After finally springing to life in the middle of last week, the Australian dollar dropped sharply to close out the week and fall back down below 0.7800 again to more familiar territory below the resistance level at 0.7850. In the last 24 hours however it has reversed and moved back up strongly to the resistance level at 0.7850 before easing lower in recent hours. During last week the Australian dollar moved through the resistance at 0.7850 to reach a new four week high around 0.7900. For the last month the Australian dollar has steadied well and traded in a narrow range between support at 0.77 and 0.78, although a couple of weeks ago it rallied higher to a two week high near 0.7850. To start last week it slowly eased back a little from resistance at 0.7850 however it is finally made its way through there. It has enjoyed receiving solid support from the 0.77 level throughout this time and will be looking to receive further support in the coming days. A few weeks ago it rallied a little higher again back towards 0.78 however it then eased back to receive more support from 0.77. Several weeks ago the Australian dollar was on a roller-coaster ride dropping sharply to a new multi-year low below 0.7630 before rallying strongly and moving back up above the 0.77 level and more recently 0.78.

In the second half of January, the Australian dollar fell very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200. Back in mid-January it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650.

Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory. It seems a long way away now but the Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

The RBA on Tuesday held back on further monetary easing, surprising most market watchers who expected a second rate cut in as many months. The central bank kept the benchmark lending rate at a historic record low of 2.25 percent, despite expectations it would do more to battle weak employment, easing inflation and sluggish corporate profits. The RBA lowered rates by 25 basis points last month, its first cut in 18 months, following moves by some 20 central banks around the world that have loosened monetary policy this year. The decision comes on the heels of a surprise announcement by the People’s Bank of China over the weekend to lower its rates, its third aggressive move to stimulate the economy in the last five months. The Australian dollar surged nearly half a cent, from $0.7797 to $7834. Meanwhile, the benchmark S&P ASX 200 index fell into the red, down 0.3 percent. In a statement, the RBA said it’s “appropriate” to leave rates steady for the time being but left the door open for further easing in the future where necessary. It maintained that growth will continue at a below-trend pace and sees domestic demand remaining weak.

(Daily chart / 4 hourly chart below)

AUD/USD March 3 at 21:55 GMT 0.7819 H: 0.7844 L: 0.7752

AUD/USD Technical

During the early hours of the Asian trading session on Wednesday, the AUD/USD is easing a little lower back towards 0.7800 after rallying up strongly in the last 24 hours back to the resistance level at 0.7850. Current range: trading right above 0.7800 around 0.7820.

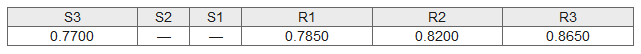

Further levels in both directions:

- Below: 0.7700.

- Above: 0.7850, 0.8200, and 0.8650.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.