Outlook:

Leading into next week’s Fed decision, we have the Bank of England (Thursday) and some decent US data—consumer credit today, the JOLTS job turnover report (tomorrow) and Friday, PP and retail sales. It’s hard to imagine anything here staying the Fed’s hand.

That gives us plenty of time to complete complaining about the Draghi disappointment. The day after the press conference, in New York for the Economics Club speech, Draghi said it’s not his fault if mar-ket got over-heated ahead of time. The revised ECB plan “was not meant to address market expecta-tions, it was meant to address our objectives for inflation.” Deputy Constancio elaborated: “The markets got it wrong in forming their expectations. They did indeed have higher expectations than were there and that’s why they reacted like they reacted but that was not our intention.”

Draghi said there is “no limit” to how far the ECB will go to meet targets. The ECB has “the power to act, the determination to act and the commitment to act.” There is “no doubt that if we had to intensify the use of our instruments to ensure we achieve our price stability mandate, then we would.” It’s the right program. Specifically, reinvestment will increase liquidity by an additional €680 billion by 2019. The ECB’s balance sheet will likely exceed the Fed’s as a percentage of GDP by the time the ECB is done.

It may seem like a strange comparison, but consider the comments Greenspan made as the financial cri-sis was at its 5-year anniversary. In Foreign Affairs magazine (Nov-Dec 2013), Greenspan blamed ani-mal spirits and underappreciation of tail risk for the crisis. It wasn’t the Fed’s fault for failure to regu-late, regulation being unnecessary and counter-productive. Greenspan seems not to know the term moral hazard, let alone see any role for the ratings agencies. Later, in Jan 2015, Greenspan said unwinding cen-tral banks’ enormous balance sheets will cause global market turmoil, including runaway inflation, and push gold, the “premier currency,” to new highs.

These two threads seem unrelated but are joined together by the Randian ideology, something that ad-dles Greenspan when most people over the age of 18 can easily discredit it. But that’s not the scary thing, The scary thing is that seeing the world through the Randian prism means the Fed chairman doesn’t actually know how the financial markets work (in a nutshell on greed and always being able to find a greater fool, with the chips falling after you have left the job).

But Draghi is a better economist or at least an economist not befuddled by ideology. He is not only man-aging expectations, a key central bank duty and something Greenspan despised, he also knows how the “economic machine works,” as hedge fund manager Ray Dalio told the FT.

Dalio says the market swing after the Draghi press conference was instigated by “erratic” investors. “[T]he more the market discounts that Draghi will move inadequately (e.g., the more the euro goes up and the stock market goes down) the more that it is likely the ECB will move at an accelerated pace and prove the market wrong. That is because Draghi and the body of those in the ECB who shape policy with him understand how the economic machine works.”

This is a “Holy Cow!” moment if ever there was one. For one thing, it’s quite odd for the reclusive Dalio to say much of anything for publication. For another, he’s one of the sharpest guys around and possibly comparable to Soros in the heyday of the sterling crash. We shouldn’t necessarily infer that he is short the euro, but if you believe in Draghi, and we do, the implication is clear. As we have written before, nothing boosts an economy like a devaluation. Devaluation has ten times more power and ten times more reach than a lousy rate cut and a little extra liquidity.

And if Draghi made a mistake by extending QE by only six months but not expanding the monthly sum, he corrected it the very next day at the Economic Club. No one should doubt the ECB’s determination. And for all we know, it wasn’t a mistake. He may have been holding back an increase in the amount in case it’s needed, plus an extension by longer than six months. Thus he has at least two more arrows in his quiver, not to mention jiggering of various maturities to influence the re-investment of maturing is-sues.

In trying to figure out Dalio’s thinking, we came up with what is perhaps an oddball theory—that the ECB is a lot less fearful of interfering in banks’ management. In the US, QE threw money at the banks and they were free to ignore “instructions” to lend. In Europe, banks will not be allowed to say “no.” Dalio’s “erratic investors” are the Greenspan crowd, those who hold that central bank interference in markets is always wrong and who assume that self-regulation will result in optimum outcomes. But the ECB intends to take a far more controlling role in managing bank behavior than the Fed.

Alongside QE, the ECB is ramping up its Single Supervisory Mechanism. We don’t hear much about it in part because the lending report is issued only four times per year, but Draghi and Company have a ton of data on exactly how QE is feeding through banks to real economic activity. In the October report, the bank lending survey states “Regarding the impact of the ECB’s expanded asset purchase programme (APP), banks continue to report that the additional liquidity from the APP is being used for granting loans. The APP had a net easing impact on credit standards and particularly on credit terms and condi-tions. The easing impact was greatest for loans to enterprises.”

Remember that in the US, banks were not pressured to use the money to make loans. They were sup-posed to, but nobody was actually holding their feet to the fire and there is no punishment for failing to obey the intent of QE. Banks just took the carry and on the whole increased lending at a tepid rate, ex-cept in fits and starts. The last Fed Senior Loan Officer Survey (October) shows banks had “little change in their standards on commercial and industrial (C&I) loans in the third quarter of 2015”. To be fair, the US banks are several years ahead of the European banks and had already loosened standards… but now they have stopped.

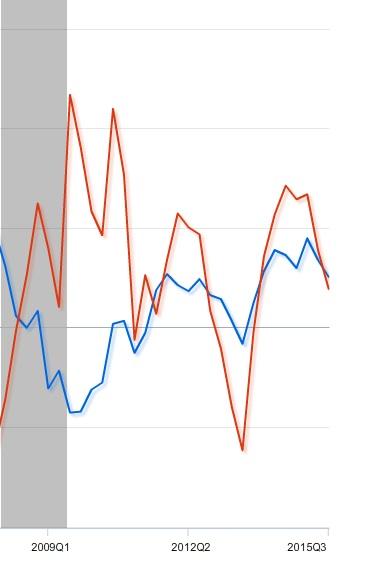

These days US banks complain they are not lending—after a burst last spring—because of over-regulation. But honestly, they are not lending because it’s easier to make a small 100%-safe return on government paper than to do the work, under more or less watchful eyes, of lending to businesses and households. The chart shows the annualized rate of growth of bank credit extension in blue and holdings of Treasuries and Agencies in orange.

For the umpteenth time we have to ask why the Fed pays any return on reserve deposits when it so obvi-ously impedes the intent of QE. Of course you can spend all your Sunday morning looking at data and make just about any case you want to. Commercial and industrial lending as a stand-alone chart looks pretty good, up 7.7% annualized in Q3 and a nice steady gain over the last five years. Lending to house-holds has lesser growth, especially to minority households. But total lending is not what’s important. What’s important is the mix of bank risk-taking and refusal to take risk—the mix of lending to private parties and parking funds in Treasuries.

The equivalent chart for the biggest eurozone banks is precisely the chart that Draghi intends to man-age. It remains to be seen whether the ECB is better at herding banks than the Fed. But the Fed is hobbled by a history and practice of leaving the banks alone to do the right thing when it has been amply demonstrated they will do no such thing. We can probably expect the ECB to keep holding European bank feet to the fire to use their funds for lending purposes, creating the multiplier effect that is the core of inflation creation. It helps considerably that the ECB has a negative deposit rate.

In the end, we probably have to agree that Draghi made a mistake by disappointing the market last week. But the market is making a mistake by failing to appreciate that whereas the Fed threw money at the banks and hoped for the right outcome, the ECB is throwing money at the banks and hectoring and prod-ding them to deliver the right outcome. At least that’s our guess.

The conventional wisdom has it that a line in the sand lies at about 1.0800 and the euro is near that level as New York comes in. A drop to 1.0750, the 50% retracement of the move, would likely set off a big-ger rout to lower levels.

Political Tidbit: We hear from Spain that many Republican candidates remind them, un-happily, of Franco—reactionary, authoritarian, nationalistic. We hear from Italy that they remind the folks there of Berlusconi—narcissistic, hedonistic, reckless—especially Trump, whose clownish postur-ing contains mostly lies but who still appeals to those who like a strong-man image. We haven’t heard from Germany or the UK yet but comments are welcome. Comedian Bill Maher jokes that the US can’t have a sane 5-week campaign process like the UK because we are dummies and it takes us so much longer to figure things out. Look how long it took for voters to see Palin as the ambition-riddled whack-job that was obvious from the first interview.

Now we have every candidate proposing some measure against Muslim immigrants, especially refugees, if not against all US Muslims citizens. On the 75th anniversary of Pearl Harbor, the event that led to put-ting Japanese-Americans into camps, we ought to be ashamed of these candidates. But the US is not alone. In France, the anti-immigrant National Front led by Marine Le Pen increased its vote from 11% in the 2010 election to 28%. Even Sarkozy’s Republicans took 27%, more than Hollande’s Socialists with 23.3%. The second round of voting is next Sunday.

Pres Obama went a little way toward alleviating the fear that lies behind voters flocking to autocrats, but not far enough. One thing in particular stands out—closing the Turkish border. It seems obvious that it would be most helpful to cut off the ISIS money from smuggling oil and the flow of new recruits. But we seem unable to sway Turkey, a NATO member (amid unverified stories that government officials are hip-deep in the oil trade). The other initiative would be to deprive ISIS of internet access. We have no idea how that can be done—but if we can pinpoint a single individual from thousands of miles away for a drone strike, we ought to be able to jam the outgoing signal. We need to pull the plug. No money, no electricity—job done.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 123.36 | LONG USD | STRONG | 10/23/15 | 120.45 | 2.42% |

| GBP/USD | 1.5085 | SHORT GBP | WEAK | 11/06/15 | 1.5137 | 0.34% |

| EUR/USD | 1.0823 | LONG EURO | NEW*STRONG | 12/04/15 | 1.0874 | -0.47% |

| EUR/JPY | 133.52 | LONG EURO | NEW*STRONG | 12/04/15 | 133.59 | -0.05% |

| EUR/GBP | 0.7175 | SHORT EURO | WEAK | 10/23/15 | 0.7194 | 0.26% |

| USD/CHF | 1.0004 | SHORT USD | NEW*STRONG | 12/04/15 | 0.9999 | -0.05% |

| USD/CAD | 1.3431 | LONG USD | STRONG | 10/28/15 | 1.3235 | 1.48% |

| NZD/USD | 0.6673 | LONG NZD | NEW*STRONG | 12/04/15 | 0.6641 | 0.48% |

| AUD/USD | 0.7300 | LONG AUD | WEAK | 11/23/15 | 0.7174 | 1.76% |

| AUD/JPY | 90.06 | LONG AUD | WEAK | 10/08/15 | 86.06 | 4.65% |

| USD/MXN | 16.7258 | LONG USD | NEW*WEAK | 12/07/15 | 16.7258 | 0.00% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.