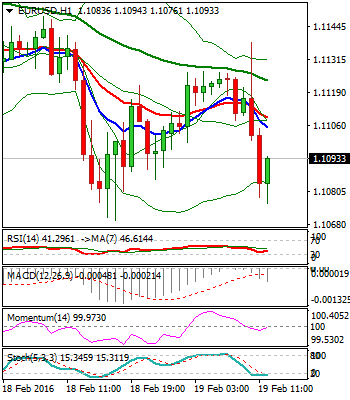

The Euro remains under pressure and returns close to yesterday’s low at 1.1070. Rising daily 20SMA, which contained yesterday’s weakness, still acts as support at 1.1176.

Bounce off 1.1170 was capped by the base of hourly Ichimoku cloud, spanned between 1.1136 and 1.1148, which marked initial resistance and was expected to limit upside attempts.

Near-term studies remain bearish and favor further weakness, with break below 20SMA, needed to expose more significant 1.1055/41 supports, 200SMA / weekly Ichimoku cloud top, break of which to confirm reversal.

The pair is on track for bearish weekly close, which will mark the first negative week after three-week rally and keep the downside pressured, together with yesterday’s close below 1.1120, Fibonacci 38.2% of 1.0709/1.1374 rally.

Alternative scenario requires return above hourly cloud to sideline immediate downside threats, while close above psychological 1.1200 barrier, reinforced by daily 10SMA, will revive bulls.

Res: 1.1138; 1.1148; 1.1185; 1.1200

Sup: 1.1070; 1.1055; 1.1041; 1.1010

GBPUSD

Cable is at the back foot, following yesterday’s upside rejection just under 1.44 barrier, capped by daily 20SMA / hourly Ichimoku cloud top and subsequent easing that closed below cracked daily 30SMA at 1.4370, which remains strong resistance.

Bearish daily studies keep focus at the downside, with upticks seen as selling opportunities and to be ideally capped under 30SMA.

The pair is also on track for strong weekly bearish close, which maintains downside pressure.

Extended near-term consolidation is expected to precede fresh bears, with attempts through initial supports at 1.4254/33, lows of past two days, to open way for full retracement of 1.4078/1.4665 recovery rally.

Only close above 1.4405, daily 10SMA would sideline near-term bears.

Res: 1.4370; 1.4391; 1.4405; 1.4449

Sup: 1.4254; 1.4233; 1.4200; 1.4147

USDJPY

The pair trades in narrow consolidation above fresh low at 112.70, posted today, on extension of three-day descend from 114.85, correction high of 16 Feb, where lower top is forming.

Descend from 114.85 remains capped by falling daily 10SMA, which currently lies at 113.85.

Overall structure remains firmly bearish and favors further retracement of corrective 110.97/114.85 upleg, with significant support at 112.45, Fibonacci 61.8% retracement and close below here to confirm bearish resumption.

Weekly candle is red, with long upper shadow, which confirms strong bearish pressure, built on past two weeks steep descend.

Upside breakpoint lies at 115 zone, Fibonacci 38.2% of 121.67/110.97 descend, where recovery attempts off 110.97 low were capped.

Res: 113.20; 113.52; 113.85; 114.35

Sup :112.45; 112.00; 111.64; 110.97

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.