The Euro trades in a corrective mode off fresh low at 1.3789, where strong support, 50% retracement of 1.3671/1.3904 / broken bear-trendline off 1.3965 peak, contained reversal off 1.3965 for now. Consolidative action broke above initial 1.3832, yesterday’s recovery rally peak and Fibonacci 38.2% retracement of 1.3904/1.3789 pullback, to retrace 50% so far, on extension to 1.3850. Improving hourly studies support further advance towards pivotal 1.3860, weekly highs and Fibonacci 61.8% retracement of 1.3904/1.3789, above which to confirm higher low formation and look for retest of key 1.3904 peak, after filling Monday’s gap. Bullish daily studies support scenario. Session low at 1.3805, also higher low of ascend from 1.3789, should keep the downside protected. Alternative scenario requires loss of 1.3805 and more significant 1.3789 support to bring bears back in play for extension of the downmove from 1.3904, 11 Apr peak.

Res: 1.3860; 1.3879; 1.3904; 1.3941

Sup: 1.3832; 1.3805; 1.3789; 1.3760

GBPUSD

Cable completed near-term corrective phase off 1.6819, as the pullback was generally contained at 1.6700 zone, broken bear-channel resistance line, excluding yesterday’s short-lived spike lower to 1.6657. Near-term bulls are fully in play for eventual break above 1.6819/21 peak, clearance of which to signal an end of short-term congestion and resume larger bull-trend towards 1.6900, round-figure, above which to expose interim barrier at 1.6957, Fibonacci 138.2% projection, en-route to psychological 1.7000 resistance. Larger picture bullish structure is supportive. Corrective actions should be ideally contained above 1.6750, previous congestion tops.

Res: 1.6821; 1.6850; 1.6900; 1.6957

Sup: 1.6790; 1.6750; 1.6718; 1.6700

USDJPY

The pair is gaining traction after break above initial 102.00/15 barriers improves near-term structure and signals basing attempt. Break above the next hurdle at 102.38, Fibonacci 38.2% retracement of 104.11/101.31 is requires to sideline downside risk and open way for further recovery towards 102.71, 50% retracement and psychological 103 barrier, also Fibonacci 61.8% retracement and reinforced by double MA’s bear-cross. Weak daily studies see corrective action limited and only break above 103 barrier is required to bring bulls fully in play.

Res: 102.38; 102.7; 103.00; 103.29

Sup: 102.00; 101.80; 101.50; 101.31

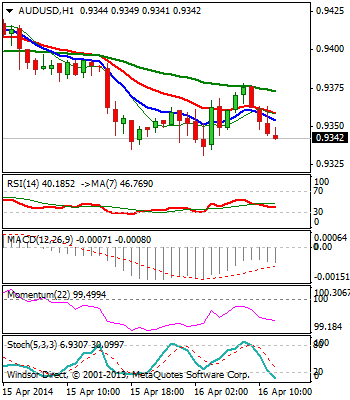

AUDUSD

The pair came under pressure after extension below near-term consolidation floor and 38.2% retracement of 0.9204/0.9460 upleg at 0.9360, also broken channel resistance line extended pullback to 0.9331, 50% retracement of 0.9204/0.9460 upleg. Negative hourlies and 4-hour indicators breaking into negative territory, keep the downside favored in the near-term, with completion of consolidative phase expected to trigger further weakness. Return and possible break of pivotal 0.9300 support, Fibonacci 61.8% retracement / previous peaks of 28 Mar / 01 Apr, to confirm reversal and mark near-term top at 0.9460. Reversing daily indicators favor the scenario, with clear break below 0.93 handle, required to confirm.

Res: 0.9383; 0.9400; 0.9424; 0.9460

Sup: 0.9331; 0.9300; 0.9253; 0.9204

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.