Daily Forecast - 31 March 2016

AUDUSD Spot

AUDUSD beat 7650/55 for a buy signal & target 7708/12 was hit. Looks like we could see a pull back today however. Minor support at 7654/50 but below here targets 7620/16. This should hold the downside initially at least but if we continue lower look for 7593/90 then an excellent buying opportunity at 7570/65.

Holding 7654/50 keeps bulls in control & re-targets 7680/82 then 7705/10. If we continue higher look for 7735/39 & longer term trend line 7760/65. A high for the day expected if we reach this far.

EURGBP Spot

EURGBP could continue higher to resistance at 7900/10. This could be the limit of the recovery & bears could start to gain control again from here. Having failed to beat the 200dma for over a month we could be seeing a longer term topping process. However other key prices today are February highs at 7928 & the March high at 7946. Only a weekly close above here tomorrow is positive.

Failure to beat 7900/10 targets minor support at 7875/71. Below here is more negative & targets 7558/55 then important short term support at 7830/28. A break below here adds pressure to target good support at 7798/93.

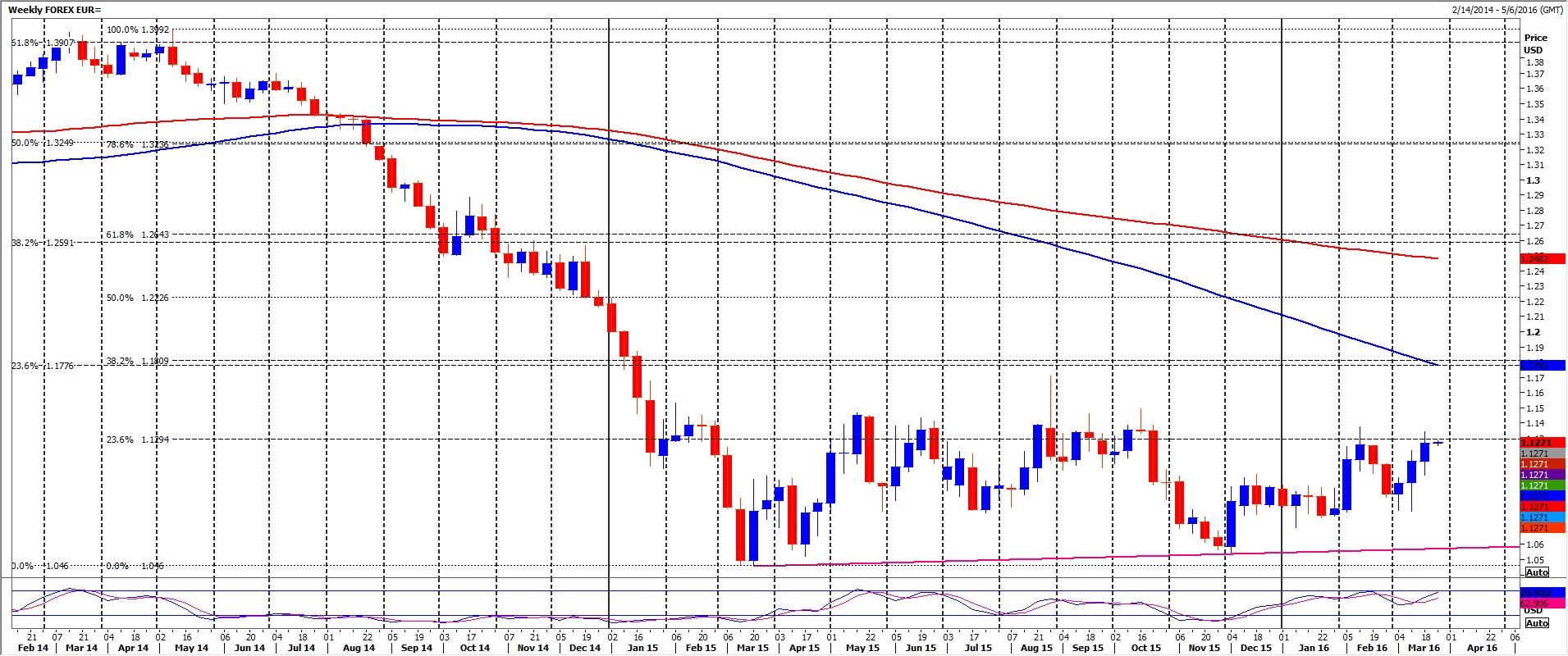

EURUSD Spot

EURUSD tried a break above 1.1330/35 so shorts were stopped above 1.1355 as we topped at 1.1364. However we are sitting at 1.1330/35 as I write so it is unclear whether we can believe the breakout. There is a good chance we will fail to hold above 1.1330/35 today, keeping the pair in a longer term sideways trend. Downside targets are 1.1314/10 then 1.1280/76. If we continue lower look for good support at 1.1239/34. This could hold the downside but longs need stops below 1.1210.

Bulls must hold the pair above 1.1330/35 to confirm a bullish breakout that should target February highs. We should struggle here in short term overbought conditions, but a break above 1.1390 can take the pair as far as 1.1455/60.

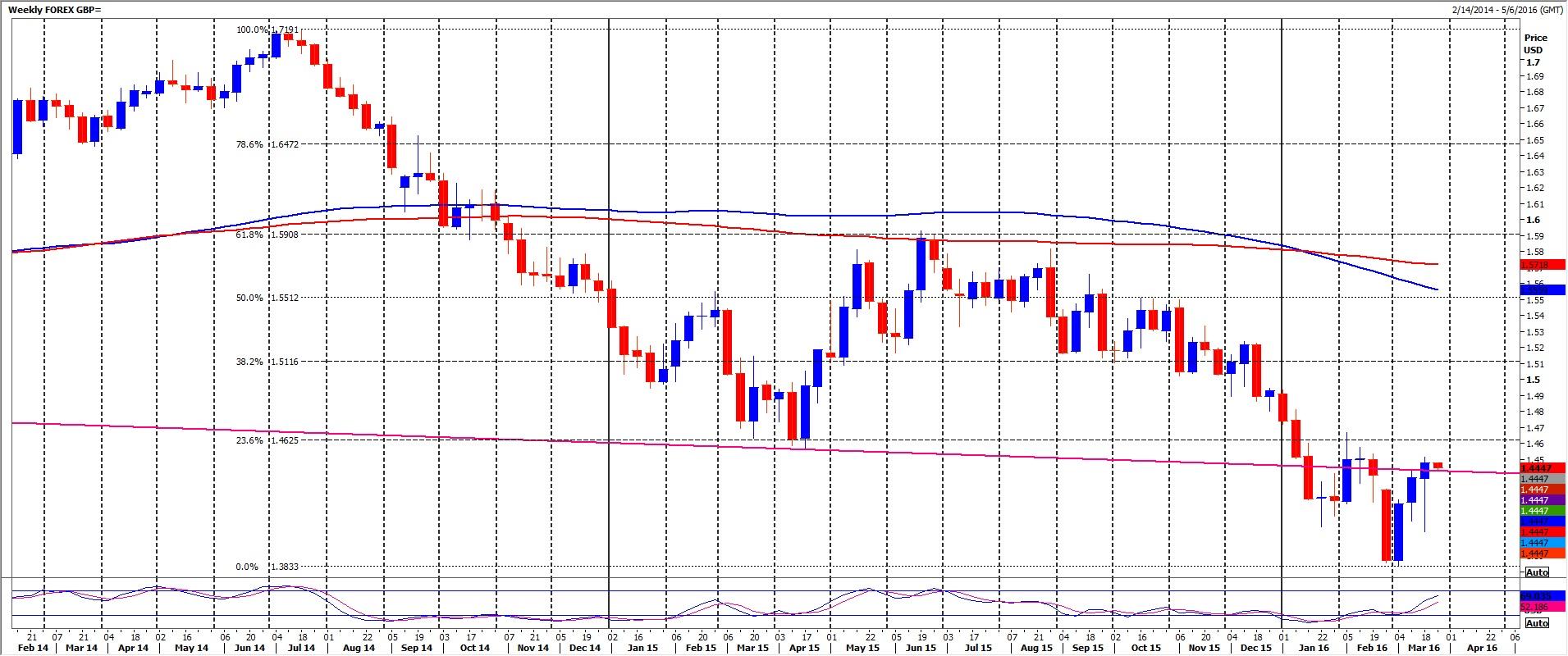

GBPUSD Spot

GBPUSD failure to beat important trend line resistance at 1.4470/80 is more negative for today. The pair have sold off to first support at 1.4365/55. This is important today & key to direction. A break below 1.4345 signals further losses to 1.4310/00, perhaps as far as strong support at 1.4260/55. Try longs with stops below 1.4225.

Holding first support at 1.4365/55 allows a recovery to 1.4400/05 but above here meets important trend line resistance at 1.4470/80. Of course this is the main challenge for bulls this week. A break & CLOSE above is required to signal the completion of the bullish inverse head & shoulders pattern. A break above March highs at 1.4514 is more positive again & helps to confirm a move towards resistance at 1.4575/80. If we can continue higher look for more important resistance at 1.4625/30.

USDJPY Spot

USDJPY very minor resistance at 112.41/44 then the main resistance of the day again at 112.66/70. We should struggle here initially but a break higher today not out of the question & targets a selling opportunity at 113.05/10. Shorts need stops above 113.40.

Holding below 112.40 targets 112.25/21 then yesterday's low at 112.00/99. If we continue lower look for some support at 111.85. We are oversold short term so a low for the day possible here. However a break below a break below 111.70 keeps the pressure on for 111.54/50 & 111.39/35.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.