EURUSD

The Euro shows no significant changes in the near-term, trading within initial 1.0800/1.0980 range, as yesterday’s rally was rejected just under range top.

The pair remains within daily Ichimoku cloud, spanned between 1.0783 and 1.1006 and break out of the cloud is needed to signal fresh direction.

Neutral tone dominates on daily studies, while technicals on lower timeframes are mixed that supports scenario of prolonged sideways trading.

Lows of yesterday and 19 Jan at 1.0867/58, mark initial supports, ahead of broken bear-trendline, former bear-channel resistance and daily 55SMA at 1.0836/20.

On the upside, congestion tops at 1.0974/83, are initial resistances, guarding daily Ichimoku cloud top.

ECB meeting is awaited as key release for the Euro today, with ECB expected to keep rates on hold.

Res: 1.0920; 1.0967; 1.0983; 1.1006

Sup: 1.0867; 1.0858; 1.0836; 1.0820

GBPUSD

Cable trades within narrow consolidation above fresh lows at 1.4127/23. Underlying strong bear-trend remains intact and suggests further downside, after completion of near-term consolidation phase.

Base of descending hourly cloud, spanned between 1.4193 and 1.4235, keeps near-term range capped for now.

Extension above hourly cloud top at 1.4235 is needed to sideline immediate downside risk and allow for stronger bounce, which will be seen as positioning for fresh downmove.

Next strong barrier lies at 1.4332, falling daily 10SMA, which marks upside pivot.

The wave C that commenced from 1.4943, 24 Dec lower top, remains intact and eyes 1.4057, its 200% expansion, ahead of psychological 1.4000 support, in fresh bearish extension.

Res: 1.4193; 1.4235; 1.4256; 1.4332

Sup: 1.4151; 1.4123; 1.4057; 1.4000

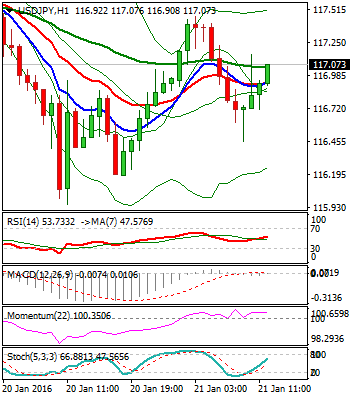

USDJPY

The pair returned to three-day congestion, following yesterday’s short-lived probe below 116 handle. Spike lower hit new low at 115.95 and reversed quickly, showing hesitation at very strong 116.13/115.56 support zone, which was briefly violated yesterday.

Overall structure remains bearish and looks for renewed attempts at critical 115.65 support and floor of multi-month congestion, break of which is needed to signal stronger correction of 3 ½ year uptrend from 77 zone.

Near-term price action shows indecision, despite 100-pips span of today’s trading, as action was so far shaped in long-legged Doji and capped by falling daily 10SMA at 117.45.

Prolonged consolidation is seen as likely scenario, before fresh attempts lower. Extended upticks cannot be ruled out, with congestion top at 118.30, also 50% of 120.64/115.95 downleg, expected to cap.

Only sustained break here and falling daily 20SMA, currently at 118.58, would sideline immediate downside risk and signal basing attempt for stronger correction.

Res: 117.45; 118.00; 118.30; 118.58

Sup: 116.45; 116.13; 115.95; 115.56

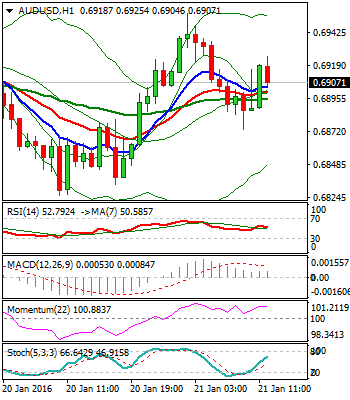

AUDUSD

The pair retested pivotal 0.6955 resistance, high of 19 Jan, where two-day recovery was capped. Yesterday’s trading that retested 0.6825 low, was shaped in Doji with very long tail, signaling that buying interest exists, but the pair so far lacks momentum for final break above 0.6955 barrier, which is required to resume recovery.

Overall picture is firmly bearish and sees current moves as correction, with recovery attempts being indicated by reversed slow Stochastic, which shows more room at the upside.

In case of violation of 0.6955 pivot, psychological 0.7000 barrier, also near Fibonacci 38.2% of 0.7325/0.6825, is seen as next target, followed by 0.7067 breakpoint, falling daily 20SMA.

Otherwise, expect prolonged consolidation, before fresh attack at 0.6825, near-term base and resumption of larger downtrend , on sustained break lower.

Res: 0.6955; 0.7000; 0.7067; 0.7113

Sup: 0.6873; 0.6825; 0.6800; 0.6750

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.